Purchasing real estate is one of the most important decisions in life and requires careful planning. In addition to choosing the most suitable property, financing, a legal review of the purchasing contract, as well as organizing the actual transaction are of utmost importance.

smzh as your reliable partner is by your side every step of the way, supporting you from financing to transfer of ownership.

Together we analyze your financial situation and determine the affordability of a property. We thus ensure that the monthly burden of interest rates, amortization, and ancillary costs does not exceed 33% of your gross income.

This analysis gives you certainty that you can afford the property in the long run.

We assess the lending ceiling (loan-to-value ratio, LTV), which normally amounts to 80% of the purchase price. The remaining 20% must be covered by equity.

smzh helps you combine your equity optimally, be it using savings, retirement savings (e.g., pillar 3a), or advance inheritance.

We examine various types of mortgages (e.g., fixed-rate mortgage, SARON mortgage) and develop an individual financing strategy that is aligned with your goals.

smzh helps you find the best financing partners – bei it banks, insurance companies, or pension funds – and negotiates attractive terms on your behalf.

The purchasing contract is a core document when buying real estate. Our experts examine your contract to identify potential legal or financial risks and explain the key aspects to you.

We pay particular attention to payment periods, property transfer, and special clauses that concern your interests.

We accompany you throughout the entire purchasing process:

A promise of payment is a binding document that assures the vendor that the purchase price is guaranteed.

Procedure:

Discover what is truly important when buying and selling real estate in Switzerland. From initial planning to searching to contract settlement – we give you valuable advice on financing options, contract negotiations, and legal requirements to ensure a secure and successful property purchase.

(in German)

Discover the most important aspects of a real estate purchase contract that clearly regulates the transfer of ownership and protects both contractual parties. Also learn the seven core elements of a contract and the reason why an in-depth examination is indispensable. Use the advice of our experts to identify potential risks and ensure that your real estate purchase is secure and favorable.

(in German)

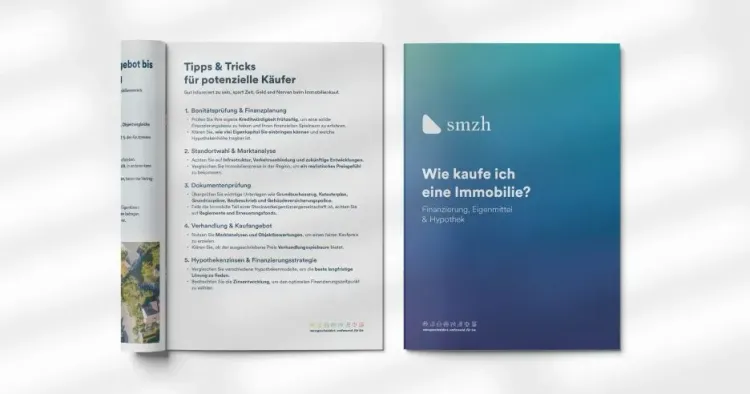

Learn the decisive factors that must be taken into account when financing your own home. Get to know the various types of mortgages and discover how you can best tailor your personal financing strategy. Furthermore, learn why careful planning and regular adjustments of your financing strategy are essential for long-term financial success.

(in German)

Anyone who wishes to purchase or sell residential property in Switzerland is faced with complex decisions. Our guide provides a compact overview of the market, financing, and legal basics so your property project is well planned.

The purchase contract is the core of every real estate purchase in Switzerland. It governs all rights and obligations in a binding manner and only enters into force upon notarial certification. Our overview explains what you should look out for.

Whether it is to buy or renovate a property or renew a mortgage: Well-thought-out financing is crucial. Learn what's key in terms of planning and how you will find a solution that suits you.

The smzh handout "How do I buy real estate?" gives a compact overview of the most important steps of a real estate purchase, covering the topics of equity and financing as well as affordability analysis, amortization, and purchase process.

Your benefits when purchasing real estate with the support of smzh:

smzh helps make your real estate purchase secure and efficient:

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

Affordability ensures that you can cover the running costs of your property in the long run without taking on an excessive burden.

The loan-to-value (LTV) ratio indicates what share of the purchase price is financed by the mortgage. It usually amounts to a maximum of 80%.

We develop an individual financing strategy, examine various types of mortgages, and negotiate the best conditions for you.

A promise to pay is a confirmation from the bank that the purchase price is secured. It provides assurance to the seller and is a key part of the purchase transaction.

Our experts examine the purchase contract for legal and financial risks to ensure that your interests are protected.