Swiss Monetary Policy

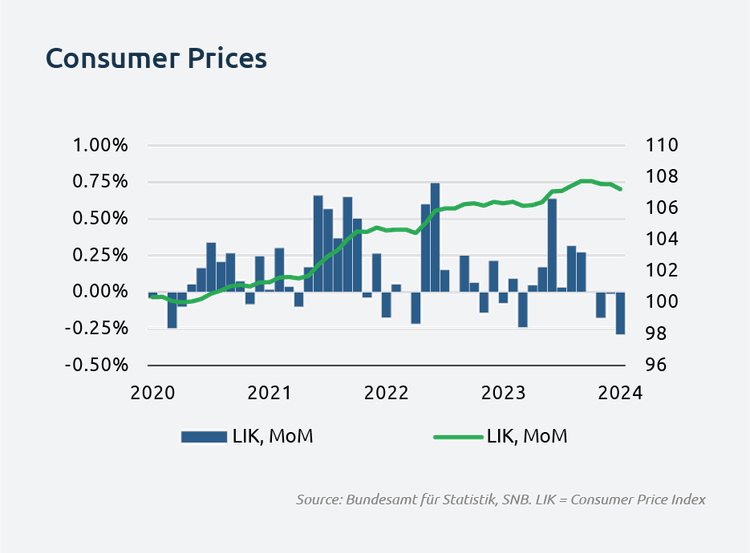

Consumer prices for September show stronger disinflation than the SNB previously anticipated. Annual inflation now stands at 0.84%, with a month-on-month price drop of 0.29%—the largest decline since the start of the inflation surge. Prices have fallen by nearly 0.50% from their peak.

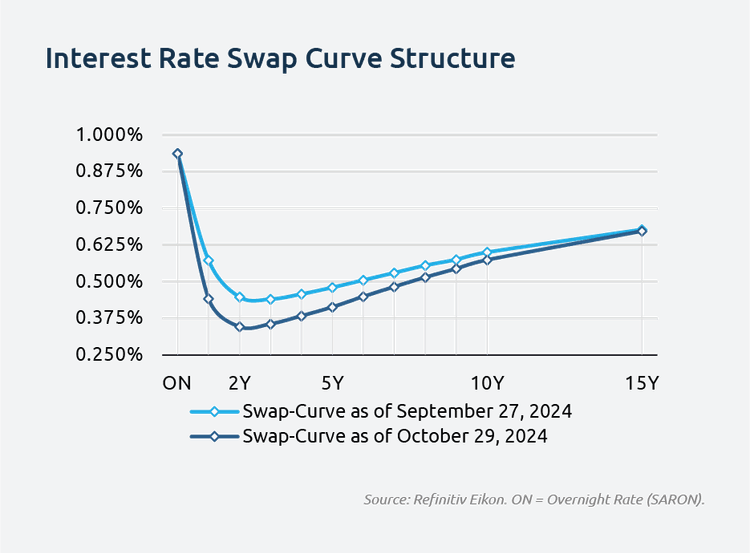

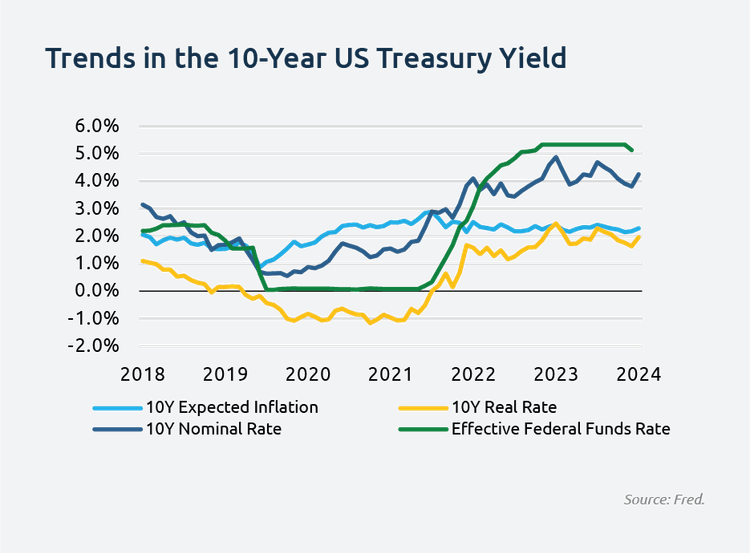

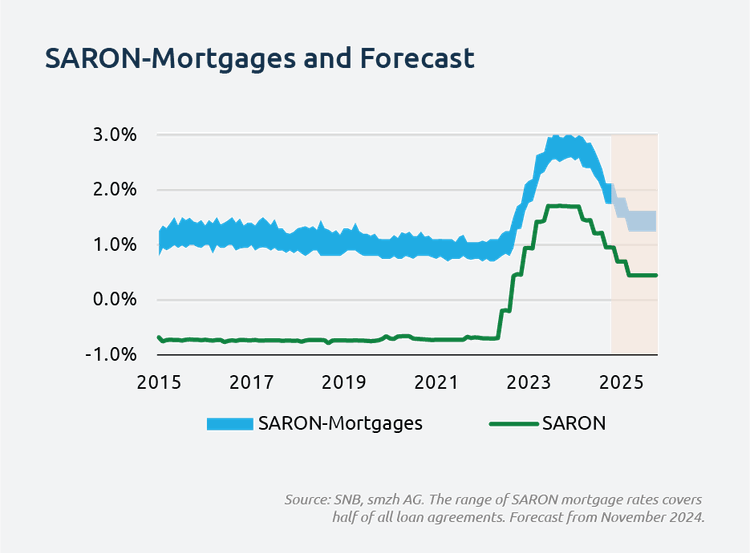

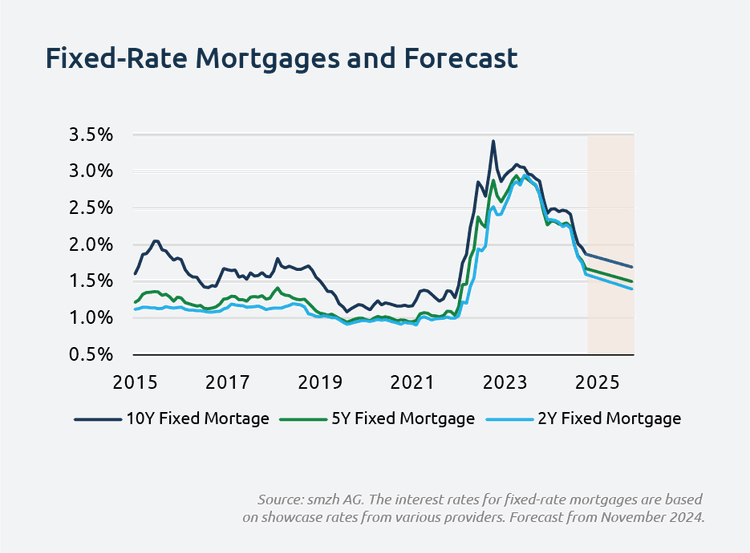

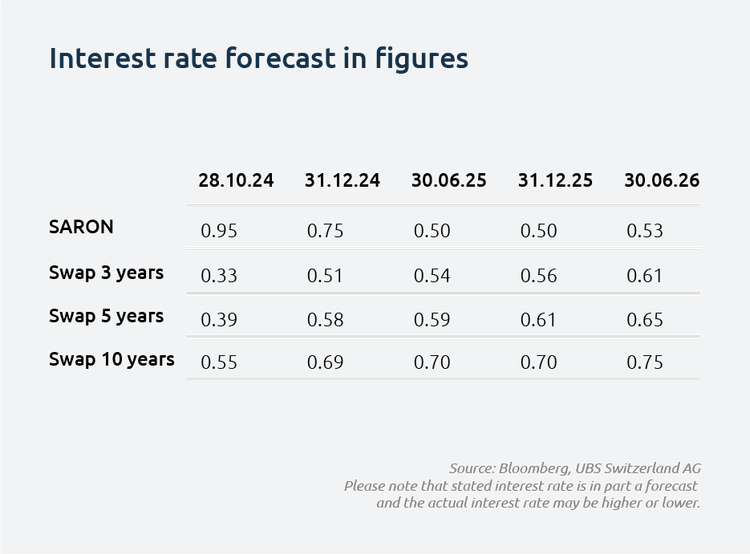

This trend increases the likelihood of a deflationary environment and supports the expectation that the SNB may need to further reduce the policy rate. The market is already pricing in two additional rate cuts to 0.50% in the upcoming sessions, with a possible third cut to 0.25% in 2025. If the market expectations prove accurate, Switzerland could once again approach a low-interest-rate environment, with negative rates potentially within reach. SNB President Martin Schlegel also considers this scenario feasible, especially if global and domestic economic conditions weaken further and the Swiss franc appreciates.

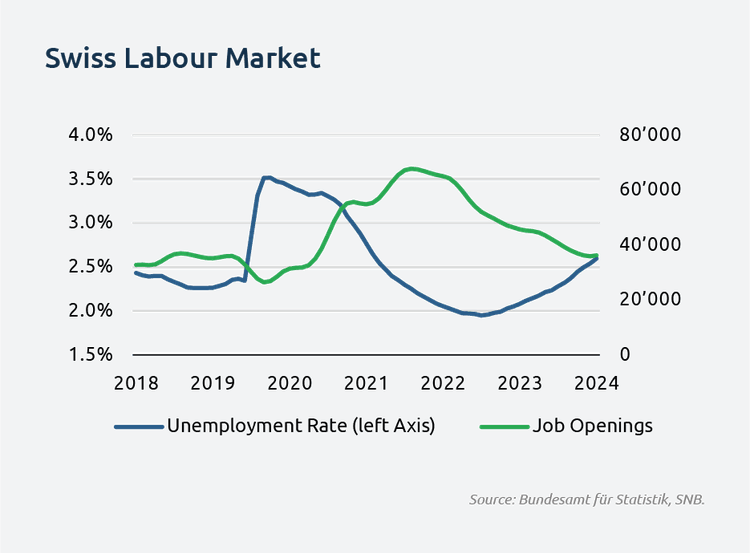

An additional easing of monetary policy is not strictly necessary but could be implemented without negative effects. The Swiss labor market continues to show moderate cooling, while the economy exhibits modest growth. The domestic economy is likely to be supported next year by consumer demand, which will benefit from real wage growth. Since the pandemic, the external sector has faced numerous challenges that have been successfully managed. However, structural issues within the EU have reduced its attractiveness as an export market, impacting Swiss exporters, particularly in Germany, Switzerland's second-largest trading partner, where economic stagnation or contraction persists.

Since the pandemic, Switzerland has intensified efforts to secure its supply chains, diversify trading partners, and access new markets—measures aimed at promoting long-term economic stability. Nevertheless, Switzerland remains vulnerable to potential global economic slowdowns, making supportive monetary policy a sensible consideration.