Many people rely on traditional savings methods such as savings accounts or time deposits as a safe way to create wealth. Reality looks different, however. Due to persistently low interest rates and inflation, your savings gradually lose purchasing power. If you leave your money on a savings account, you may not even get enough interest to offset inflation.

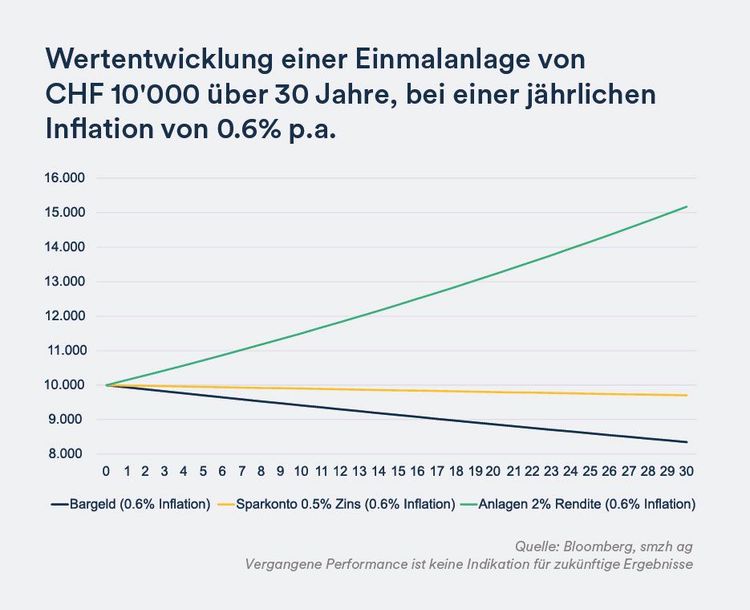

With annual inflation of 0.6%, a one-time investment of CHF 10,000 would develop as follows over a 30-year period: Interest-free cash would see its purchasing power diminished to around CHF 8,300, a savings account with 0.5% interest would be at around CHF 9,700 when adjusted for inflation, and investments with an annual return of 2% would have inflation-adjusted purchasing power of over CHF 15,000.

The main reasons for this gradual erosion of value are:

Traditional saving is therefore no longer enough to ensure financial security. A strategic alternative is needed.

Equities: Attractive returns in the long term thanks to stakes in a company.

Real estate: Real assets that often provide a certain degree of inflation protection.

Commodities & precious metals: Gold and silver as a potential hedge in times of crisis.

Security buffer: 3–6 months' worth of expenses on an instant-access savings account paying decent interest.

Core investment: CHF 500 a month in broadly diversified investment solutions.

Risk distribution: Add alternative investments such as gold or commodities.

Investing CHF 500 a month for over 25 years at a return of 6% can accumulate savings of over CHF 347,000 – left on a savings account, that total would only amount to around CHF 153,000.

Our financial experts help you develop an investment strategy that is tailored to your individual objectives. We Finanzexperten helfen Ihnen, eine Anlagestrategie zu entwickeln, die auf Ihre individuellen Ziele abgestimmt ist. Our approach rests on:

smzh ag is your strong independent partner helping you to safeguard and optimize your wealth sustainably.

Would you like to learn more about the best alternatives to traditional saving? Our advisors are happy to provide a non-binding consultation anytime. Contact us now!

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

Low interest rates and inflation eroding the value of your savings in real terms.

Investments in bonds, equities, real estate or commodities offer better return potential in the long run.

A broadly diversified investment strategy helps avoid losses in value while using growth potential.

Yes, long-term investing minimizes fluctuations and leads to sustainable wealth creation.

We help you develop a tailor-made strategy that protects your wealth and allows it to grow.

Financial reality: A comparison of interest rates, inflation, and investment returns

From saving to investing: The right approach for long-term wealth creation

Risk profiling: The basis of a successful investment strategy

Investing in practice: Strategies, types of investment, and implementation

Costs & fees: The underestimated factor in investing

Success needs planning: Long-term optimization of your investment strategy