What are luxury assets and what do you need to consider if you are interested in investing in such assets.

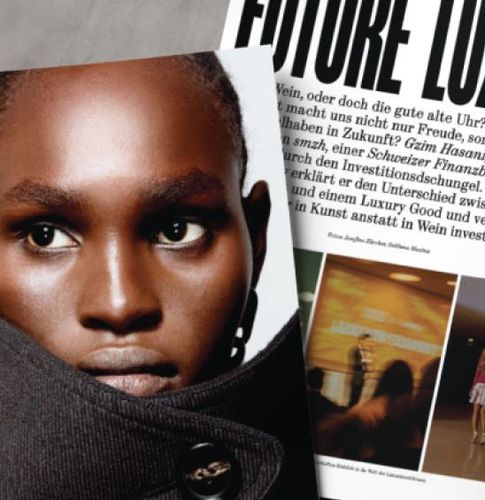

Interview with our CEO, Gzim Hasani, in FACES magazine

(in German)

Read more and deepen your understanding

A luxury investment involves allocating capital to premium, tangible assets such as rare watches, exclusive real estate, high-value works of art, and even luxury handbags. These items not only retain their value over time, but often have the potential to appreciate significantly, making them particularly attractive investment opportunities.

(in German)

A fine watch, an inherited piece of jewelry, or a rare artwork hanging on your wall – your favorite items deserve proper insurance coverage. Many people assume that household contents insurance provides this protection. Unfortunately, this is a widespread misconception. Find out why.

A financially independent life – with clever income, a well-thought-out investment strategy, and conscious consumption.

(in German)

Everything you need to know about this enthusiasts' hobby

When people hear the term “classic car,” it’s not only car and motorcycle enthusiasts whose eyes light up – nostalgia quickly takes hold, bringing to mind beautiful vintage vehicles. By definition, however, the concept of a classic car goes far beyond just cars and motorcycles. It also includes trucks, buses, tractors, locomotives, and even ships.

The Fédération Internationale des Véhicules Anciens (FIVA) classifies vintage vehicles as follows:

• At least 30 years old

• Preserved in a historically correct state and well cared for

• Not used as a daily means of transport

• Part of our technical and cultural heritage

Read our publication to learn everything you need to know about this enthusiasts' hobby (in German).

The market for fine wines achieves an annual turnover of an estimated USD 5 billion. Yet investing in wine requires specialized knowledge.

Luxury assets – a fascinating and profitable investment that is attracting more and more investors. But what exactly does the term mean? The distinction between a luxury good and a luxury asset is the expectation of value preservation and appreciation. A luxury good primarily serves for consumption and represents exclusivity and style. A luxury asset, however, is a strategic investment that creates value over the long term and is considered part of a diversified wealth strategy.

Call us or make an appointment online for a non-binding first conversation. We look forward to hearing from you.