What is estate planning?

Estate planning determines in advance how your assets will be distributed after your death. It minimizes potential conflicts among heirs, establishes your individual wishes, and ensures a fair and tax-optimized allocation. Estate planning is especially important, as roughly CHF 88 billion in assets are inherited or gifted in Switzerland each year, with a growing share of gifts.

Careful estate planning is essential, especially for estates that include real estate or businesses.

Real estate values (e.g., market, tax or productive value) can vary strongly, which may lead to misunderstandings. An independent valuation is of utmost importance.

Real estate objects tend to be difficult to share. Possible solutions are a sale, takeover by one heir, or joint use.

Determine whether a business is to be managed by heirs or external successors.

Company values (e.g., asset, productive or market value) can vary strongly.

Paying compensation to other heirs can be a financial challenge.

Define legal heirs, as no personal wishes will be taken into account without a will.

Integrate matrimonial property law and ensure that your spouse is adequately provided for.

Partners without marriage certificate are not considered legal heirs and must be named in a will to inherit.

Regulations such as those involving real estate or insurance should be brought in line with a new family situation.

Discover the key aspects of a will, which allows you to record your wishes during lifetime so that, after your passing, no decisions are left to the legislature and potential conflicts among heirs are prevented.

(in German)

Shine, glamour – and very down-to-earth: Entrepreneur and entertainer Alf Heller talks with us about financial planning, retirement provision, and the question nobody asks but everyone faces: What about a will?

(in German)

Our inheritance advisory service helps you address complex family, legal, and tax issues proactively, tailored to your situation, easily understandable, and with a focus on your personal circumstances.

Timely succession planning reduces the risk that unforeseen events might jeopardize business continuity.

Inheritance requires smart planning. Learn in simple terms what the difference is between a will and an inheritance contract, and what's important in estate planning.

A will makes it possible to clearly define your last wishes and in doing so deviate from the legal line of succession and take account of your personal circumstances.

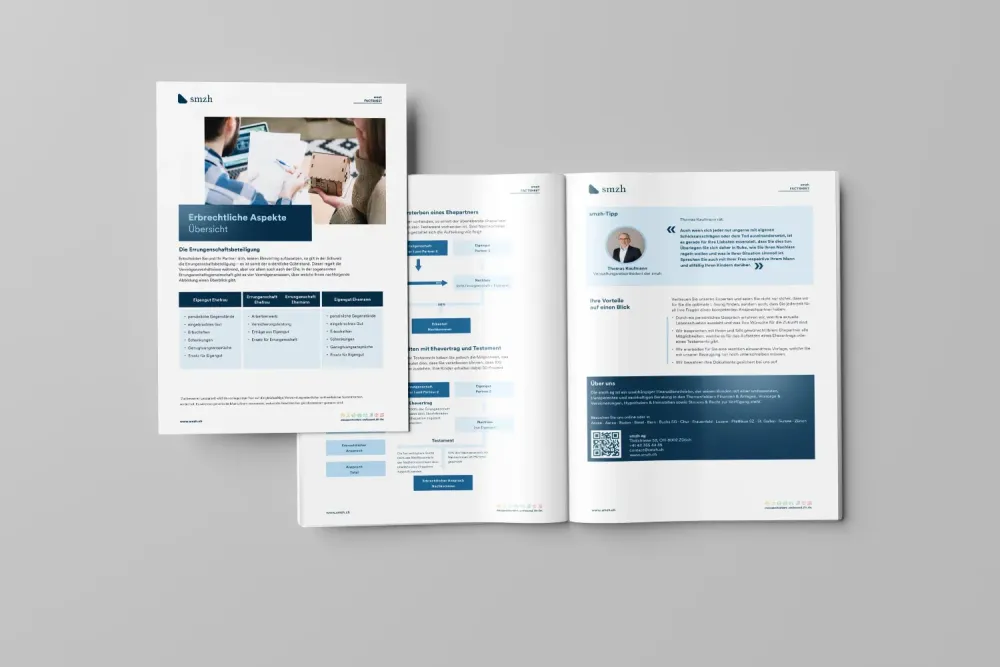

Without a marriage contract, the matrimonial regime of participation in acquired property applies by default. Anyone wishing to arrange their estate differently should consider a marriage contract and a will.

Make a complete inventory of your assets, including real estate and businesses.

Identify potential areas of conflict or problems, particularly related to real estate or company assets.

Will: Clearly names heirs and defines the exact distribution of assets.

Inheritance contract: Contractual agreements, e.g., for company succession, that are binding for all parties involved.

Clarify whether the property should be sold, transferred, or used jointly.

Tax optimization, e.g., by using tax allowances or distributions across several years.

Tax-optimized transfer, e.g., via gifts or staggered transfer.

Define succession rules, including compensation of heirs who do not take over the business.

Look into inheritance and gift tax, as they can vary strongly by canton.

Use tax allowances and tax-optimized transfers.

Staggered capital transfers to reduce tax progression.

Plan your estate with smzh – In a competent and forward-looking manner.

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

It establishes clear rules, minimizes conflicts among heirs, and prevents an unexpected tax burden.

Through an independent valuation and clear provisions in the will, such as sale or transfer, a fair arrangement can be achieved.

It is a legally binding document that governs the distribution of the estate. Inheritance contracts are especially useful for complex estates, as in the case of business succession.

It's best to start early, particularly in case of significant wealth or changing circumstances (e.g., marriage, divorce, childbirth).

Without a will, statutory succession applies, which may not reflect your wishes and can lead to conflicts.