The foundation for long-term investment success.

An investment strategy is a systematic plan for achieving your financial goals and protecting your wealth. A clearly defined and well-founded investment strategy provides the framework for all investment decisions and is based on a thorough analysis of your financial objectives, risk tolerance, and investment horizon. By strategically diversifying across asset classes such as bonds, equities, and alternative investments such as real estate, risks are managed and opportunities effectively leveraged.

We act with foresight and structure – each decision follows a proven multi-step approach. This is how we lay the foundation for sustainable growth and financial stability.

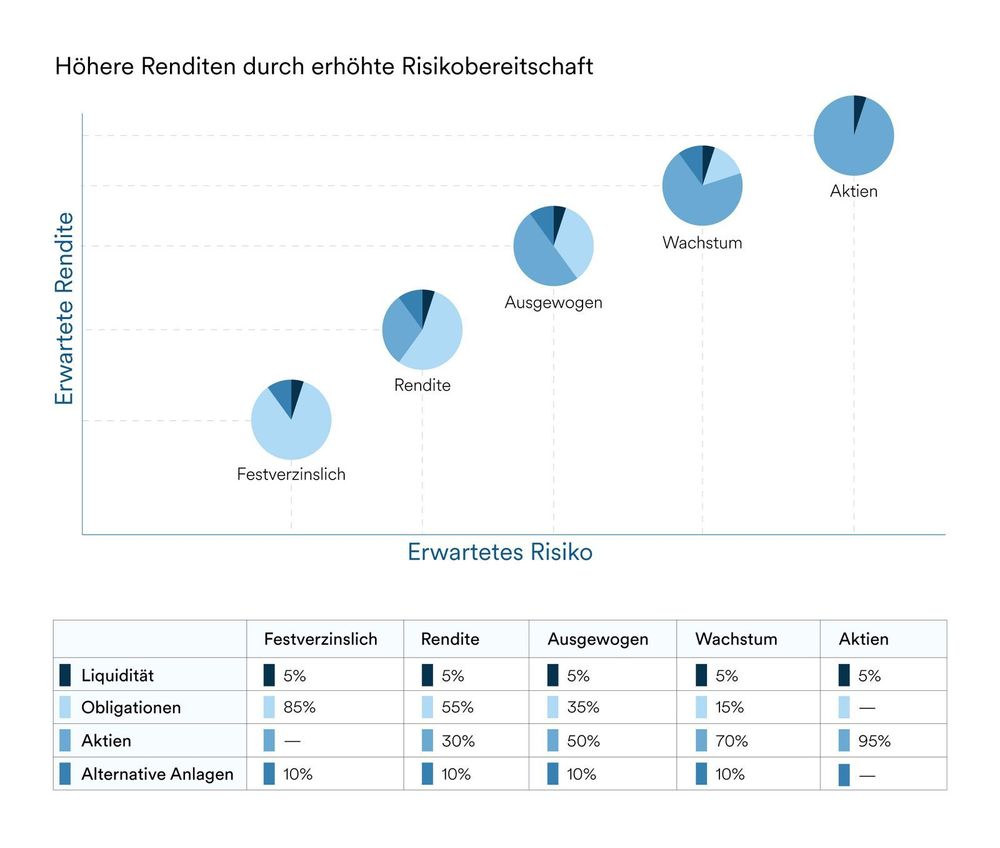

Higher returns can be achieved through higher risk tolerance.

Emotions significantly influence investment decisions and can strongly shape your behavior. Greed and fear are two of the most powerful emotional factors. Therefore, it's essential to adhere to a disciplined and systematic approach. This helps avoid emotionally driven decisions and instead focuses on fundamental strategic principles like diversification and balanced asset allocation.

Discipline and long-term thinking are essential to weathering market fluctuations and achieving stable returns.

We handle questions about investing such as those shown on the right on a daily basis. We look forward to supporting you with your investment strategy.

An investment strategy is essential to systematically achieve financial goals and protect wealth in the long run. It offers a clear framework for investment decisions, helps manage risk, and leverages opportunities, leading to sustainable growth and stability.

Your risk profile is determined by taking account of your financial goals, needs, and investment horizon. Regular reviews ensure that it always reflects your current circumstances and risk/return expectations, enabling optimal asset allocation.

SAA defines the long-term orientation of your portfolio based on your risk profile. It includes the optimization of asset allocation across different classes like equities, bonds, and alternative investments. The SAA is reviewed and adjusted annually in response to market conditions.

We distinguish between five basic risk profiles: Fixed Income, Yield, Balanced, Growth, and Equities. Each corresponds to a specific investment strategy tailored to your personal needs and goals.

Emotions like greed and fear can heavily influence decisions and lead to irrational behavior. A disciplined approach helps avoid emotional decisions. By focusing on strategic principles like diversification and balanced asset allocation, you can ride out market fluctuations and achieve stable returns.

Book a free advisory session with our experts: