As a real estate owner in Switzerland, you carry the responsibility for a valuable investment. Buildings insurance provides the foundation of your insurance protection, safeguarding your real estate from various risks. We support you in finding the best possible insurance protection for your property.

From mandatory buildings insurance to household contents insurance to liability insurance – the range of compulsory insurance coverage is wide. Particularly the so-called GUSTAVO cantons have special regulations that you should be familiar with. Additional insurance such as water damage insurance for buildings or protection against natural hazards or loss of rental income completes the insurance range.

Your residential property involves responsibility, also when it comes to insurance coverage. Be it mandatory or supplementary insurance: Our overview shows how you can protect your home.

In 19 Swiss cantons, there is public-sector buildings insurance. These cantonal building insurers provide comprehensive coverage in the event of:

Regulations vary significantly by canton:

The insurance value is usually defined as the replacement value based on an estimate that is renewed every 12 to 15 years. In case of older buildings, the present value may be used as a basis.

The so-called GUSTAVO cantons (Geneva, Uri, Schwyz, Ticino, Appenzell Innerrhoden, Valais, Obwalden) employ a different system:

In Uri, Schwyz and Obwalden, buildings insurance is mandatory, but can only be concluded with a private insurer. In Geneva, Ticino, and Valais, there is no insurance mandate. Yet we strongly recommend taking out insurance, as natural disasters may be rare, but can result in steep costs that pose an existential threat.

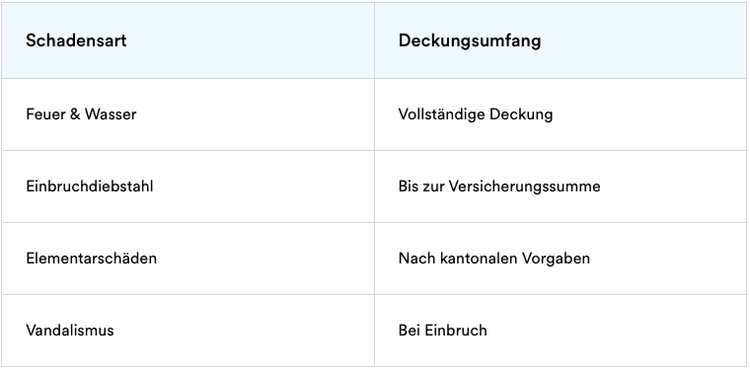

The household contents insurance protects your movable property at replacement value. The following events are included in basic coverage:

Note that in case of valuables such as jewelry or cash, special upper compensation limits apply. These limits are waived if the items were properly stored in a safe deposit box.

We recommend reviewing the sum insured every two years, particularly following:

Underinsurance can lead to significant financial losses in the event of a claim. For example, if your household contents are insured for a value of up to CHF 80,000 but the actual value is CHF 100,000, only 80% of the costs would be covered in case of damage. To ensure optimal coverage, we recommend automatic sum adjustment in line with inflation. This adjustment is linked to the consumer price index and protects you against gradual underinsurance.

We recommend special insurance coverage for particularly valuable items. Valuables insurance provides:

It is particularly important to correctly itemize:

Valuables insurance is an ideal complement to your household contents insurance, closing important coverage gaps. We are at your disposal if you would like to receive personalized advice on how to best insure your valuables.

The right liability insurance protects you from the financial consequences of third-party compensation claims. We show you which insurance solutions are indispensable for property owners.

Private liability insurance is the foundation of your personal liability protection. It covers damage that you may cause as the owner of an:

The insurance covers both personal injury and property damage caused by you or your family members.

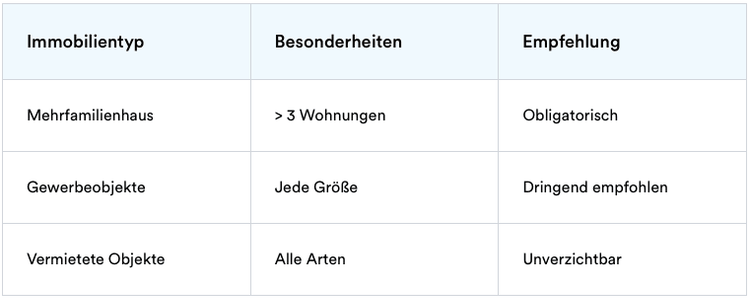

For property owners of bigger objects or rental objects, we strongly recommend taking out a separate owner's liability insurance. This type of insurance is particularly important in case of:

Owner's liability insurance protects you against claims that result due to or in your property. For instance in case:

We would like to draw your attention to key differences between the various types of insurance:

In case of condominium ownership, liability is more complex. We recommend particular caution, as private liability insurance of individual owners usually doesn't cover damages to shared areas.

Key aspects for condominium owners to consider:

1. Joint insurance:

2. Subsidiary cover:

3. Particularly important: Building liability insurance for condominium owners also offers protection in case of:

Legal basis: According to article 58 of the Swiss Code of Obligations, owners are liable for damages resulting from faulty installation, production or poor maintenance. Article 679 of the Swiss Civil Code expands liability to damages related to property rights violations.

We therefore strongly recommend:

Special risks require special coverage – we show you the most important additional insurance types that protect you beyond standard coverage.

In Switzerland, the Seismological Service registers over 800 tremors each year. The last major earthquake, in 1946, caused damage amounting to billions adjusted for today’s value. We would like to point out that only about 5–10% of buildings in Switzerland are insured against earthquakes.

Key coverage aspects of earthquake insurance:

Earthquake insurance is particularly relevant for:

Special case: In the canton of Zurich, earthquake insurance is a mandatory part of buildings insurance.

We understand how important regular rental income is for landlords. Rental income insurance protects you from financial losses if your rental properties become uninhabitable after a covered damage event.

Covered events:

A practical example: If two apartments with monthly rents of CHF 4,000 each become uninhabitable, the insurance covers the loss of income for up to 24 months.

Legal basis: According to Art. 259b of the Swiss Code of Obligations, tenants can reduce rent in the event of defects for which they are not responsible, or withhold rent entirely if the property is uninhabitable. Rental income insurance mitigates these financial losses.

Key coverage aspects:

Insurance for the surrounding area complements coverage of your property by adding important external elements. It includes:

Permanently installed elements:

Mobile elements:

The insured sum should correspond to the replacement value of all insured objects. We recommend reqularly adjusting the insured sum, particularly after new acquisitions or remodeling.

Special benefits:

Owning a home means both security and responsibility. Whether it’s buildings, household contents, liability, or construction insurance – find out which insurance policies are essential for property owners and how to comprehensively protect your assets. Get the necessary information now and proactively protect yourself against financial risks.

(In German)

Suitable protection for your home:

Schedule a consultation with our experts free of charge:

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

As a homeowner, it is important to have residential building insurance. Additionally, liability insurance is recommended. If you are building a house, construction fire insurance and construction all-risk insurance can also be beneficial.

In Switzerland, building insurance depends on the canton. In most cantons, cantonal building insurance it mandatory.

In Switzerland, the following insurance types are mandatory: liability insurance for all motor vehicles, health insurance for all residents, and accident insurance for gainfully employed persons.

Yes, building insurance is compulsory in most cantons. Yet household contents and liability insurance are optional, but recommended for homeowners.