Last Wednesday, Jerome Powell announced the first rate cut by the Fed since the onset of the pandemic, a significant 0.5% reduction. Typically, during the so-called blackout period preceding a Fed decision, there is about a 90% certainty regarding the outcome. However, this time the situation was less clear: just before the decision, the probability of a 0.5% cut was about 55%, while a 0.25% reduction was priced at 45%. This uncertainty created heightened anticipation up until the announcement.

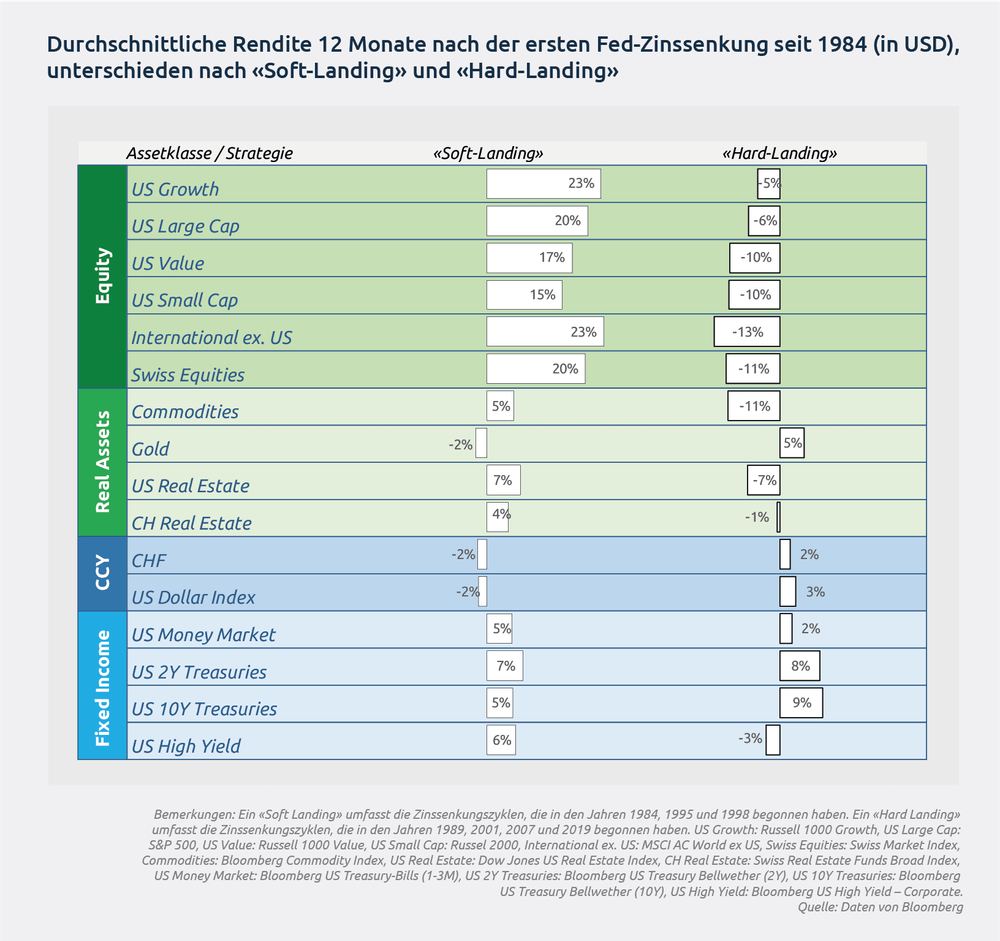

The financial markets, which have been highly responsive to economic data and Fed communications in recent months, welcomed the rate cut with a new all-time high for the S&P 500, reflecting optimism about a successful soft landing. Whether the Fed will achieve such a scenario or whether the monetary measures might lead to a recession, or a hard landing, remains a key focus in the coming weeks and months. For investors, the crucial question now is how to position their portfolios ahead of the upcoming rate cut cycle and which asset classes could benefit depending on the scenario.

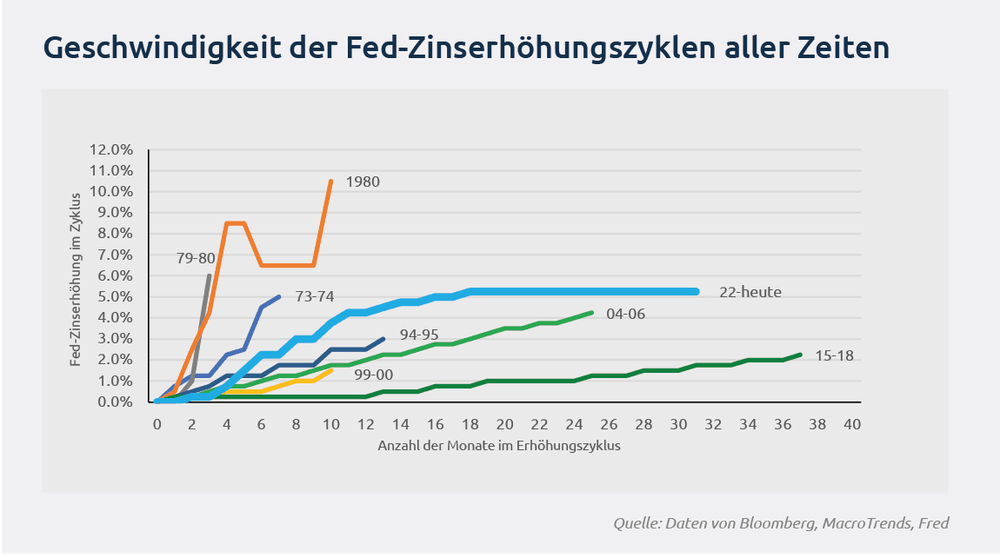

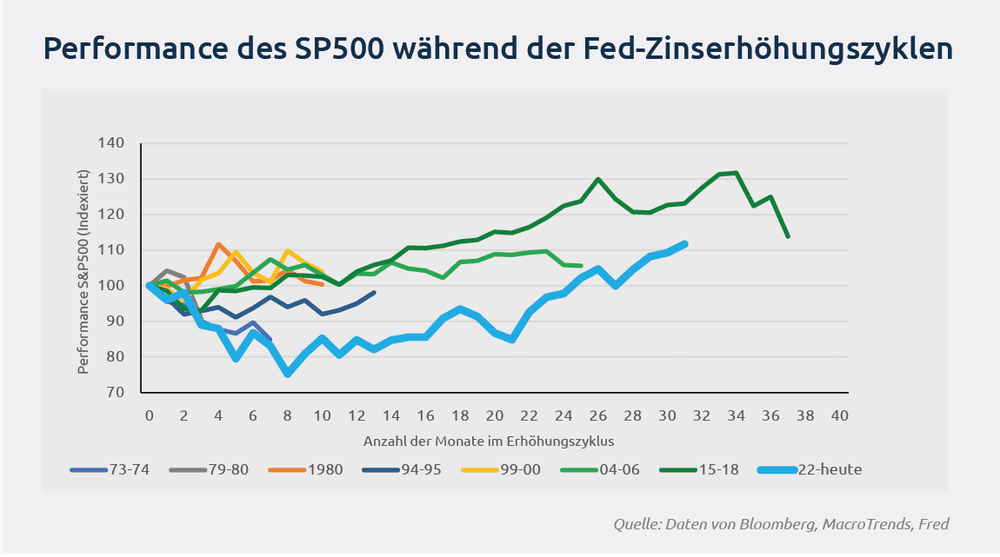

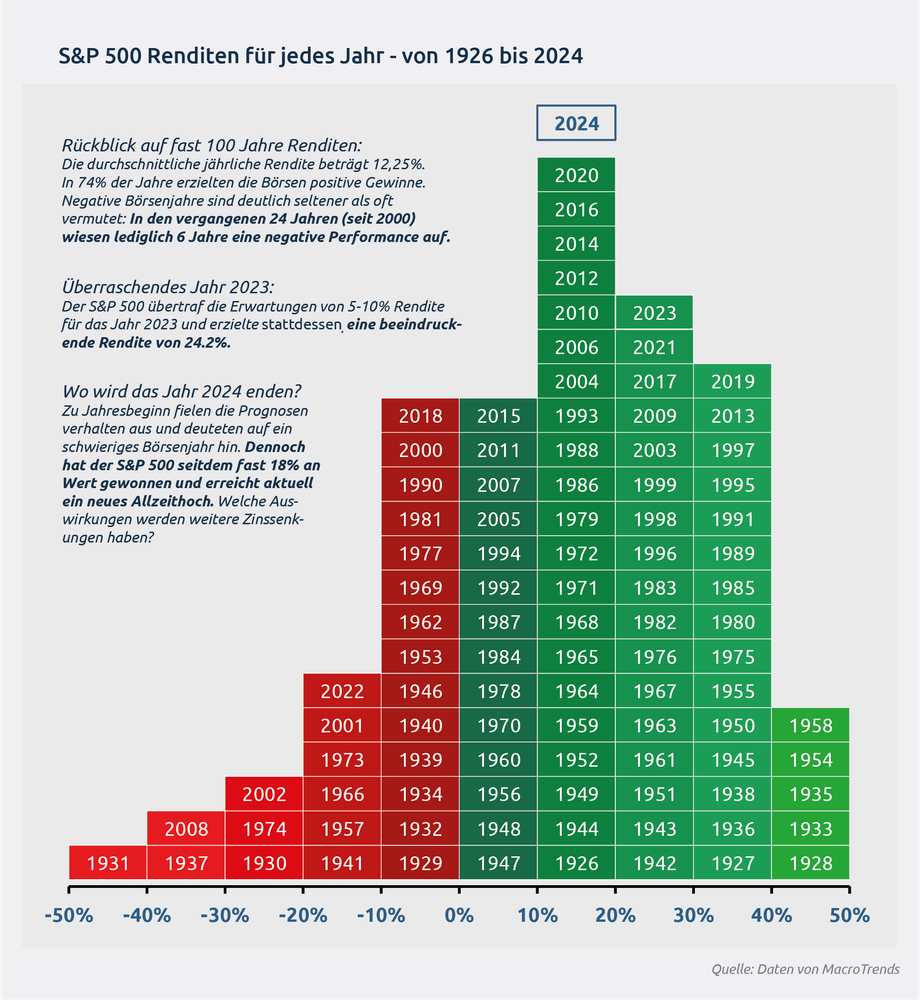

In the following brief analysis, we place the recent rate hike cycle in a historical context and compare the performance of the equity markets during similar phases. We then differentiate between a soft-landing and a hard-landing scenario, analyzing the historical performance of various asset classes and strategies during past rate cut cycles.