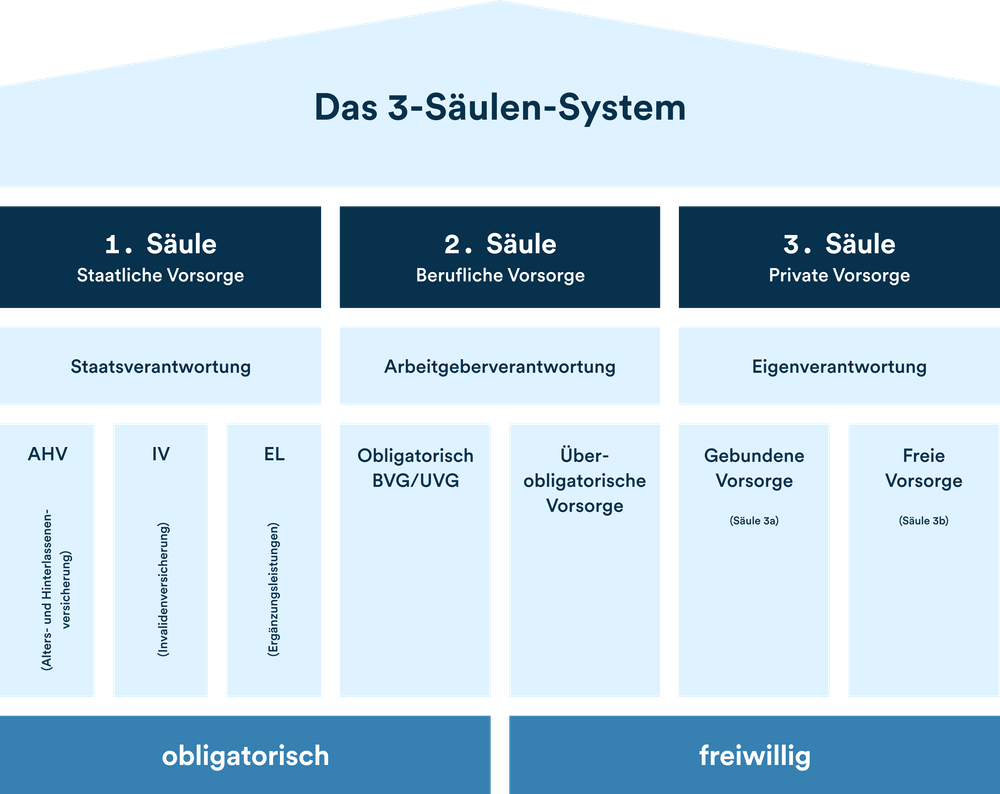

3rd pillar: Private provision

Pillar 3a

Pillar 3a (restricted provision) is a voluntary plan that complements one's pension in retirement. Access to 3a savings is subject to certain conditions.

Pillar 3b

Pillar 3b (unrestricted provision) is not tied to retirement and can be used for medium or long-term savings goals. Contributions are not subject to any annual maximum amounts.

Pillar 3b contains all voluntary kinds of savings that are not already included in the other pillars of the Swiss pension provision system.

Pension solutions in the 3rd pillar can include savings accounts, bonds, equities, investment funds, structured products, or insurance policies. Such solutions are available from banks as well as insurance companies.

Goal: Close the income gaps the other pillars leave and cover additional needs.