The basics: The Swiss banking system

Switzerland is world-renowned for its stable and secure banking system. Banks provide comprehensive services for private individuals, corporates, and investors. A Swiss bank account is essential for payment transactions, salary payments, and everyday financial transfers.

Private account for salary payments & daily transactions

Savings account for long-term wealth creation

Investment account for investments & wealth growth

Proof of identity (passport or residence permit)

Proof of residence & employment contract

Tax declarations for foreign account holders

Activate online banking & mobile apps

Set up standing orders & payment transactions

Apply for credit or debit card

Learn how you can ensure a seamless relocation to Switzerland through proper planning – for a successful fresh start both at home and at work.

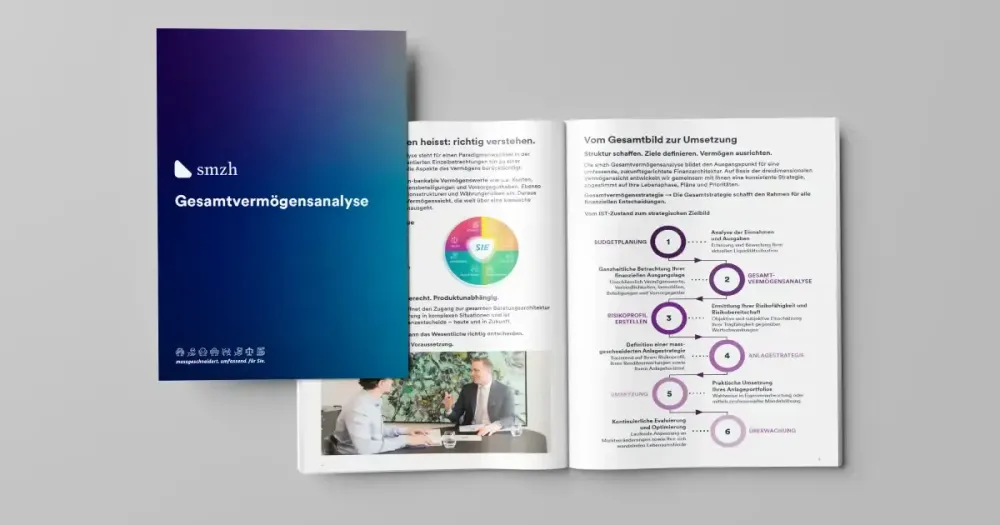

The smzh comprehensive asset analysis represents a paradigm shift in financial advisory: A shift away from fragmented single reviews toward a structured complete view that takes into consideration all aspects of your wealth.

(in German)

smzh Invest provides access to a professional investment strategy based on a comprehensive asset analysis – individual, transparent, and independent. Invest with a plan, with structure, and with the aim to safeguard and grow your wealth sustainably.

Your partner for banking & finance

smzh ag supports you in all financial matters – from account opening to investing to pension planning.

We accompany you on your financial journey!

Tap our experts' advice and find the best finance solutions for your circumstances.

We handle questions about banking & finance on a daily basis. These are the most frequently asked ones:

Yes. Provided you have a valid residence permit or proof of domicile, you can open a bank account.

The answer depends on your needs – large banks provide international services, while cantonal banks often have better conditions for local clients.

Fees vary by bank and account type. They typically range from CHF 5 to 10 a month.

Pillar 3a is a private retirement provision that offers tax advantages and helps secure your financial future in retirement.