Europe as the beneficiary of the changed era of "US exceptionalism"

US President Donald Trump’s unpredictable trade policy has led to a reassessment of the era of "US exceptionalism." This concept refers to the unique position of the United States as the dominant economic power and a leading player in global financial markets, underpinned by economic strength, innovative capacity, the US dollar’s role as a reserve currency, and geopolitical influence. This special status has enabled the US to attract capital and establish its financial markets as the most stable worldwide.

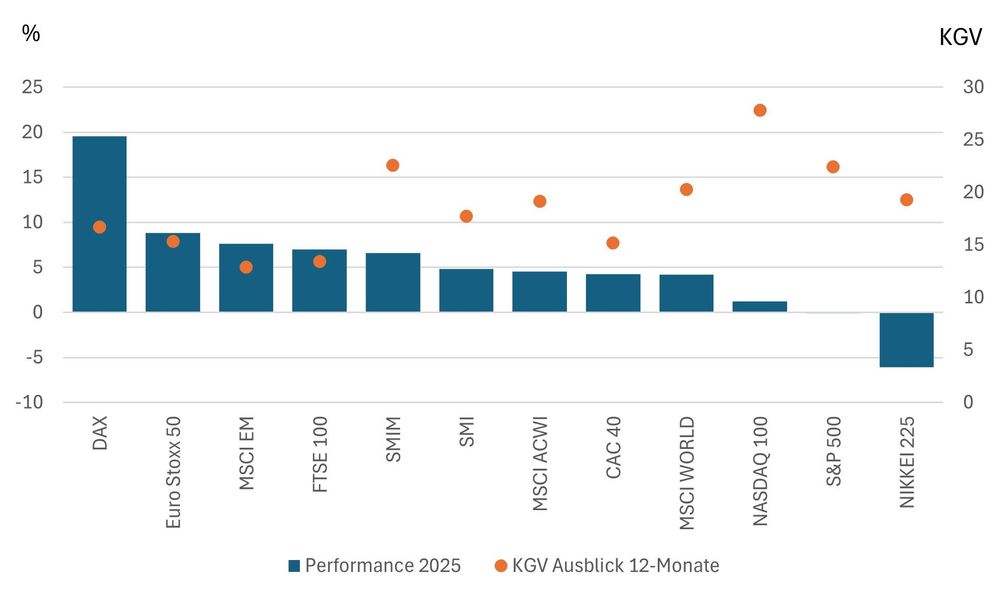

A reassessment of this era therefore directly impacts assets that underpin US economic dominance: the dollar and US Treasuries. Two traditional safe havens have suddenly become less attractive and are seeing increased capital outflows. The precise extent to which foreign investors have reduced their holdings of US Treasuries – and thus their USD positions – will only become clear in a few weeks. With the possible end of US exceptionalism, investors are now questioning the implications of these capital flows. Europe, as the world’s second-largest economy with the second global reserve currency, seems to be one of the main beneficiaries. This is reflected in European equity markets, which have significantly outperformed their global peers so far this year.

Fig. 2 Comparison of key equity markets, year-to-date performance and 12-month forward price-earnings ratio (P/E)