Trumponomics 2.0 and DeepSeek’s sudden fame

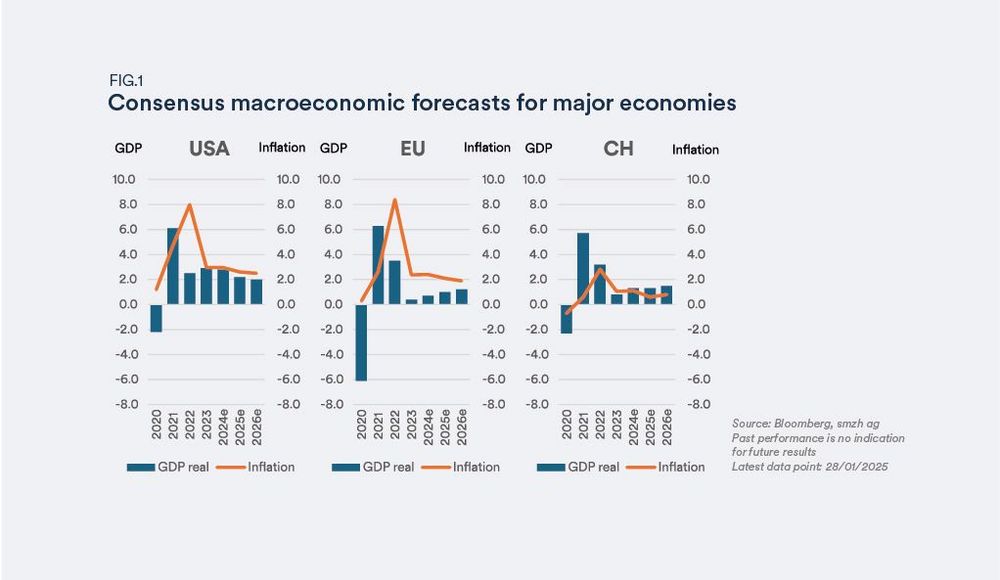

2025 has started with a series of seismic shifts across global financial markets, setting the stage for what may be a transformative period with the inauguration of Donald Trump for his second term as President of the United States taking center stage. The new administration’s economic agenda, often referred to as «Trumponomics 2.0», is shaping investor sentiment and market expectations. Potential tax cuts, shifts in trade relations, and regulatory adjustments could have significant long-term impact on economic growth, corporate earnings, inflation, and geopolitics. As markets adjust to these evolving policies, the Federal Reserve’s role in balancing inflation and interest rates remains a key market focus.

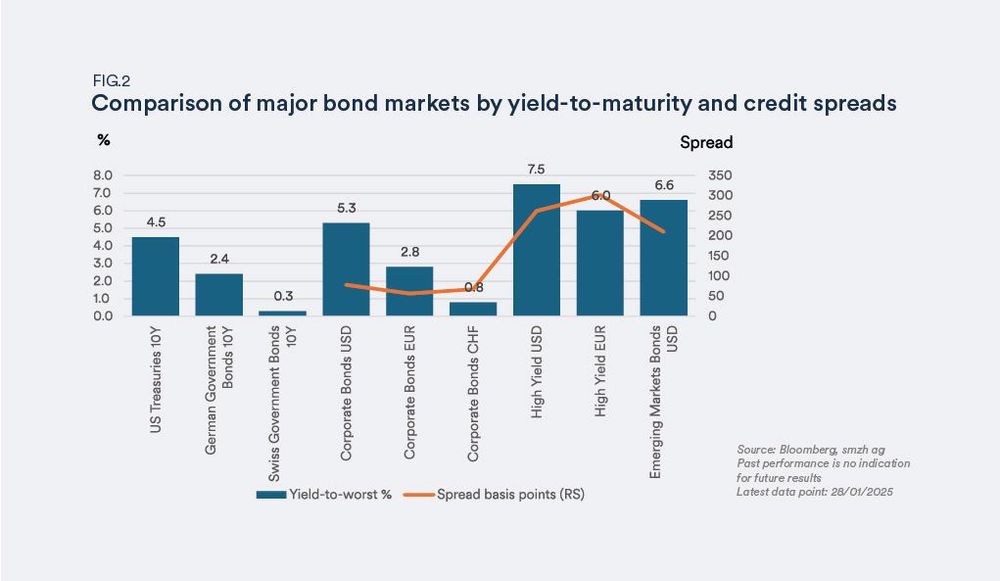

At the same time, rising US Treasury yields are drawing attention. Approaching levels not seen in nearly two decades, these yields reflect changing economic conditions and shifting investor expectations to a world where higher interest rates may persist longer than expected, potentially influencing equity valuations and capital allocation in financial markets.

In the midst of these macroeconomic shifts, the emergence of DeepSeek has introduced an additional layer of complexity. The relatively unknown Chinese AI company made headlines claiming to have built a cost-effective chatbot in just two months using lower-capability chips. While doubts remain about the full capabilities of its technology, the announcement raised concerns about the sustainability of AI investments and the need for expensive high-performance computers, as well as the high profit expectations of leading companies in this field. However, there is also a positive perspective: competition has its advantages, as it has the potential to drive innovation and improve accessibility across the entire sector.

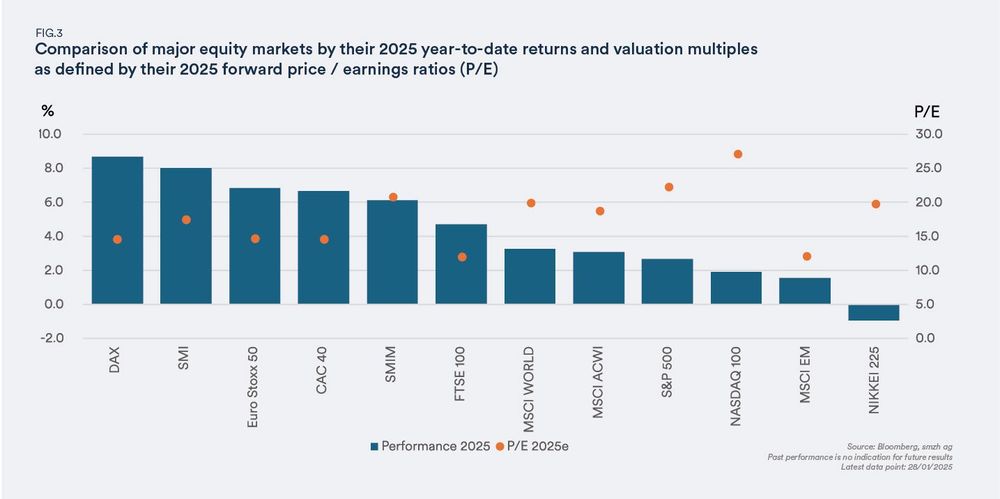

As financial markets navigate a period of heightened geopolitical uncertainty, investors increasingly appear to be pricing in more optimistic scenarios. While this momentum may persist, history suggests a sense of caution. As highlighted in our investment outlook earlier this year, this environment could lead to a volatile and mixed market performance in the first half of the year, as investors respond to evolving challenges, followed by a recovery later during the year.

Market corrections, however, often arise from unexpected triggers rather than anticipated risks. Indeed, such an eventual correction should be seen as a healthy consolidation rather than a bigger downturn. Therefore, with strong underlying fundamentals expected to remain in place throughout the year, any market pullbacks could create compelling buying opportunities that investors should carefully consider.

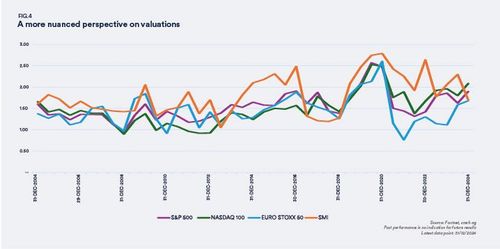

Speaking about equity market valuations, the current historically high price/earnings ratios of US equity markets have sparked an intense debate among investors about whether the market is overvalued. Instead of comparing current ratios with historical data, we encourage investors to also consider alternative measures that adjust for the shifting sector dynamics within equity markets. This is a theme we elaborate in more detail in our special topic.

I hope you find this edition of our smzh Investment Guide inspiring and look forward to connecting with you to discuss your ideas and hear your feedback

Best regards,

Bekim Laski, CFA

Chief Investment Officer