The key to a comprehensive investment strategy.

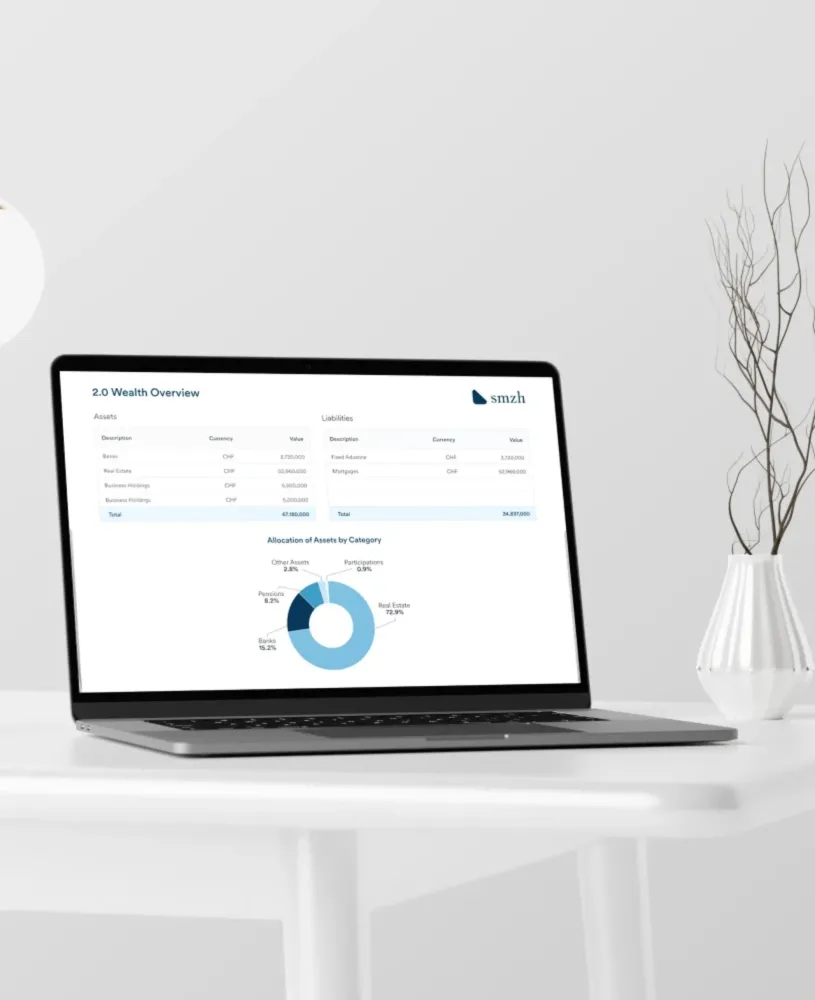

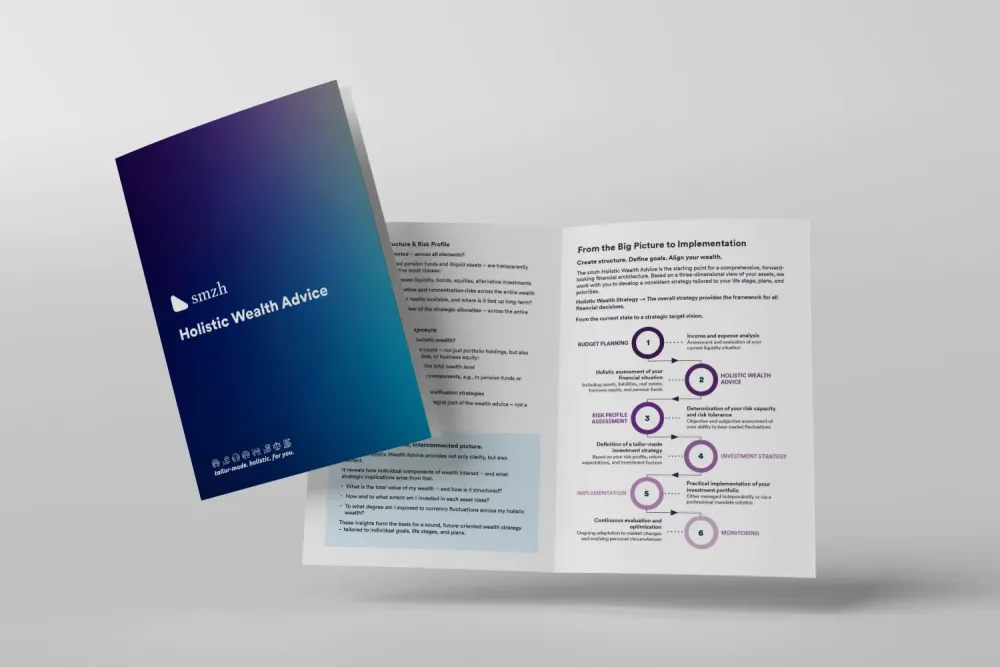

It all starts with a realistic budget – only through the structured capture of all assets and liabilities does a complete picture of your financial situation emerge. This is precisely where the Holistic Wealth Advice from smzh ag comes in – as the core of a modern, life-phase-oriented financial architecture.

It creates structure, clarity, and transparency – regardless of how diversified your wealth is or which institutions manage it. Our analysis includes not only traditional bank assets, but also real estate, retirement assets, business interests, tangible assets, and liabilities.

At the center are three key dimensions:

The Holistic Wealth Advice from smzh not only provides transparency but establishes critical connections: it shows how the various components of your wealth interact – laying the foundation for developing a tailored investment strategy.

Unlike traditional advisory approaches, our analysis doesn’t stop at your securities account or short-term return targets. It opens access to the entire smzh advisory architecture. The wealth overview provides a holistic analysis of your financial situation. It serves as the basis for identifying areas of action in investments, finances, mortgages, real estate, retirement, insurance, legal, and tax matters.

smzh ag delivers clarity and structure through holistic wealth advice:

Schedule a free consultation with our experts:

We handle questions such as those shown on the right on a daily basis. We look forward to supporting you with your investment strategy.

smzh’s approach considers not only securities but your entire wealth – including retirement funds, real estate, business holdings, and liabilities.

It’s a starting point. We accompany you long term and adjust your strategy as your life, goals, and the market evolve.

The cost depends on the scope and depth of advice you desire. We’re happy to provide a custom, transparent, and non-binding quote as part of your initial consultation.