The Swiss National Bank (SNB) today made a historic decision, lowering its policy rate to zero percent for the first time. Until now, the SNB had deliberately avoided this level – even during the era of negative rates between late 2014 and early 2022, the policy rate remained slightly below zero but never exactly at zero percent.

A rate cut by the SNB was widely expected ahead of today’s monetary policy assessment. However, the key question was whether policymakers would already reintroduce negative rates. Since the start of the hiking cycle in 2022, the SNB has surprised analysts in five out of twelve monetary policy decisions.

Response to declining inflation and a strong franc

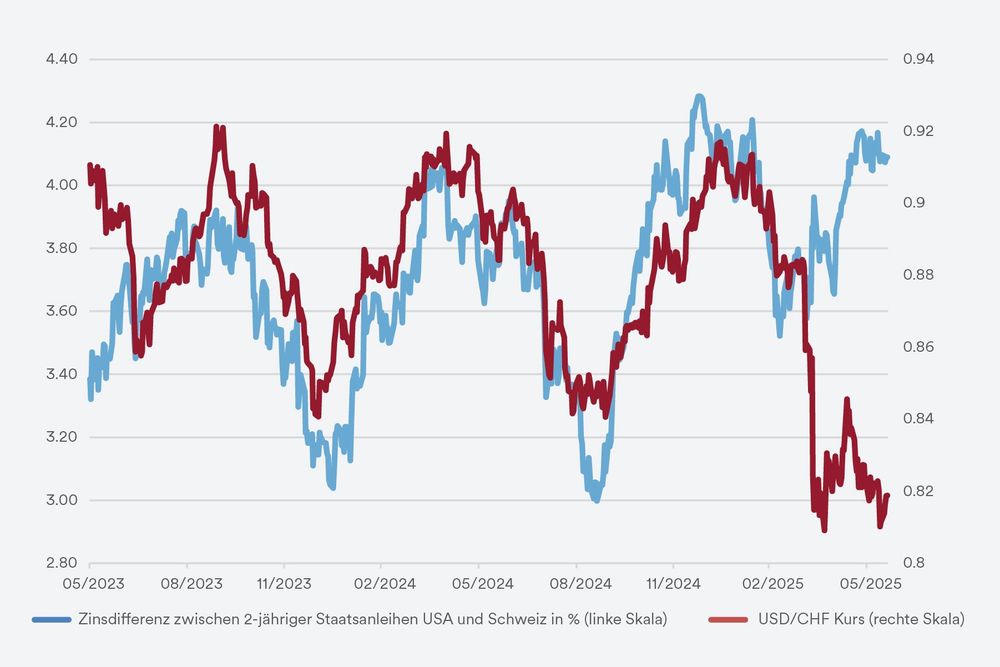

Today’s rate cut should be viewed as a response to two main factors: declining inflation in Switzerland and the persistent strength of the Swiss franc. Nevertheless, there remains considerable skepticism among market participants about the SNB’s ability to sustainably weaken the franc, as external influences remain too dominant.

In May 2025, Switzerland’s inflation rate fell into negative territory for the first time since March 2021. While this is a symbolic threshold, it did not surprise either the SNB or the analyst community. The reasons are well documented: negative inflation is mainly due to imported deflation resulting from the strong franc. For example, prices of imported goods fell by -2.4%, while inflation for domestic goods remained moderate at +0.6%.

Core inflation – which excludes volatile components such as energy and food – also declined slightly, but remains at +0.5% (after +0.6% a year earlier). This means that while imported goods have become cheaper, prices for services and many domestic products have remained stable. As a result, the purchasing power of the population benefits in the short term from falling inflation. However, a prolonged period of deflation must be avoided, as it would dampen consumer spending, burden the economy, and could ultimately increase unemployment. For now, Switzerland remains far from this scenario.

Why the SNB chose not to move to negative rates

The decision to lower the policy rate to zero percent, without returning to negative territory, appears reasonable from today’s perspective. While a reintroduction of negative interest rates had not been ruled out in advance, such a step would have been considered premature given the continued stable state of the economy.

The Swiss economy remains robust overall, the labor market is stable, and despite falling inflation, there are currently no signs of a broad-based deflationary spiral.

Will negative rates return as early as September?

Nonetheless, there are growing indications that negative interest rates could soon become a reality in Switzerland once again. On the capital market, they already are: Swiss government bonds with maturities of up to five years now trade at negative yields. Against this backdrop, market observers expect the SNB may opt for another rate cut at its next policy assessment in September, thus ushering in a new era of negative rates.

Muted market reactions

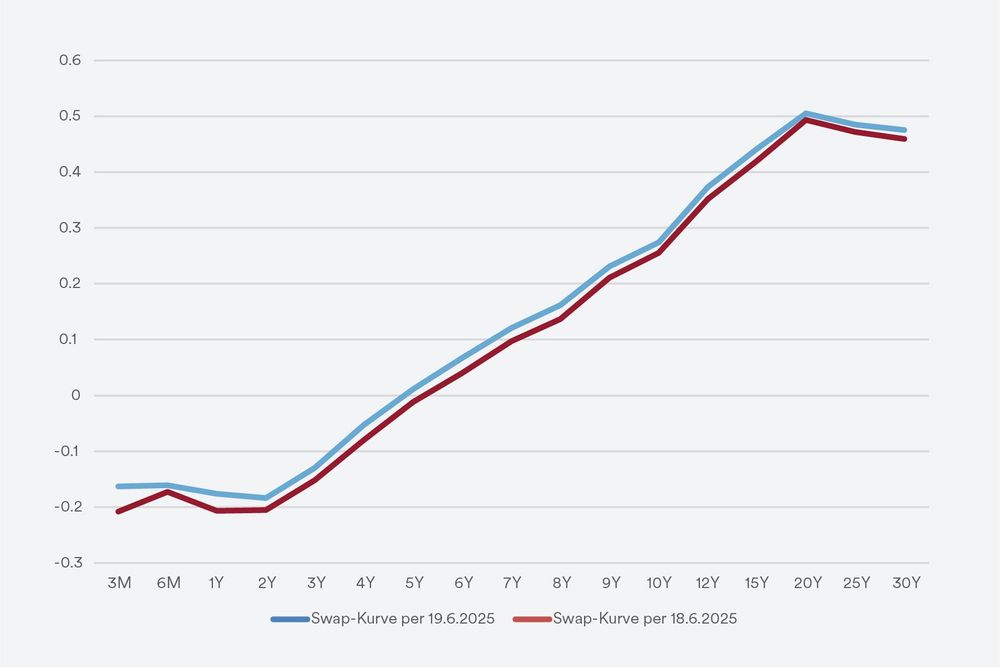

Immediate reactions in the financial markets have been subdued. The Swiss franc has appreciated approximately 0.2%-0.3% against the euro and US dollar. CHF interest rates have even increased slightly by around 0.05%, as the Swiss yield curve has already been in negative territory for some time. Before today’s rate decision, equity markets showed weakness, pressured by increased risk aversion surrounding potential escalation of the situation in the Middle East.

Fig. 1: The CHF yield curve sees a modest counter-move after the SNB decision