Die besser als erwartete makroökonomische Entwicklung ermöglichte im vergangenen Jahr eine Stabilisierung an den Finanzmärkten The better-than-expected macroeconomic development allowed for stabilization in the financial markets last year, with an unexpectedly positive trend on the stock markets at the end of the year.

A year ago, two questions dominated the discussion on intrest rate development: How high? For how long? THe answer to the first question is now known. If there is no sudden reversal in inflation, the peak in interest rates is likely behinde us. However, the answer to the second question is still pending.

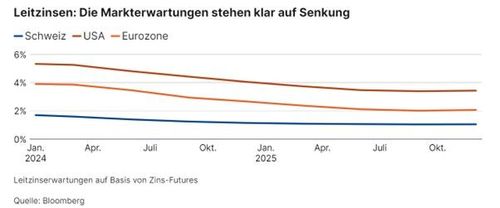

Both in Switzerland and in Europe and the USA. inflation seems to be under control for now. Therefore, the market assumes that central banks will implement several interest rate cuts this year. The prevailing opinion among Swiss economists is currently that the Swiss National Bank (SNB) will cut interest rates twice by 0.25 percentage points each during the current year. This would mean that the key interest rate would be at 1.25 percent at the end of the year. The likelihood of SNB interest rate cuts this year is already priced into the current fixed mortgage interest rates.

However, if the economic situation develops worse that expected, the SNB could cut interest rates morge significantly, leading to further decreases in mortgage rates. On the other hand, a return of higher inflation rates could lead to a more restrictive monetary policy, resulting in an increase in mortgage rates. The significant uncertainties about further interest rate and market developments are evident in the wiedly divergent forecasts of various economists.

Fixed-rate mortgages due in 2024 will lead to cuts in the disposable income of private households, leaving less for consumption. For business, refinancing maturing liabilities will result in higher interest expenses, reducing profitability and increasing hurdles for investment projects.

For the first time since 2008, central banks now have monetary policy leeway, allowing for interest rate cuts.