Stocks of companies with small and medium market capitalizations (small- and mid-caps) play an important but often underestimated role in equity markets. In recent years, these stocks have lagged behind established large-cap companies. However, under changing market conditions, they can also present attractive opportunities for investors. Below, we explore what distinguishes these companies, the challenges they have recently faced, and why they are coming into sharper focus again.

What are small and mid-caps?

Small and mid-cap stocks represent companies with market capitalizations ranging from a few hundred million up to around five billion Swiss francs. Unlike the familiar constituents of the large-cap universe, these companies are often in an earlier stage of their corporate lifecycle, more specialized, and more dependent on domestic or niche markets. Their key attraction lies in agility: they can innovate quickly, seize market share, and benefit disproportionately when economic growth accelerates. That dynamism also entails risk, however. Smaller firms typically have less diversified revenue streams, lower cash reserves, and a higher sensitivity to credit conditions. Their performance is therefore more volatile and closely tied to the economic cycle. But higher volatility also means higher growth potential.

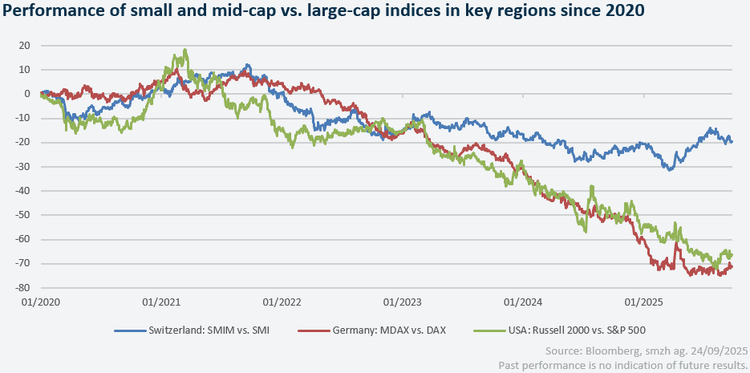

Why have they underperformed?

Over the past few years, small and mid-cap equities have underperformed. Rising interest rates pushed up borrowing costs, economic uncertainty favored larger, diversified firms, and investor flows concentrated on mega-cap technology stocks. The surge of passive investing has further tilted capital toward large-cap indices, leaving the smaller-cap part of the market overlooked.

Why do they look attractive now?

Currently, small and mid-cap stocks are trading at significant discounts compared to large caps as well as to their own historical averages. As interest rates decline, smaller companies benefit directly from lower financing costs, which enhances profitability and opens up additional growth opportunities. Regardless of the business cycle, small and mid-caps provide exposure to trends that are often underrepresented among large enterprises.

This is particularly relevant for Swiss investors: the Swiss Market Index (SMI) is dominated by a handful of global heavyweights from the healthcare, consumer, and financial sectors. While these companies offer stability and international diversification, they also concentrate risk and largely exclude more dynamic market segments.

In contrast, the Swiss small and mid-cap market – tracked by indices such as the SPI Extra or the SMIM – provides access to innovative companies in industrials, technology, medtech, and niche consumer goods. Many of these firms are global leaders in their specialties, yet they remain largely off the radar of international investors.

Including small and mid-caps in a portfolio not only increases diversification beyond the “Swiss Giants” but also reflects the innovative strength and dynamism of the domestic market. However, they should be seen as a complement – not a replacement – for large-cap positions within a diversified portfolio.