On March 17, 2023, the National Council and the Council of States approved the reform of occupational benefits insurance. The referendum on the OPA reform will take place on September 22, 2024. The aim of this reform is to strengthen the financing of the 2nd pillar, maintain the level of benefits and improve the protection of part-time employees, especially women.

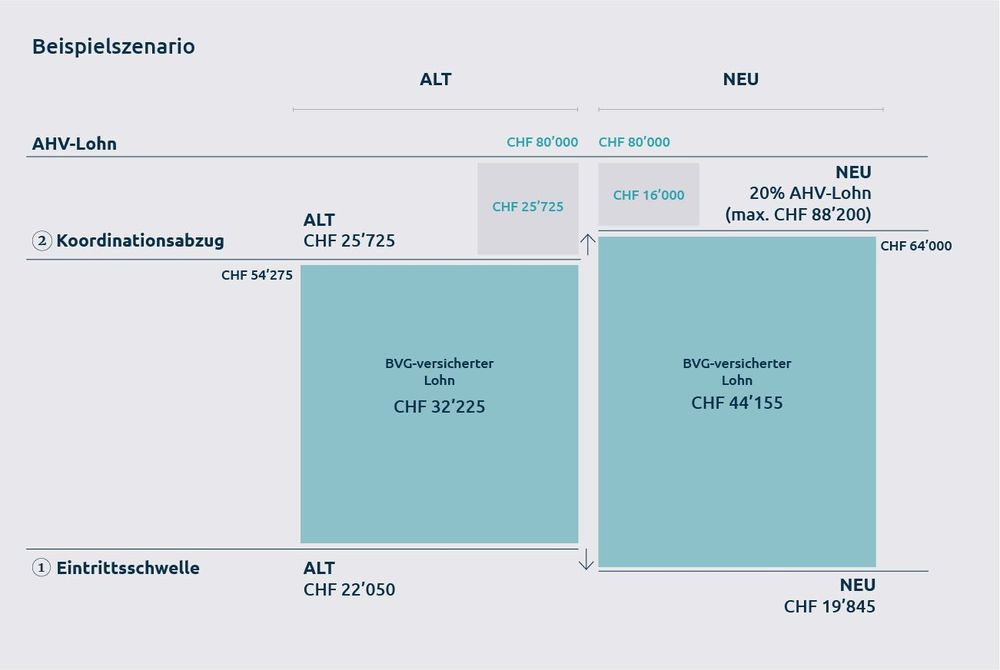

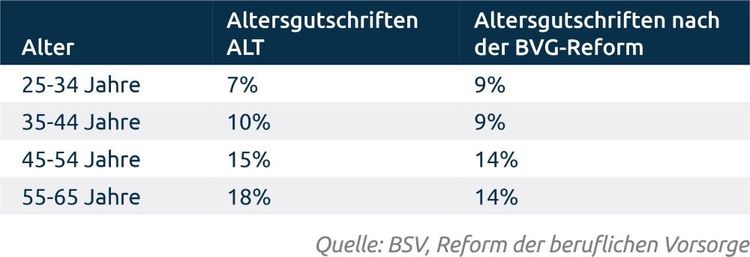

A central element of the approved reform is the reduction of the OPA conversion rate from 6.8% to 6.0%. This is intended to reduce the undesirable redistribution from employees to pensioners and introduce pension supplements for the transitional generation. At the same time, the savings process will be strengthened by adjusting the retirement credits and the coordination deduction. These measures will help to largely maintain the level of benefits and improve the pension situation of workers with low wages - often younger or part-time employed women and men.