With carefully considered financial planning, you lay the foundation for long-term financial stability. We analyze your income and wealth situation, optimize your expenses, and develop an individual strategy that is perfectly aligned with your goals in life. Whether it’s retirement planning, wealth accumulation, or major investments – our financial planning combines all aspects of your finances in one holistic concept. This way, you maintain an overview, minimize risks, and achieve your objectives securely and sustainably.

Financial planning comprises a comprehensive, individual analysis and strategy development for your financial future. It provides a structured assessment of your current income and wealth situation, combined with long-term planning to achieve financial goals in different phases of life. smzh takes a holistic approach that reconciles all financial aspects – from income and expenses to retirement provision, taxes, and asset structure.

Development of an individual financial plan that takes into consideration your goals and stages of life

Consideration of tax optimization, provision possibilities, and wealth accumulation

Creation of scenarios to analyze the impact of the planned measures

Taking into account risks such as loss of income or market changes

Support in terms of implementation, e.g., adjustment of savings and investment plans, new structuring of insurance solutions or financing concepts

Support in optimizing your liquidity and wealth structure

Proactive monitoring and adjustment of the financial plan in case of changed circumstances or market conditions

Bekim is Chief Investment Officer at smzh with many years of experience in wealth and investment management. In this conversation, Bekim explains why wealth management is relevant for everyone and why it is worth addressing this topic early on. He emphasizes that successful financial planning has nothing to do with magic – as long as the right advisors are by your side. It is important to seek professional advice and to regularly review your personal portfolio.

"The first step toward successful financial planning?" Gzim Hasani, CEO of smzh ag, explains why a clear starting position and specific goals are decisive in financial planning – and how to best get started,

Many people don't quite know how their financial situation looks or how they can achieve their goals. Financial planning creates clarity and structure.

Whether it is joining the labor force, establishing a family, or entering retirement – every phase in life requires different financial priorities that financial planning can help coordinate optimally.

Financial planning takes into consideration unforeseeable events and provides solutions to safeguard against loss of income or wealth risks.

You benefit from a structured approach to saving, investing, and tax optimization to reach your financial goals faster.

Financial planning helps you ensure that your finances remain stable in the long run and that you can react to changes flexibly.

One real-life example of Holistic Wealth Advice.

(in German)

Clarity is not a privilege – It's a prerequisite.

(in German)

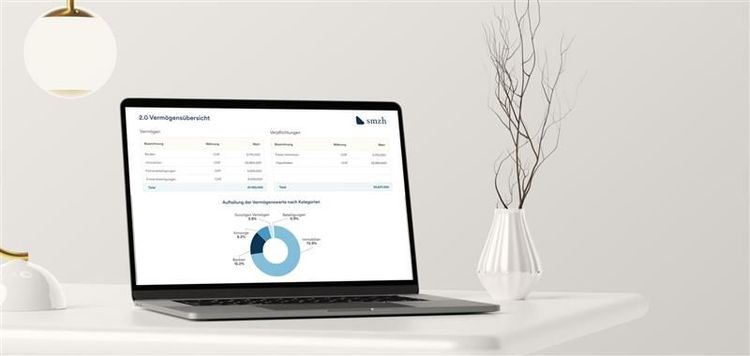

smzh Invest gives you access to a professional investment strategy based on Holistic Wealth Advice – personalized, transparent, and independent. Invest with a plan, structure, and the goal to safeguard and grow your wealth in the long run.

Your benefits in financial planning with mit smzh:

Plan your financial future with smzh – holistically, individually, and sustainably.

We handle questions such as those shown on the right on a daily basis. You don’t need to deal with them by yourself – the initial consultation of our 360° Check-Up is free of charge and non-binding.

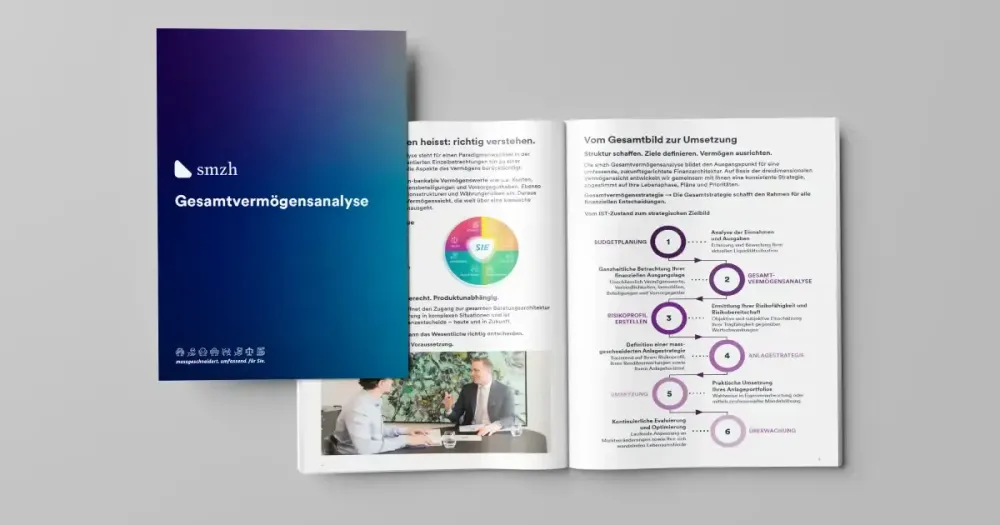

Financial planning is a comprehensive analysis of your financial situation – including income, expenses, wealth, debt, and retirement provision. Based on this analysis, we develop an individual strategy that supports your financial goals and accompanies you through all phases of life.

For everyone – whether you are starting your first job, have a family, are an entrepreneur, or have retired. Each phase of life is accompanied by different financial challenges. Financial planning helps to make provisions in a targeted manner, minimize risks, and build wealth in the long run.

Your financial plan includes a clear overview of your current financial situation. It defines short, medium, and long-term goals and details specific measures such as ways to optimize your taxes, improve your retirement provision, or build wealth in a structured manner.

We start with a detailed analysis of your starting situation. Based on this analysis, we then develop a tailor-made concept, simulate various scenarios, and accompany you when it comes to implementation. Afterwards, we regularly check whether any adjustments are necessary.

Our initial consultation is free of charge and non-binding. You then receive a transparent offer that takes account of the scope and complexity of your individual circumstances.