At a time when interest rates on savings accounts barely balance inflation rates, the key question is: How can I ensure that my wealth doesn't just retain its value, but increases in value? The answer is simple, but now always intuitive: Investing is the new saving.

The traditional savings account used to be considered a safe haven for savings. However, the reality has changed. In recent years, low-interest-rate policy has forced many savers to accept effective losses. Since 2015, the Swiss National Bank’s key interest rates have often been in negative territory. Some banks even imposed negative interest rates on large account balances, making saving without investing unprofitable. Swiss households are collectively losing several billion francs in purchasing power each year by keeping their assets exclusively in savings accounts. In the long run, this seemingly safe investment leads to a real loss in value.

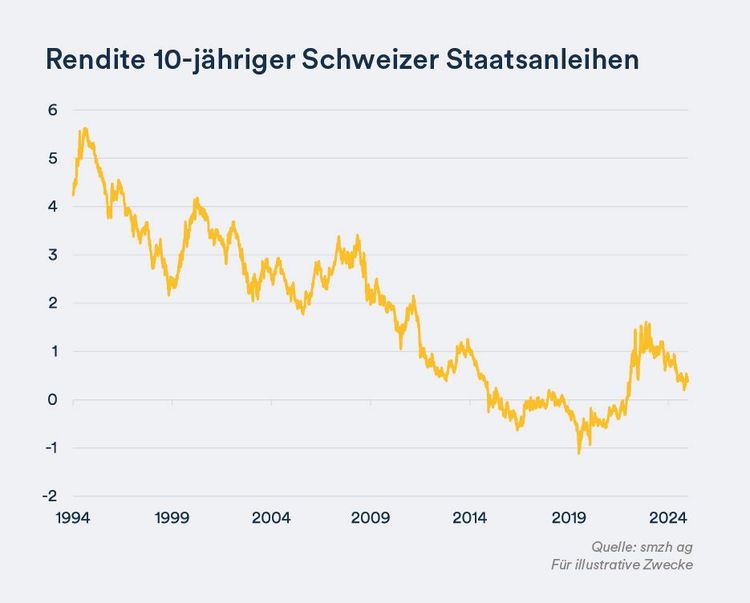

Even investments in 10-year government bonds no longer provide any returns, as yields have steadily declined over the past 30 years due to persistently low interest rates.

Investing means putting your money to work for you. It not only helps protect against a loss of purchasing power, but also enables targeted wealth accumulation. Available options range from bonds and equities to real estate and commodities. Each of these asset classes offers its own advantages and disadvantages.

Fixed-income securities where investors borrow capital to the issuer and, in return, receive regular interest payments and are repaid the nominal value at maturity.

Direct stake in companies offering potentially high returns, but at elevated volatility.

A proven investment offering stable rental yields and long-term growth potential.

Direct investments in commodities that act as protection against inflation and enhance portfolio diversification.

Long-term statistics highlight the opportunities: The Swiss Performance Index (SPI) has delivered an average annual return of around 8% over the past ten years. Even with small monthly contributions, investors can benefit from the power of compound interest. For example, someone who invests CHF 100 each month over 30 years at an average annual return of 6% can accumulate more than CHF 100,000 in wealth.

Our experts at smzh ag support you on your journey toward a sustainable and successful investment strategy. As independent advisors, we analyze your financial situation and develop tailored solutions. Our focus is on defining your individual goals, optimally taking your risk tolerance into account, and regularly reviewing your strategy. With us, you maintain an overview of your investments and adapt your strategy flexibly to changing market conditions.

Benefit from our expertise and lay the foundation for your financial future together with smzh ag.

Do you have any questions ro would like to develop an investment strategy that is tailored to your needs? Contact us today – we will support you every step of the way.

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

You can start with small monthly amounts, for instance CHF 50, to invest in a diversified way.

Through broad diversification and a long-term approach, you can reduce risks and achieve a stable return.

Pillar 3a is a tax-advantaged way to save including the option to invest in diversified investment solutions.

A suitable strategy depends on your objectives, your investment horizon, your risk tolerance, and your risk appetite. A personal consultation can help you determine these factors.

At least once a year, to ensure that your strategy remains appropriate given your objectives.

Numerous studies have shown that sustainable investments often achieve similar returns as traditional investments.

Why traditional saving no longer works

Financial reality: A comparison of interest rates, inflation, and investment returns

From saving to investing: The right approach for long-term wealth creation

Risk profiling: The basis of a successful investment strategy

Investing in practice: Strategies, types of investment, and implementation

Costs & fees: The underestimated factor in investing

Success needs planning: Long-term optimization of your investment strategy