Set course for your future today. The Swiss three-pillar system provides financial security when it matters. An early start to saving and clever planning create the foundation for worry-free retirement – and we support you in achieving this goal.

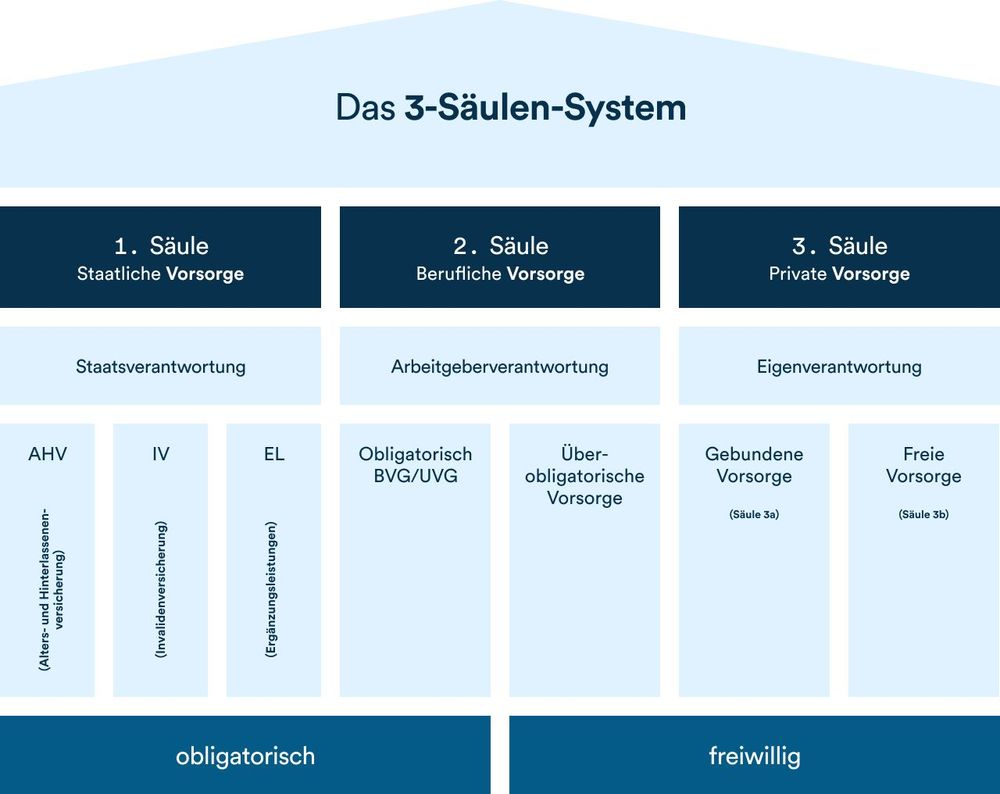

Switzerland's proven three-pillar system ensures financial security at every stage of life. It combines state-sponsored basic coverage (AHV), occupational pension plans (pension funds), and private retirement savings to bridge income gaps and enable you to maintain your standard of living. With careful planning, you can make the most of these three pillars to ensure you are well protected, even in unexpected situations. Our experts will support you in achieving your retirement goals and strengthening your long-term financial independence. Together, we will build a solid foundation for your future.

The Swiss three-pillar system offers a solid foundation to ensure financial security in retirement. Discover how you can best tap the advantages of state, occupational, and private provision.

The 1st pillar aims to cover one's basic cost of living in retirement, in the event of disability or death. smzh supports you in looking into your entitlements, closing gaps, and using benefits optimally.

Occupational provision with a perspective: The 2nd pillar aims to safeguard your standard of living in retirement. smzh shows you how to best use pension fund assets, savings on vested benefits accounts, and lump-sum payments.

Private provision with foresight: Pillar 3a helps you actively secure your financial future. smzh shows you how to save in a tax-optimized way, invest with focus, and plan your retirement provision smartly.

More freedom in your retirement provision: Pillar 3b allows you to plan your financial future more flexibly than ever before. smzh supports you in safeguarding your personal goals – with customized solutions, clever planning, and strong partners.

Your retirement deserves more than mere standard solutions. With smzh, you plan your retirement benefits holistically – from old-age and survivor's insurance (AHV) and pension fund benefits to the ideal combination of all sources of income. Transparent, individual, and tax savvy.

In case life takes an unexpected turn: smzh is by your side in the event of disability offering clear guidance, coordinated support with applications, and personalized indemnity solutions. This way, we ensure that you are financially protected and legally prepared in every circumstance.

Security in case of emergency: We show you which benefits survivors or persons with a disability receive – from an AHV pension to payments from additional insurance. smzh helps you maintain an overview and optimally plan for your financial security.

CHF 1,580.-

We analyze your insurance solutions to date and help you find suitable products at the best rates. Moreover, we make sure you are neither overinsured nor have gaps in your coverage. As part of our retirement provision analysis, we show you the benefits you are entitled to in the event of disability or death. Together we determine your requirements and find suitable offers for you.

Call us or make an appointment online for a non-binding first conversation. We look forward to hearing from you.

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

Payments into pillar 3a can be deducted from taxable income. Upon withdrawal, pillar 3a savings are taxed separately from other income at a reduced rate.