At 40, the strategic phase of your retirement planning begins

From the age of 40, your perspective on your financial future changes: the time until retirement becomes shorter – and strategic mistakes are harder to correct. Now is the time to start planning with a clear purpose rather than just saving.

Pillar 3a is one of the most effective tools in Swiss financial planning. It combines tax savings, wealth accumulation, retirement, and real estate strategies – flexible, long-term, and tax-optimized.

In this guide, we show you how to use pillar 3a strategically and professionally from the age of 40 to create financial security and flexibility for your future.

Pillar 3a is the tied, voluntary pension plan in Switzerland, and together with AHV/IV (1st pillar) and the occupational pension plan (2nd pillar), it forms the foundation of your retirement provision.

Especially from age 40 onward, pillar 3a becomes even more significant: it offers specific advantages that you can actively leverage for your benefit.

What you need to know:

Tax benefits: Contributions to pillar 3a are tax-deductible each year. You can contribute

Conclusion: Pillar 3a is not a classic savings account – it is a strategic tool that helps you save taxes, invest with a purpose, and prepare actively for retirement.

At a bank, you hold your 3a savings in a traditional pension savings account or a securities deposit.

Typical features:

With insurance providers, pillar 3a is embedded in a pension solution with a fixed premium – usually combined with risk coverage and additional benefit guarantees.

Typical features:

Initial situation:

Income: CHF 90,000 (gross, with occupational pension fund) Contribution to pillar 3a: CHF 7,280 (maximum annual amount 2025)

-> Tax saving depending on canton of residence: approx. CHF 1,600 – 2,400 a year

📌 Examples:

Note: The actual savings depend on your domicile, marital status, income, and church tax duty.

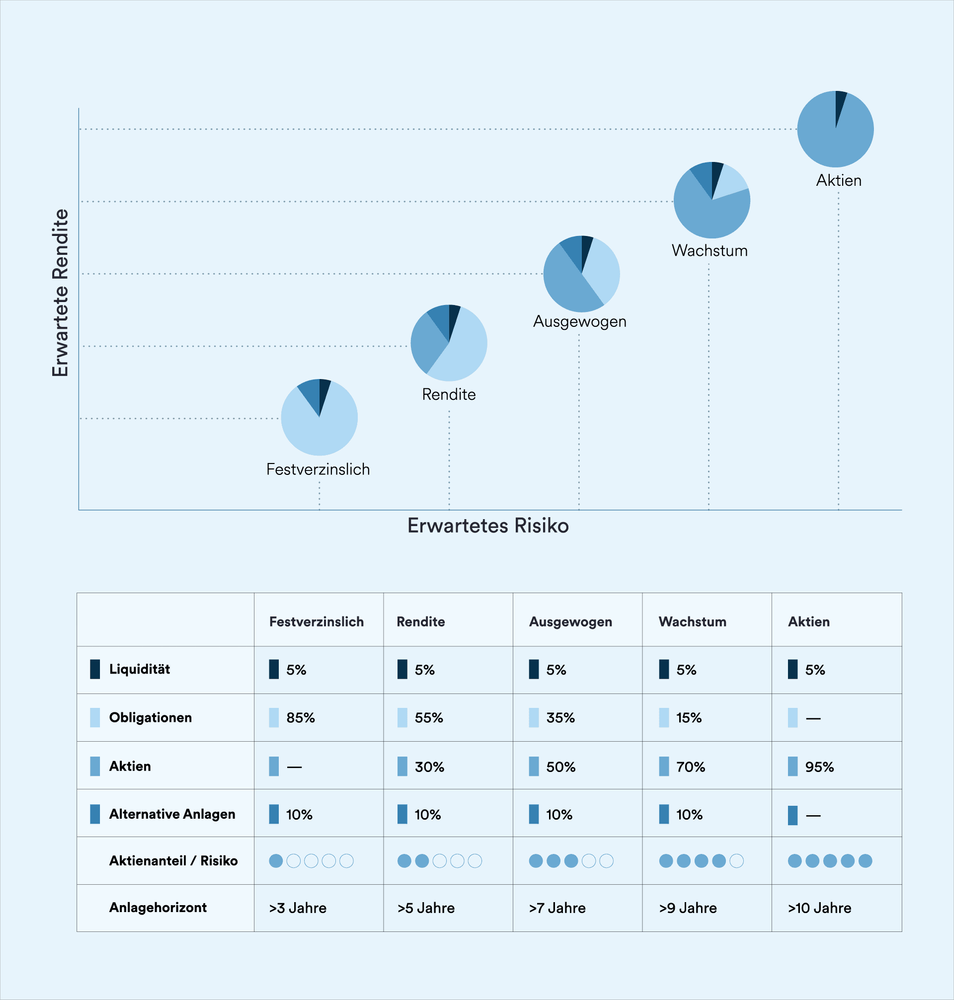

If you only save money within pillar 3a, you leave long-term potential untapped. Especially from the age of 40, it is worth investing your accumulated pension capital strategically. With an investment horizon of 15 to 20 years, you can benefit from more attractive returns than on a traditional pension account.

With our independent advice, we work together to find the right investment strategy – tailored to your risk profile, life stage, and financial time horizon. We compare solutions from a wide range of providers for you – neutral, BVV2-compliant, and fully focused on your objectives.

Pillar 3a is not a product, but a strategic tool – for tax, wealth, pension, and real estate purposes.

As part of our independent 360° advice, we analyze your current situation:

Based on your situation, we will find the best and most suitable solution on the market for you.

tailor-made. holistic. for you.

1. Quick assessment of your existing 3a solution

→ Does it still suit you? Is there any additional potential?

2. Understanding tax & financial optimization

→ Specific examples

3. Three steps to clarity – easy & understandable

→ Explained in simple & understandable language

smzh ag stands for independent, comprehensive, and tailored financial solutions that are accessible to everyone. Regular personal interaction with our clients is especially important to us. This is the only way for us to truly understand their goals and wishes, which are always at the center of our considerations. We are fully committed to finding the optimal solution for both your current life situation and any future needs.

We always act responsibly – particularly toward our clients, partners, and society by taking every decision with utmost diligence.

The needs and objectives of our clients are at the center of our daily work.

Trust is the foundation of our work – we guard it with utmost care by always striving to find the best solutions for our clients.

Long-term and sustainable solutions for our clients.

We always strive to find innovative solutions that add value for our clients.

Our principle of independence enables us to always act in the best interest of our clients.

If you currently have no 3a savings, download our guide that we will send you by WhatsApp. All you have to do is respond by WhatsApp saying that you have no pillar 3a savings yet. One of our senior client advisors will be happy to support you – free of charge and non-binding.

We will send you the guide by WhatsApp. To receive it, click the button "Get the PDF Guide" and fill out the contact form.

The pillar 3a guide is completely free of charge.

The guide provides a clear overview of the options available to you.