Wake me up when September ends

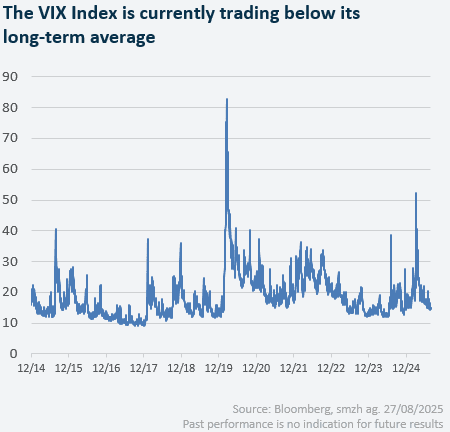

The song “Wake Me Up When September Ends” by Green Day holds deeply personal meaning for the band’s lead singer and, in its original context, has of course no link to financial markets. Nevertheless, the title serves as a metaphor for a widely discussed phenomenon: market seasonality and, in particular, the so-called “weak September.” Historically, this month has been one of the most challenging in the calendar year, leading one to wonder whether it might be best to “sleep through” September and only become active again in October or even later. This topic is particularly relevant at present, as equity markets continue to reach new highs despite ongoing geopolitical tensions, trade policy uncertainties and concerns about global economic growth.

Seasonality describes recurring patterns or anomalies that emerge during certain periods. Familiar examples include the saying “Sell in May and go away” or the so-called Santa Claus rally at the end of the year. For decades, such anomalies have been the subject of academic research as well as market wisdom among investors. The seasonal market weakness in late summer, especially in August and September, is among the most prominent patterns. Data from many international equity markets indicate that average returns in these months often lag the annual average. Possible explanations include lower market liquidity during the summer months, seasonal profit-taking following the earnings season, or institutional portfolio adjustments. Yet, despite these explanatory approaches, they remain merely tendencies as there are years in which markets post considerable gains during this time.

Between statistics and strategy: Staying invested is key, even during market turbulences

The crucial question is whether such patterns should serve as a basis for investment decisions. Critics argue that modern markets have become more efficient, and that many historical anomalies can be diminished through arbitrage and algorithmic trading. Empirical patterns, therefore, do not represent guarantees. Market dynamics are influenced by a wide range of factors, including economic indicators, corporate earnings, geopolitical developments, or monetary policy decisions, which can override any seasonal pattern.

Given the strong performance of major equity markets since the beginning of the year, valuations are currently at elevated levels. In an environment shaped by persistent uncertainties, a healthy correction could indeed be overdue. However, this does not mean that investors should withdraw completely from equities. Despite heightened risks, it remains key to stay invested to avoid jeopardizing long-term investment objectives.

For investors whose equity allocation is above their strategic target level, optimization measures such as partial profit-taking or portfolio reallocations may be appropriate. All others might be inspired by the charming notion of simply “skipping” a potentially turbulent September and instead devoting time and energy to personal interests or long-postponed projects.

Enjoy the read.

Best regards,

Gzim Hasani, CEO

Bekim Laski, CFA, Chief Investment Officer