Past performance is no reliable indicator of future results.

Source: Bloomberg, smzh ag. 28/08/2025

Between statistics and strategy

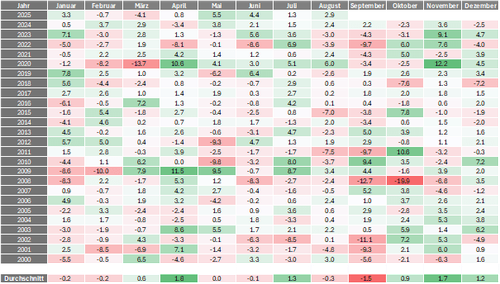

Seasonalities describe recurring patterns or anomalies that appear during specific time periods. Well-known examples include the saying “Sell in May and go away” or the “Santa Claus Rally” at year-end. For decades, such anomalies have been discussed in both academic research and among market participants. One of the most prominent patterns is the seasonal market weakness in late summer, particularly in August and September. Data from many international stock markets show that average returns during these months often fall below the annual average. Explanations include reduced market liquidity due to the holiday season, seasonal profit-taking after earnings season, or portfolio adjustments by institutional investors.

This raises a key question: Are we facing an imminent market correction, and should portfolios be proactively positioned for this possibility? The crucial issue is whether investors should base their decisions on such patterns. Arguments against doing so point to the increased efficiency of modern markets, which has diminished many former anomalies through arbitrage and algorithmic trading. Additionally, market dynamics are influenced by a wide range of factors – including economic indicators, corporate results, geopolitical developments, and monetary policy decisions – that may override seasonal effects. There have even been years when markets posted significant gains during this time. Thus, empirical patterns offer no guarantees.

Staying strategic despite market corrections

Given the strong performance since the beginning of the year, major equity markets are currently trading at elevated valuation levels. In an environment marked by ongoing uncertainties, a healthy correction might be overdue. However, this does not mean investors should exit the equity markets altogether. Despite increased risks, it makes sense to remain invested to avoid jeopardizing long-term investment objectives.

For investors whose equity allocation is above their strategic target, optimization measures – such as partial profit-taking or portfolio rebalancing, possibly involving structured products or derivatives – may be appropriate.

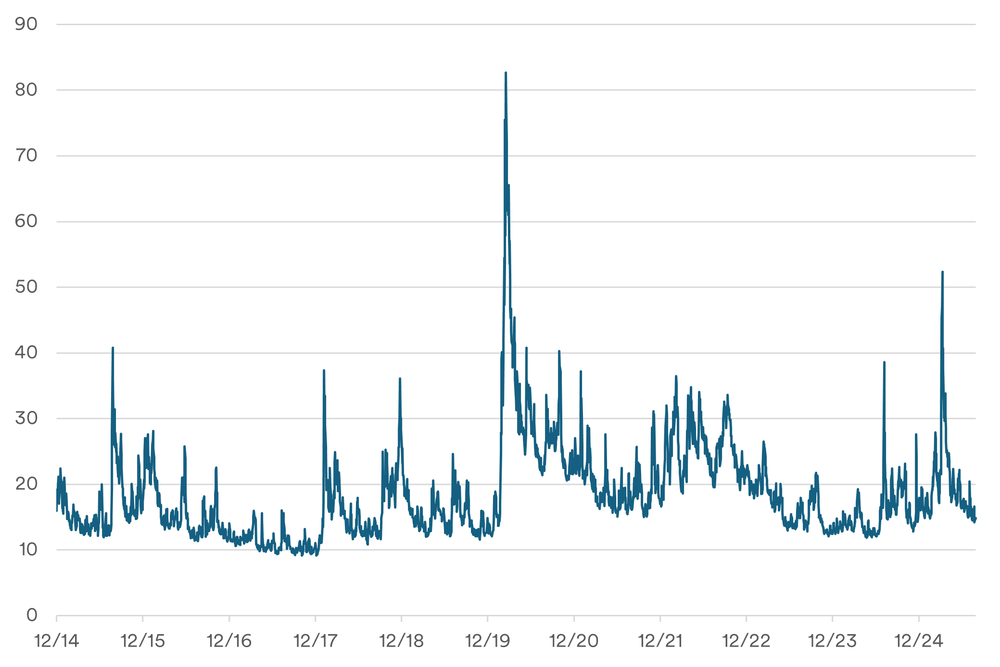

Volatility is unavoidable, but can be actively used as an opportunity

Even though the future cannot be predicted, volatility and setbacks are circumstances that any sound investment strategy should take into account. Broad and optimal portfolio diversification remains the best and most cost-effective way to guard against volatility. This means staying disciplined and committed to long-term asset allocation despite market fluctuations.

There are, however, investment strategies specifically designed to benefit from volatility. These include solutions involving hedge funds or structured products. For such approaches, volatility characteristics are crucial. It is especially important to consider whether these strategies benefit from rising or falling volatility. This is not always clear-cut, as many products have complex volatility profiles, and the initial volatility exposure may change during the product’s term.

In general, the most well-known structured products can be categorized as follows (this list is not exhaustive):

Structured products that benefit from declining volatility

- Reverse Convertibles

- Barrier Reverse Convertibles

- Autocallable-Zertifikate

- Express-Zertifikate

Structured products that benefit from increasing volatility

- Warrants

- Mini-Futures

- Outperformance-Zertifikate

- Leverage-Zertifikate

The Swiss market for structured products is dominated by structures that profit from falling volatility, particularly because of their income-oriented features (reverse convertibles, autocallables, etc.). Structures that seek to benefit from rising volatility, such as warrants and leveraged products, are primarily used for tactical trading or hedging purposes.

Practical tips

It is advisable always to consider the current volatility metrics before using structured products. As a rule of thumb: if volatility indicators are below their long-term average, products that benefit from rising volatility may be more attractive than those relying on falling volatility.

In practice, this means: when volatility metrics are trading below the long-term average, structures such as reverse convertibles or barrier reverse convertibles tend to offer less attractive terms.