Nowadays, investing is not just an option, but a necessity. Traditional saving is no longer enough to preserve purchasing power or build wealth in the long run. Inflation is continuously chipping away at savings, while low interest rates barely provide any returns. Whoever simply parks their money in a savings account loses real value year after year.

Savings sitting on a bank account are gradually worth less due to inflation.

People who only save end up losing money – Investing is the only way to preserve purchasing power in the long run.

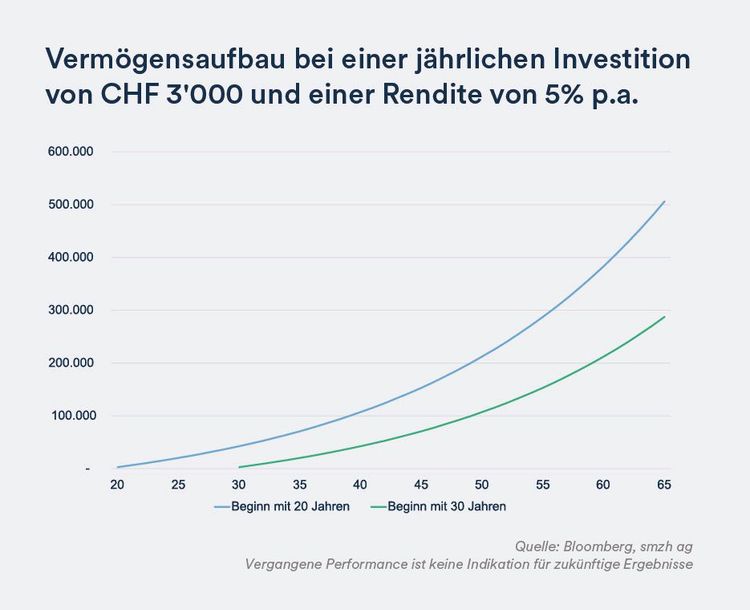

The sooner you start to invest, the more you benefit from long-term growth.

You don't need to have significant wealth to invest successfully – monthly investments of as little as CHF 50 in a broadly diversified investment solution allow you to benefit in the long term.

The compound interest effect increases your profits over years – the sooner you start, the bigger the impact.

At an annual inflation rate of 2%, your money will lose about 18% of its purchasing power within 10 years.

Whoever does not invest accepts a guaranteed loss of value.

Diversify your capital across various asset classes (bonds, equities, real estate, alternative investments).

Diversification helps you reduce the risk of single-security losses and benefit from long-term growth.

High fees can significantly dent your return.

If possible, select cost-efficient products such as ETFs and mind the total expense ratio (TER).

Compare providers and avoid unnecessary transaction costs.

Market movements are absolutely normal – avoid rash buying or selling decisions.

A long-term strategy beats short-term speculation.

Savings plans you help make optimal use of market opportunities and reduce timing risk.

Monthly investments balance market flucutations and enable gradual wealth creation.

We accompany you from your initial investment to optimizing your investment strategy in the long term. Our offering comprises:

smzh ag is your partner to help you invest professionally and sustainably.

Are you ready to make a first step toward a successful financial future? Let our experts advise you.

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

The earlier you start investing, the greater the effects of interest rates and growth will be. Those who wait lose both time and return.

There are low-risk types of investment. Moreover, a broadly diversified portfolio can reduce flucutations significantly. The investment horizon plays a decisive role in this context.

By investing in low-cost ETFs, avoiding unnecessary transactions, and adhering to a long-term strategy.

Short-term flucutations are normal. In the long run, markets do offer opportunities, and a broadly diversified portfolio can help balance market swings.

We help you develop a tailor-made strategy, accompany you in the long term, and optimize your investment solutions continuously.

Machen Sie den ersten Schritt – investieren Sie in Ihre Zukunft!

Klassisches Sparen kann Ihr Vermögen nicht mehr schützen – Investieren ist der einzige Weg, um Inflation auszugleichen und langfristig Wohlstand aufzubauen. Wer früh beginnt, mit Disziplin investiert und die richtigen Anlageprodukte wählt, kann mit überschaubarem Risiko ein solides Vermögen aufbauen.

Why traditional saving no longer works

Financial reality: A comparison of interest rates, inflation, and investment returns

From saving to investing: The right approach for long-term wealth creation

Risk profiling: The basis of a successful investment strategy

Investing in practice: Strategies, types of investment, and implementation

Costs & fees: The underestimated factor in investing

Success needs planning: Long-term optimization of your investment strategy