A risk profile is a systematic assessment of an individual’s ability and willingness to take financial risks. It forms the foundation of a personalized investment strategy and ensures that investments are aligned with the investor’s financial goals, risk tolerance, and investment horizon.

The psychological readiness to accept market fluctuations.

The financial capacity to tolerate losses without one's stability being impaired.

The planned duration of an investment which decides the influence of market fluctuations.

These objectives reflect whether the main goal of investing is capital preservation, maximizing returns, or retirement provision.

Trust in financial markets influences one's behavior in phases of turbulence.

Thorough risk profiling helps investors make informed decisions and plan their investments for the long term.

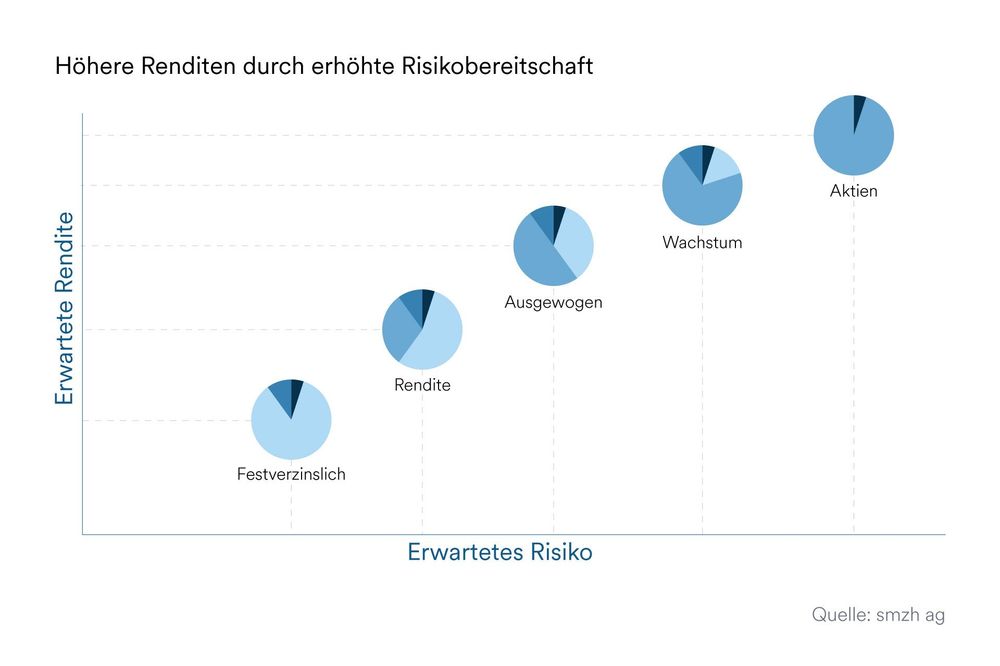

Once we have explained the key factors of a risk profile, it is important to understand how these factors contribute to defining and selecting an appropriate investment strategy. One fundamental finding in financial planning is that greater risk appetite generally goes hand in hand with higher expected returns. Investors who are willing to accept more significant market swings can achieve potentially higher returns.

We distinguish between five different risk profiles that pursue different investment objectives:

Income: Capital preservation and stable returns

Yield: Defensive approach

Balanced: Optimal balance between security and return

Growth: Long-term capital growth

Equities: Maximizing capital growth

Establishing a risk profile is a multi-step process

Assessing emotional response to losses.

Determining personal return expectations.

Assessment based on standardized questionnaires and conversations with specialists.

Determining the available capital, debt, and liquidity.

Comparing income and potential financial liabilities.

Making sure that the investments do not jeopardize one's standard of living.

Fixed income: Focus on capital preservation and stable returns by investing exclusively in bonds and money market instruments.

Yield: Defensive approach with low volatility that complements regular income with a low equity ratio.

Balanced: Balance between security and return thanks to a balanced mix of equities and bonds.

Growth: Return-oriented strategy with high equity portion to achieve long-term capital gains.

Equities: Maximizing long-term capital growth with a full equity allocation and, as a result, higher volatility.

Regular monitoring of the strategy, particularly amid changed circumstances.

Adjustment of allocation to optimally balance risks and opportunities.

We support you in developing a sound risk profile and creating a strategy tailored to your individual needs. Our services include:

Would you like to create your personal risk profile and develop a tailor-made investment strategy? Contact us for a non-binding consultation.

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

A risk profile assesses your willingness and ability to incur financial risks. It helps you develop a suitable investment strategy and avoid losses that might jeopardize your financial stability.

With a detailed analysis of your financial situation, your risk appetite and your investment horizon. Questionnaires and expert analyses help make a sound assessment.

Fixed income: Focus on capital preservation and stable returns by investing exclusively in bonds and money market instruments.

Yield: Defensive approach with low volatility, supplemented by regular income from a low allocation to equities.

Balanced: Strikes a balance between security and returns through a well-diversified mix of equities and bonds.

Growth: Performance-oriented strategy with a high proportion of equities aimed at achieving long-term capital gains.

Equity: Maximizes long-term capital growth through a full allocation to equities, accepting higher volatility as a result.

Yes, especially during life changes such as marriage, retirement, or changes in income. Regular reviews ensure that your strategy remains aligned with your goals at all times.

Your risk profile determines the type of investments that are suitable for you. A conservative investor will prefer more defensive investments, while a more dynamic investor will be willing to tolerate greater fluctuations to achieve higher returns.

Why traditional saving no longer works

Financial reality: A comparison of interest rates, inflation, and investment returns

From saving to investing: The right approach for long-term wealth creation

Investing in practice: Strategies, types of investment, and implementation

Costs & fees: The underestimated factor in investing

Success needs planning: Long-term optimization of your investment strategy