Don’t fight the US Fed – but how about the SNB?

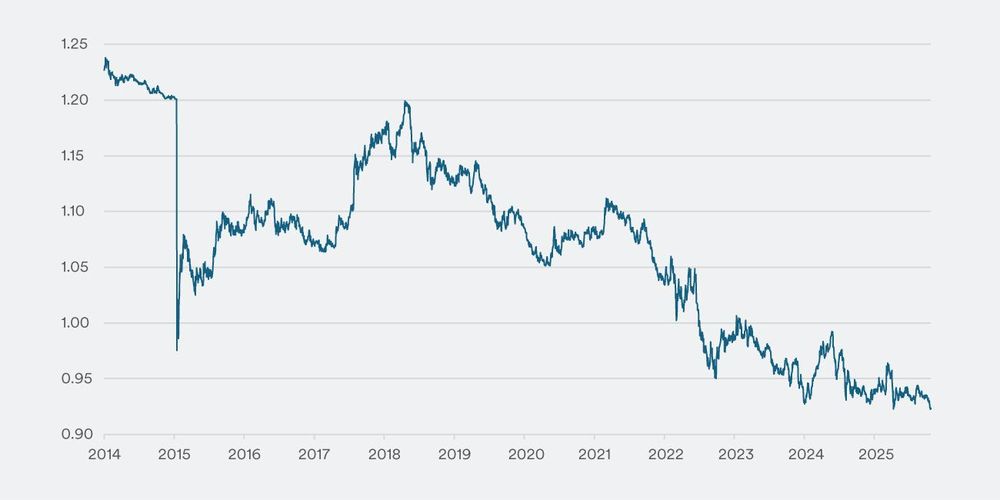

There is broad consensus among experts that, in the event of substantial franc appreciation, the Swiss National Bank (SNB) would first intervene in the currency markets before considering a return to negative interest rates. Whether it can influence the exchange rate on a sustained basis, however, is highly doubtful. Unlike the US Federal Reserve (Fed) or the European Central Bank (ECB), the SNB lacks the same degree of market-moving prowess. The stock market adage “Don’t fight the Fed” implies that investors should follow the US central bank’s monetary policy, as its control over interest rates and liquidity generally prevails in the long term. While the SNB’s measures also warrant attention, its influence over global capital flows and exchange rates remains markedly more limited in comparison.

The strength of the franc currently reflects widespread demand for safe-haven assets, especially in light of the US dollar’s recent weakness. Since the announcement of US tariff measures, the dollar has notably come under significant pressure. As a result, the Swiss franc is likely to continue appreciating both against the euro and the US dollar.

Putting the current financial market environment in a broader context

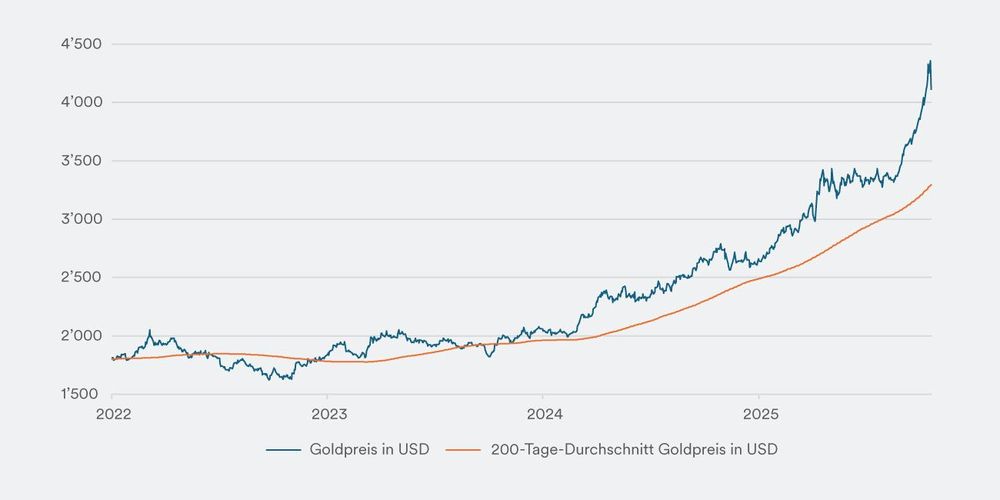

Financial markets are currently presenting investors with a complex set of challenges, as correlations between traditional asset classes have risen significantly. Nearly all asset classes are appreciating simultaneously – from riskier market segments such as heavily shorted stocks, cyclical equity indices, and high-yield bonds, to traditional safe havens like government bonds and the Swiss franc. This phenomenon is unusual, as equity rallies typically coincide with bond market declines, and gold usually benefits from broad-based uncertainty and risk aversion. This “everything rally” is being driven by a combination of high liquidity resulting from central bank interest rate cuts, economic resilience despite the risks posed by US trade policies, and solid corporate earnings, which benefit both growth assets and real stores of value like gold.

Although these complex conditions make short-term portfolio allocation and risk management significantly more challenging, they do not undermine their importance. It remains advisable to maintain a diversified investment strategy that aligns with your own risk profile and return expectations. Especially in volatile and complex market phases, the value of staying invested with discipline and consistency becomes clear. In the long term, the commitment to a well-defined strategy is crucial for investment success. A calm, disciplined approach focused on long-term objectives helps ensure the successful implementation of an investment strategy even in demanding market environments.