Emerging market equities poised for a comeback

In June, positive trends continued in global equity markets. Although performance was somewhat more moderate than in May, US equities maintained their leading position throughout the month, particularly driven by a sustained recovery in the technology sector following the sharp decline in April.

Following the rapid rebound from April’s lows, valuations in the equity markets have also increased. For example, the US S&P 500 Index is trading at around 22 times expected earnings, indicating that either corporate profits in the US will need to rise significantly or the Federal Reserve will need to cut interest rates sharply this year. In addition, given increased uncertainties, investors may also demand a higher risk premium to invest in US equities, which could potentially lead to a period of consolidation.

In this context, the search for alternative investment opportunities beyond US equities is regaining importance. One of the most obvious destinations for capital outflows from the US market continues to be Europe, which is home to the world’s second-largest economy and reserve currency, and where the rule of law prevails. In fact, European and Swiss equity markets have both outperformed this year on average, despite lagging somewhat behind their US and emerging market counterparts in May and June. Nevertheless, both European and Swiss equities remain attractive. For Swiss stocks, the recent interest rate cut by the SNB should prompt a renewed focus on alternative yield-generating strategies, with quality dividend stocks continuing to look appealing.

Another group benefitting from these developments are emerging market equities (EM equities). Emerging markets encompass a wide range of countries with diverse economic structures, sectors, and growth drivers – from markets with global technology leaders in Asia and China to commodity-exposed markets in Latin America and the sizable consumer sector in India.

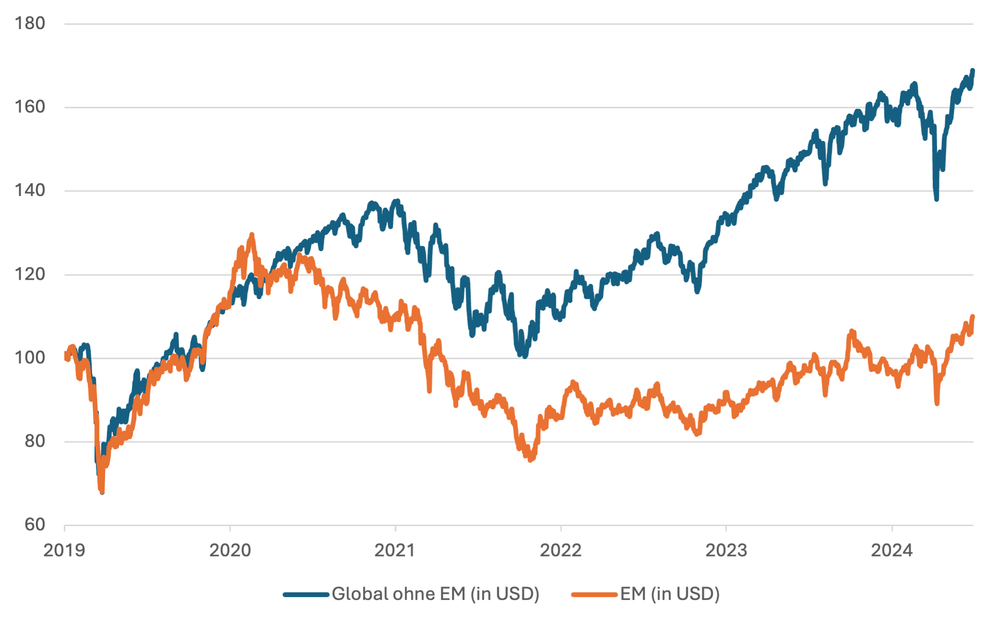

Although investing in EM equities also entails risks, they can be an attractive option for investors seeking growth opportunities and portfolio diversification. While EM equities have underperformed in recent years, particularly versus US markets, several factors are now developing in their favor, making EM investing increasingly attractive.

- First, de-escalation in trade conflicts suggests that the greatest uncertainty may be behind us. This could serve as a key catalyst for renewed investor interest in the region.

- Second, the US dollar (USD) has shown weakness this year, which has historically supported EM asset performance. If the USD remains weak, this could further boost EM equity performance.

- Third, while US bond yields may rise in the short term due to US fiscal policy and inflation concerns, the Federal Reserve could take a more supportive stance this summer. Falling US rates are typically favorable for emerging markets.

- Fourth, most EM central banks are currently on an interest rate cutting path, thanks to favorable inflation trends.

- Fifth, the outlook for technology companies, particularly in China, remains positive, with consensus growth forecasts for the Chinese economy holding steady at just under 5% for 2025. Additional stimulus announcements over the summer could further improve sentiment for China and EM equities in general.

- Sixth, while valuations are not usually a decisive catalyst, EM equities are currently quite attractively valued – trading at a forward P/E ratio below 13x, compared to over 19x for developed markets (a discount of about 35%).

- Finally, international investor exposure to EM equities – especially China – is currently low, indicating potential for increased future demand.