Invest strategically with professional guidance.

We all have individual financial goals, whether it is to achieve financial independence, enjoy worry-free retirement, or safeguard our family. To achieve these goals today, traditional saving is no longer enough. Building or preserving wealth sustainably requires a sound, flexible investment strategy – just like smzh Invest!

So your dreams become affordable.

So you have more time for the important things in life.

So your wealth spans generations.

Irrespective of the size of your wealth – no minimum investment, no minimum fees

Free capital, pillar 3a, or vested benefits

smzh – wealth manager – custodian

Personal advice and support according to our family office light approach

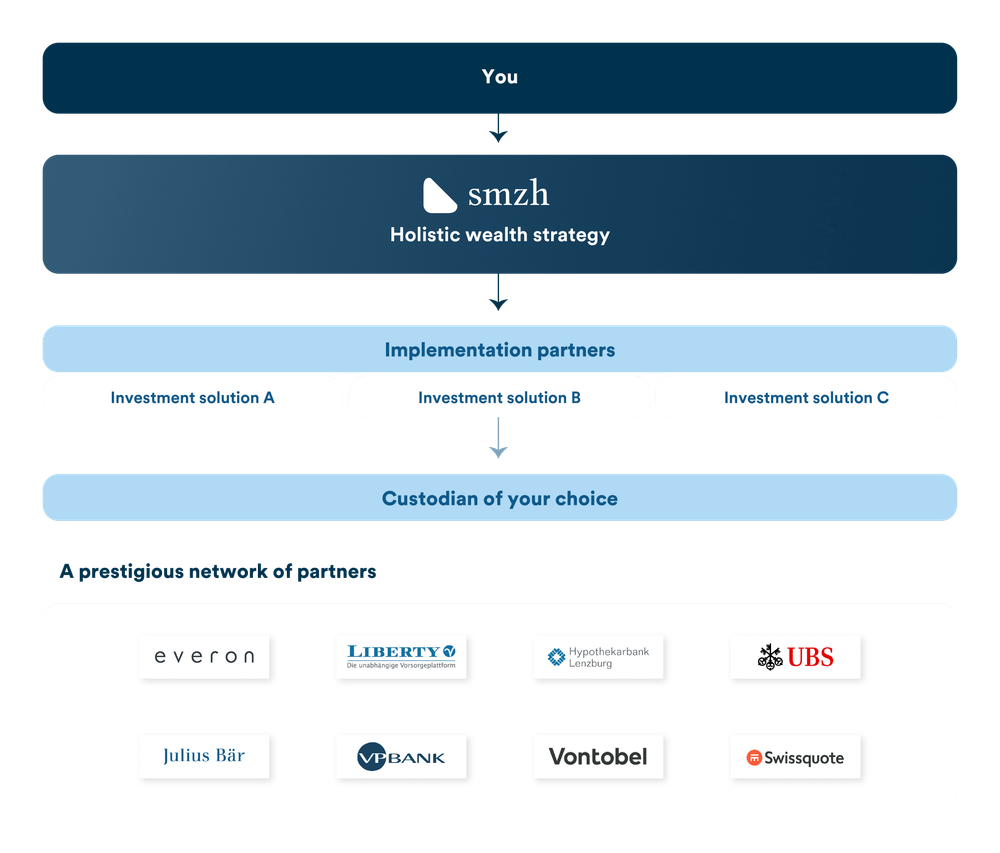

The selection of your investment strategy and preferred implementation form provides the basis for operational implementation. At smzh, we do not think in isolated components – instead, we focus on a consolidated, strategically managed structure with clear responsibilities and one objective: to achieve your long-term wealth goals efficiently, independently, and transparently.

Whether you choose an ETF-based strategy or require a complex investment solution, we integrate your decision within a consolidated framework:

You benefit from a solution that meets the highest professional standards while being tailored, modular, and easily accessible.

Independent. Collaborative. Transparent.

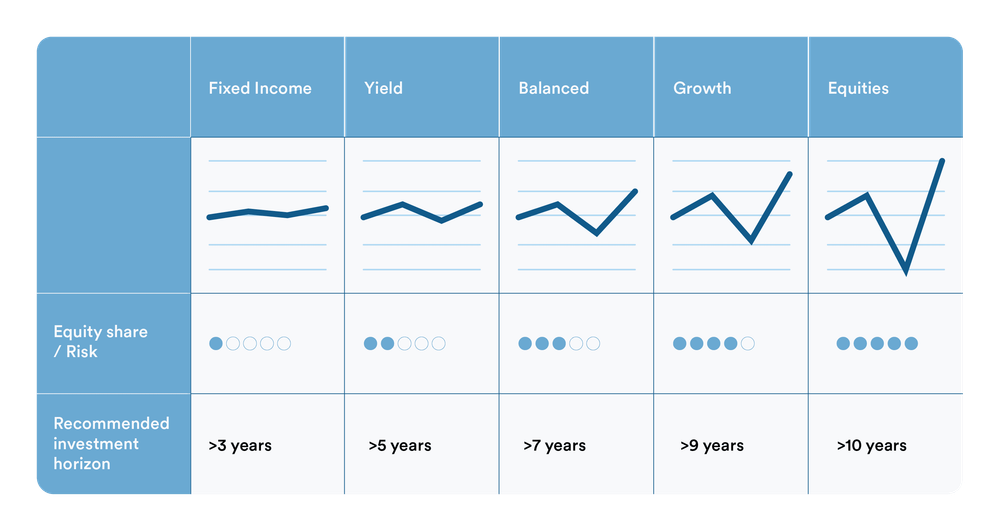

Based on our Holistic Wealth Advice and your goals, we define your personal investment strategy, which has your risk profile at its core: How much fluctuation are you able and willing to tolerate? What are your return objectives? How long is your investment horizon?

Sound scientific evidence helps us strike the right balance between bonds, equities, and alternative investments such as real estate, in line with your risk profile.

We distinguish between:

We did not reinvent wealth management – but we are making it accessible for everyone, in just a few steps.

We handle questions such as these on a daily basis. We look forward to supporting you with your investment strategy!

The total costs amount to 0.75% for wealth management and 0.90% for pension solutions (pillar 3a and vested benefits). This total includes management fees, custodian fees, brokerage fees, foreign exchange costs, an e-tax statement, and our personal advice. It excludes product fees (0.08%-0.25% depending on the strategy) as well as tax-related duties such as stamp duty and value-added tax.

You are free to decide how much you would like to invest – whether as a one-time investment or using a savings plan. Our solutions are not dependent on income or wealth.

We place great importance on providing personalized advice, regardless of your wealth or income level. Thanks to our independence, we are able to draw from a broad range of solutions tailored exclusively to your interests. This ensures that you benefit from transparent, objective advice and comprehensive service with no conflicts of interest. In addition, our family office light approach offers you holistic support for your entire financial ecosystem.

Your strategy is defined by the smzh Chief Investment Office (CIO) and implemented by our experienced wealth management partner Everon.

Yes. Our investment solutions are modular and flexible. You can adjust your strategy, investment horizon, or risk profile anytime.

No. smzh Invest gives you access to the same professional structures and strategies that are normally exclusive to private banking clients – regardless of the amount you invest.

For our Invest solutions, we collaborate with experienced partners: Wealth management is in the hands of Everon, while the pension platform Liberty acts as our partner for pension solutions. When it comes to custodian, you can choose between Hypothekarbank Lenzburg, Julius Baer, UBS, Vontobel, Swissquote and VP Bank.

Your assets are held at a renowned custodian of your choice. You may choose between Hypothekarbank Lenzburg, Julius Baer, UBS, Vontobel, Swissquote, or VP Bank. Your securities account is held under your name so you have access to it at all times and enjoy full transparency and security when it comes to your assets.

Thanks to the Everon-smzh app, you can check on and monitor the performance of your investments around the clock. And of course, our client advisors are always happy to provide a personal consultation.

Yes, you can liquidate your investments in full or in part at any time – the assets become available immediately. Please note, however, that there may be a brief settlement period depending on the product or investment.

smzh ag stands for independent, holistic, and tailor-made financial solutions that are accessible to all. We place particular importance on regular, personal dialogue with our clients, as this enables us to understand their goals and wishes, which are always at the center of our considerations. We do everything to find the ideal solution for your current phase of life and any future eventualities.