The Transformation of the Swiss Banking Sector: What Does the Loss of Credit Suisse Mean for SMEs?

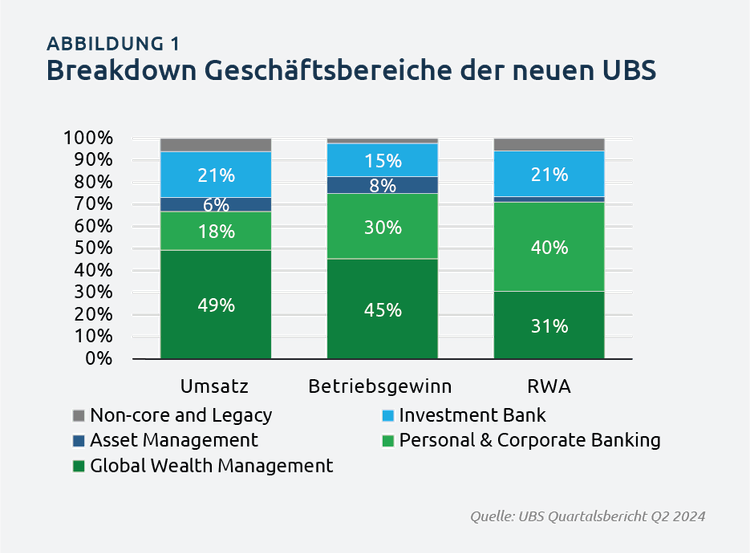

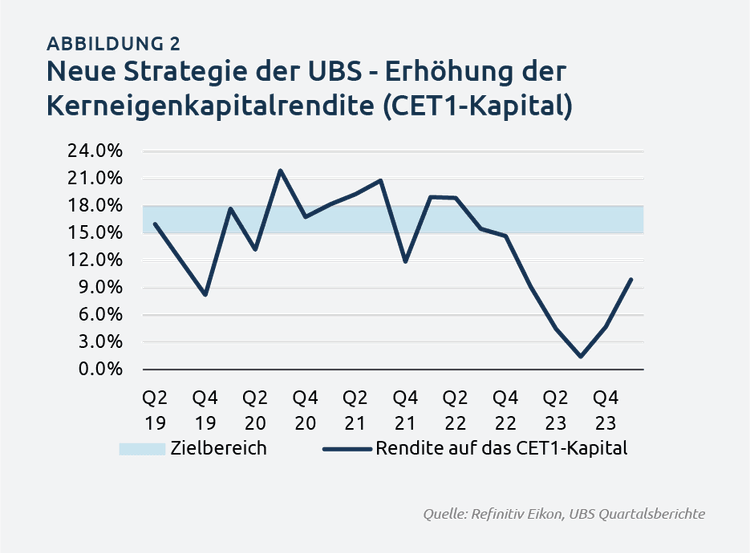

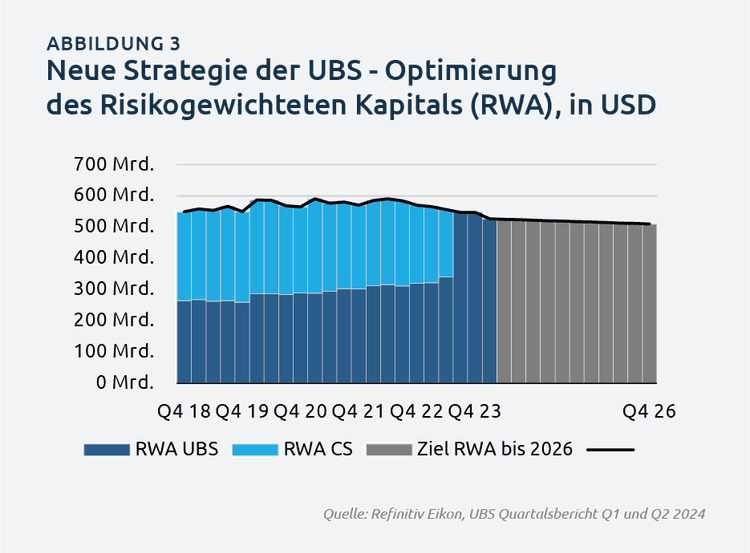

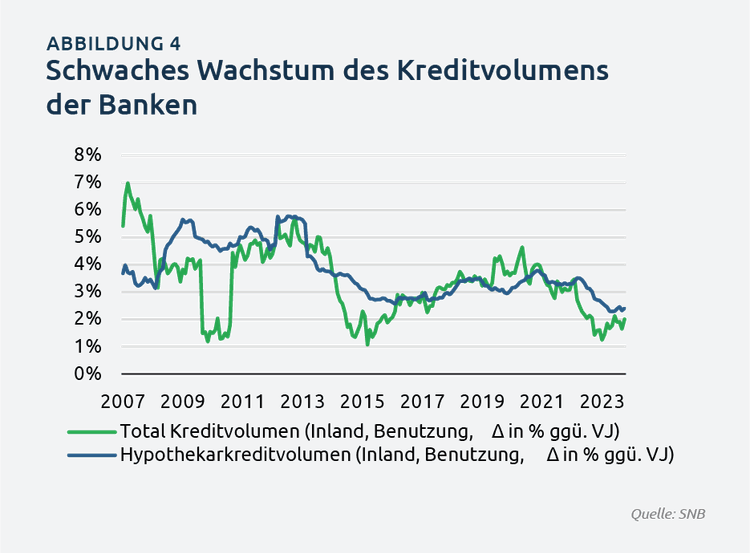

The Swiss financial sector is undergoing a profound transformation following UBS's acquisition of Credit Suisse, a shift that will particularly affect Swiss businesses, especially SMEs, which are the backbone of the Swiss economy. This analysis examines the strategy of the new UBS, its impact on corporate banking, and the opportunities for other market players to fill the gap left by Credit Suisse. It also highlights the actions that Swiss companies need to take.