The Swiss National Bank (SNB) has kept its policy rate unchanged at 0.00% at its latest monetary policy assessment, thereby ending a streak of six consecutive rate cuts for the time being. The message is clear: a return to negative interest rates would require clearly identifiable deflation risks or a significant economic downturn. While the US-imposed tariffs are tangibly impacting certain sectors and have contributed to downward revisions of growth forecasts, the SNB does not consider this sufficient reason to immediately deploy its interest rate policy tool again. Instead, the central bank is taking a wait-and-see approach and only foresees further measures if clear economic signals emerge.

Next rate move: -0.50% or a prolonged pause

Interest rate cuts into negative territory have only limited effectiveness. As a result, any future measures would likely need to be larger in scale. At the same time, from the SNB’s perspective, price stability is considered assured in the medium term – even if inflation temporarily hovers at or below zero. In concrete terms, this means that the next logical step would be either an extended pause or a cut of 0.50%.

Market reaction

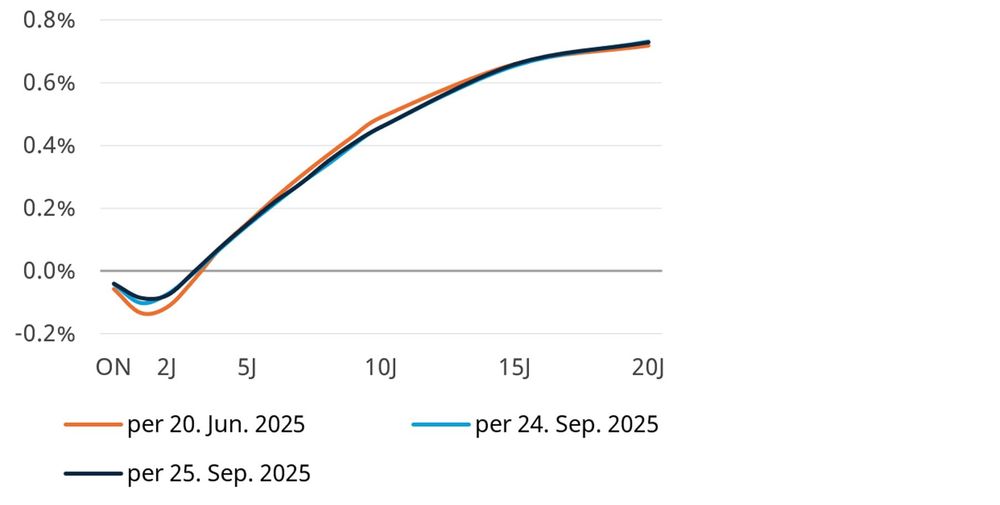

The immediate reaction in financial markets has been muted. Both the yield curve and the Swiss franc have remained virtually unchanged compared to the previous day. Stock markets have also shown little response to today’s interest rate decision, with the Swiss market trading lower due to a generally weak opening.

Further appreciation pressure on the Swiss franc

So far, previous rate cuts have done little to weaken the franc. Against the euro, the currency remains stable; against the US dollar, the franc has even appreciated further since June. This development is driven on the one hand by market expectations of lower Fed rates, and on the other hand by the absence of additional SNB measures such as deeper negative rates or systematic foreign exchange interventions in the near term. Today’s decision reinforces this assessment and suggests that the franc may face continued appreciation pressure.

Mortgages and real estate benefit

Even without new negative interest rates, the low interest rate environment remains in place. For homebuyers, this means continued attractive financing conditions, which—coupled with rising rents—highlight the financial advantages of home ownership and are likely to support demand. Institutional investors are already subject to negative deposit rates, and the limited appeal of the Swiss bond market is prompting a shift toward real estate and mortgage investments.

.

Bild 1: Kaum Reaktion am Swap-Markt auf den SNB-Entscheid

Zinsswap-Kurve im Vergleich