The Art of Adaptability

In the realm of financial markets, adaptability is no longer a competitive advantage —it is a prerequisite for sustained success. This reality brings to mind Donald Trump’s much-cited book «The Art of the Deal», which portrays negotiation as a calculated contest of power: characterised by inflated opening demands, strategic ambiguity, and the deliberate use of uncertainty as leverage. While such tactics may yield results in high-stakes business negotiations, they can prove highly disadvantageous for long-term investors navigating the aftershocks of erratic policy decisions.

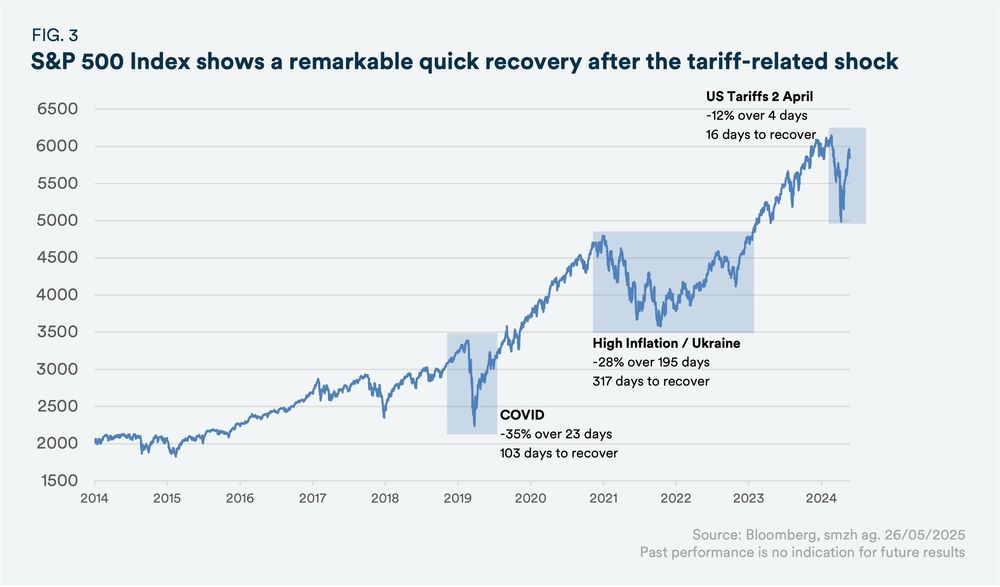

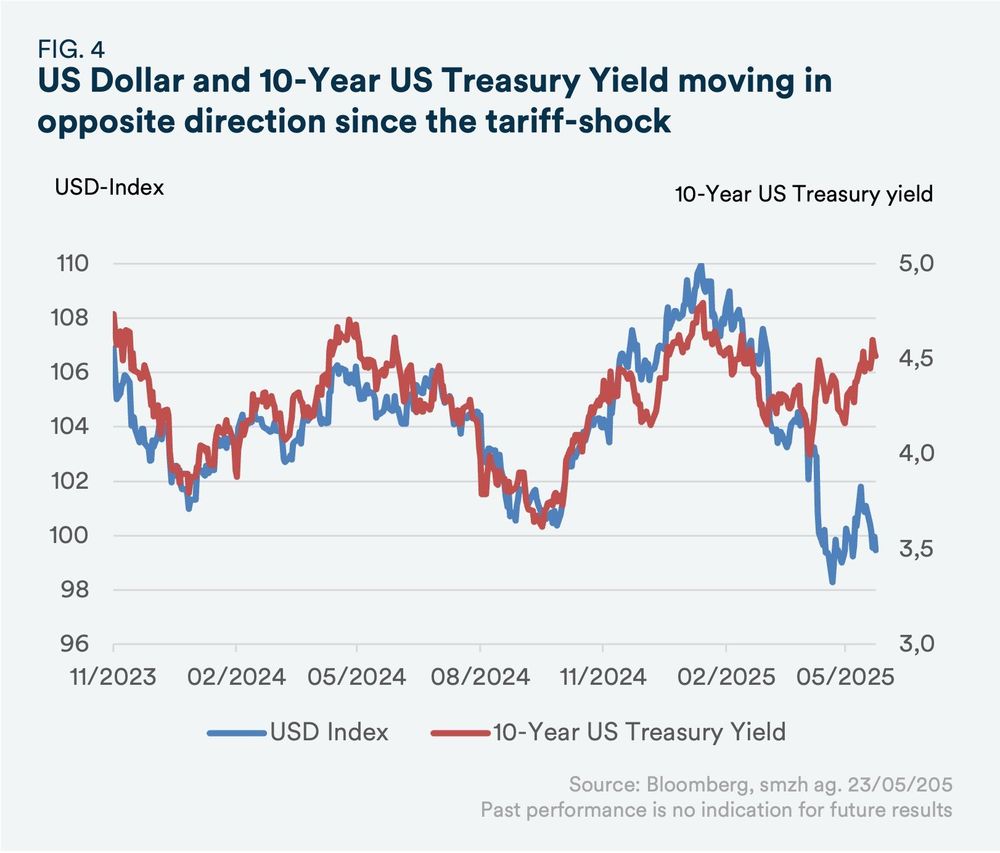

Following the tariff shock on 2 April, analysts and economists have been forced to adjust their forecasts and recommendations, often mirroring the erratic nature of Trump’s tariff announcements. This situation highlights the importance of adaptability but also raises questions about the balance between responsive adjustments and maintaining a strategic focus.

«The Art of Adaptability» is not about constant repositioning in response to every headline. It is about strategic assessment —the ability to separate relevant matters from emotions. While it is essential to stay informed and adjust to new circumstances, it is equally important to avoid making erratic decisions based on incomplete or uncertain information. The lesson from the recent market disruption is clear: adaptability is essential, but it must be applied judiciously. Over the course of the year, we have consistently advocated for a calm and measured approach —maintaining diversified portfolios and adhering to long-term plans despite short-term uncertainty. This strategy has proven effective. Those who stayed the course were better positioned to navigate the volatility than those who reacted impulsively.

While the future is inherently uncertain, market volatility and temporary drawdowns are integral to the risk-return profile of any sound investment strategy. This fundamental principle should not be forgotten. Financial markets will always be subject to unforeseen events and policy shifts. The key lies in remaining focused, relying on rigorous analysis, and making decisions grounded in strategy rather than sentiment. In doing so, investors not only mitigate risk but also position themselves to seize opportunities —where others may be distracted by emotions.

Enjoy the reading.

Best regards,

Gzim Hasani, CEO

Bekim Laski, CFA, Chief Investment Officer