Executive Summary

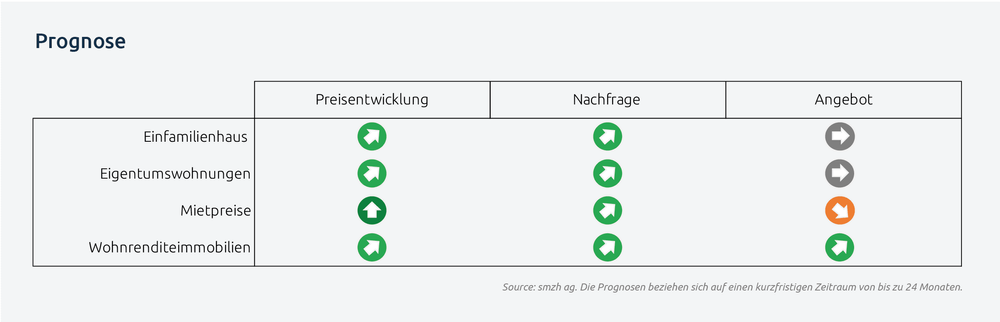

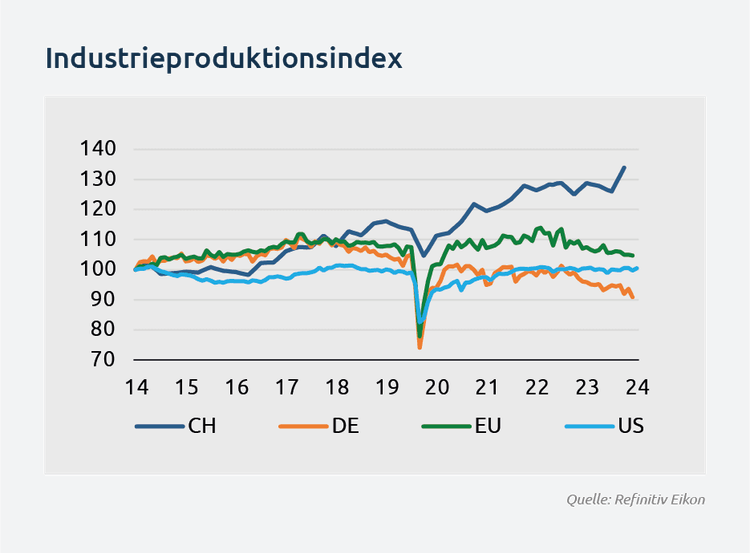

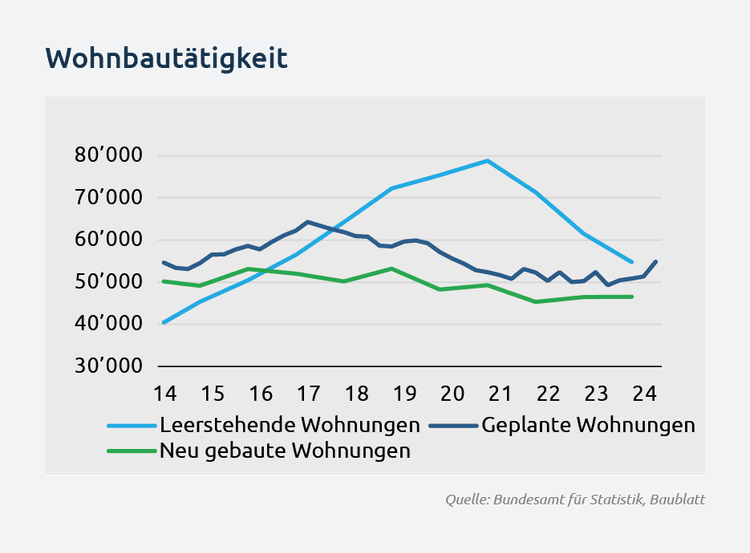

Market environment: The strong demand for rental apartments and home ownership is supported by the positive economic situation and immigration. Initial signs of a revival in construction activity are noticeable, but the supply remains limited.

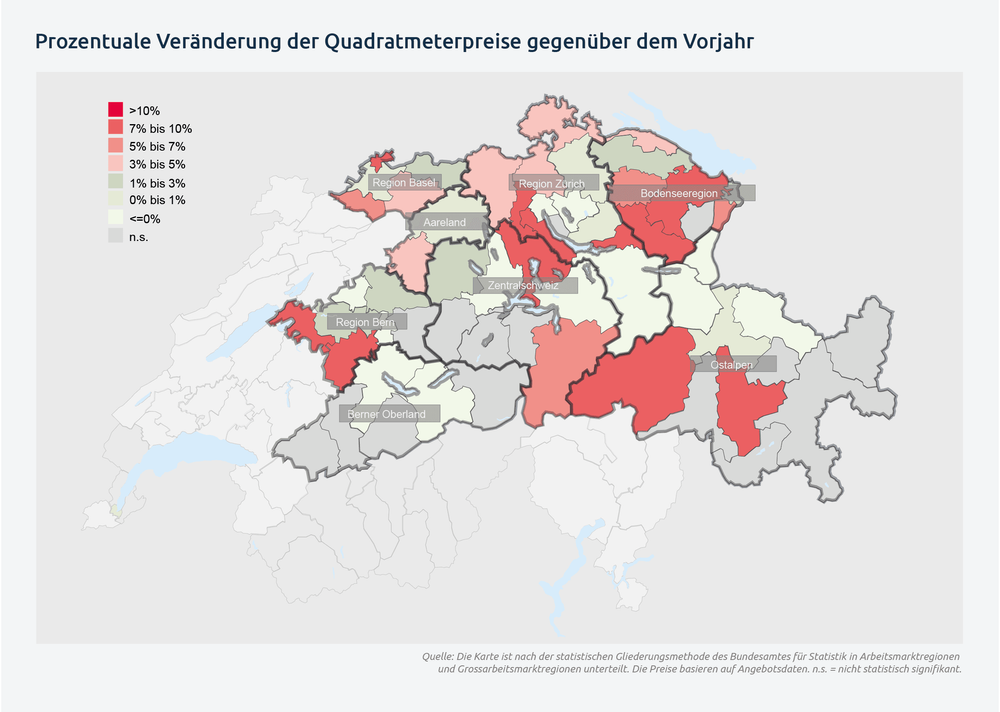

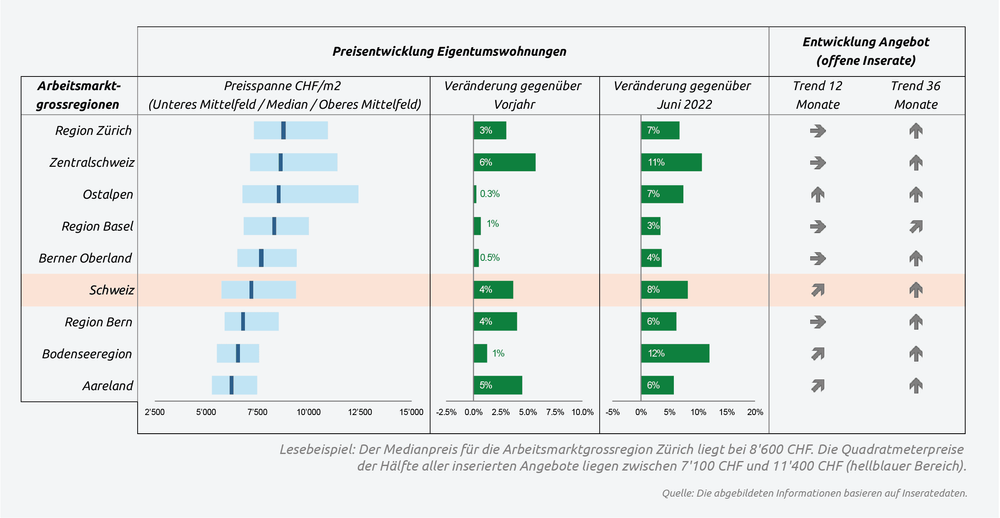

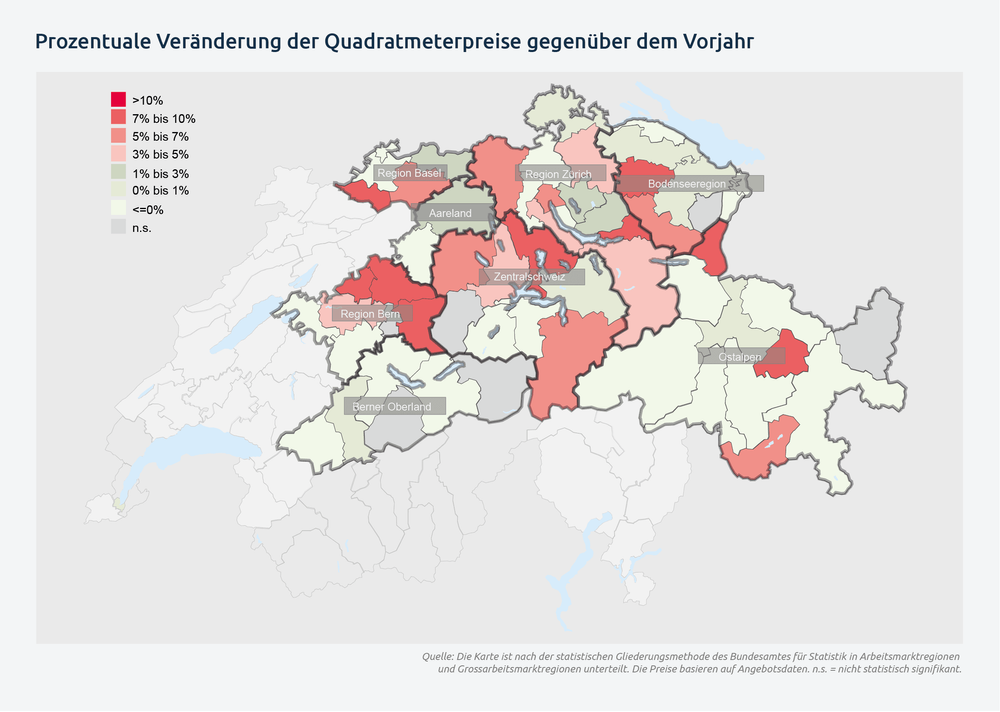

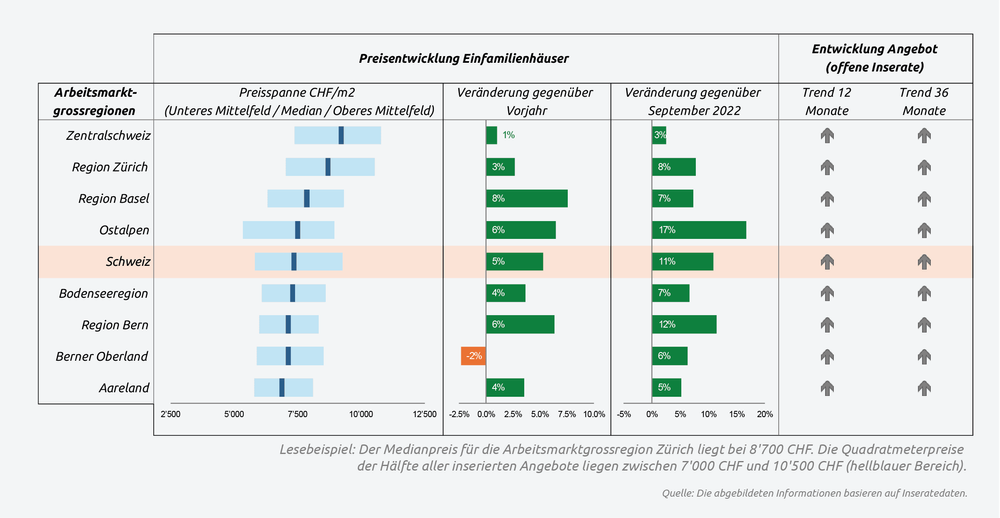

Owner-occupied home market segment: Falling financing costs continue to drive transaction prices upward. The excess demand supports this trend, but the lending criteria of banks limit buyers' willingness to pay higher prices.

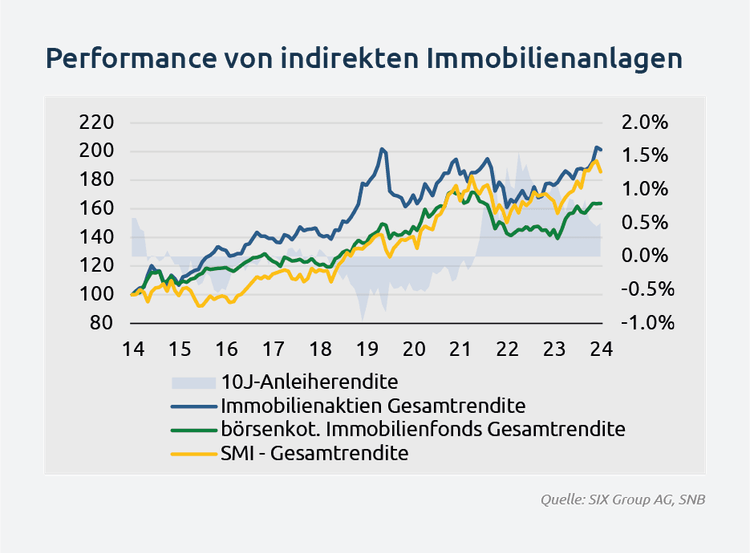

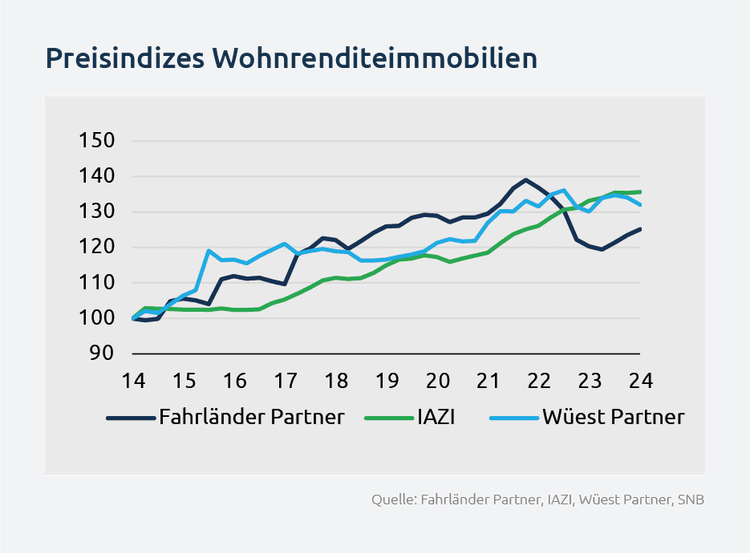

Investment property market segment: The transaction market for investment properties is experiencing an active repositioning of market participants, as fears of rising interest rates and significant price corrections have almost disappeared. While newer properties in prime locations remain in high demand, properties with location deficits and renovation needs offer potential price advantages.

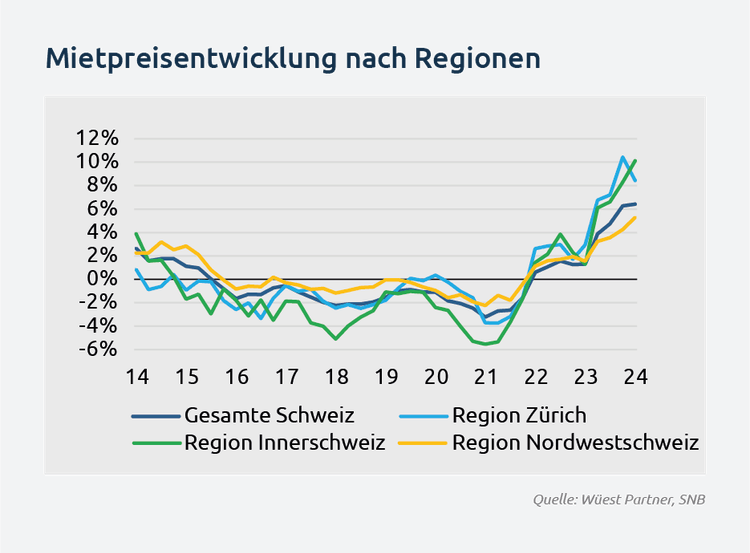

Rental market segment: The mortgage reference interest rate is expected to decline soon due to falling mortgage rates, although there is no consensus on the timing. Asking rents continue to rise, and this trend is expected to persist.