In recent years, the financial landscape in Switzerland has changed significantly. Traditional savings methods that once offered reliable value increases now rarely preserve real wealth. Interest rates on savings accounts have been declining for decades, while inflation persists.

In 1992, the average interest rate on savings accounts was around 7% per year. By 2024, the yield on long-term Swiss government bonds averaged just 0.5%, with interest rates on savings accounts typically even lower. As a result, saved cash loses real value, as inflation continuously erodes purchasing power.

The consequence: Anyone who deposits their capital in a savings account over the long term risks a real loss of wealth.

To safeguard the value of one's wealth and achieve a positive return, it's important to transition to investments that provide a positive return. Some basic rules apply when doing so:

Bonds: Fixed-income securities that are stable, but may provide a negative real return when inflation is high.

Equities: In the long run, equities offer the greatest potential real value increase, as companies adjust their prices and profits can rise.

Real estate: Real estate provides inflation protection, as rents and real estate values usually go up.

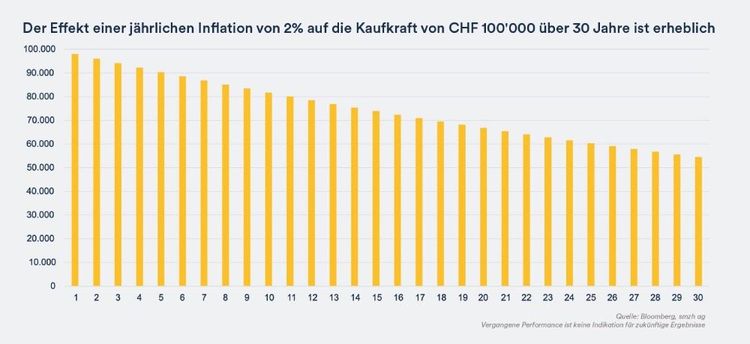

Over time, cash loses purchasing power if the inflation rate is higher than the interest rate.

Whoever would like to preserve their wealth in the long run should invest in inflation-protected or return-generating types of investment.

A broadly diversified portfolio reduces risks and balances out market fluctuations.

Combine various asset classes to minimize risk and maximize return opportunities.

3–6 months' expenses on an account with a relatively decent interest rate.

Invest CHF 500 a month in a broadly diversified solution with a long-term growth strategy.

Addition of alternative investments such as gold, commodities or real estate funds.

Our experts help you develop a sustainable investment strategy that is tailored to your individual needs. We offer:

Thanks to our experience and independence, we are your reliable partner for long-term wealth creation.

Would you like to learn how you can protect your capital against inflation and generate a sustainable return? Contact us today for a non-binding consultation.

We handle questions such as those shown on the right on a daily basis. You don't need to deal with them by yourself – our 360° Check-Up is free of charge and non-binding.

The purchasing power of your savings is reduced if inflation is higher than the interest rate on your savings account.

Assets such as equities, real estate, and commodities offer long-term inflation protection, as their prices tend to rise with inflation.

Bonds provide stability, but when inflation rises, their real return can be negative.

We analyze your individual situation and develop a tailor-made strategy to invest your capital in an inflation-protected way.

Why traditional saving no longer works

From saving to investing: The right approach for long-term wealth creation

Risk profiling: The basis of a successful investment strategy

Investing in practice: Strategies, types of investment, and implementation

Costs & fees: The underestimated factor in investing

Success needs planning: Long-term optimization of your investment strategy