Executive Summary

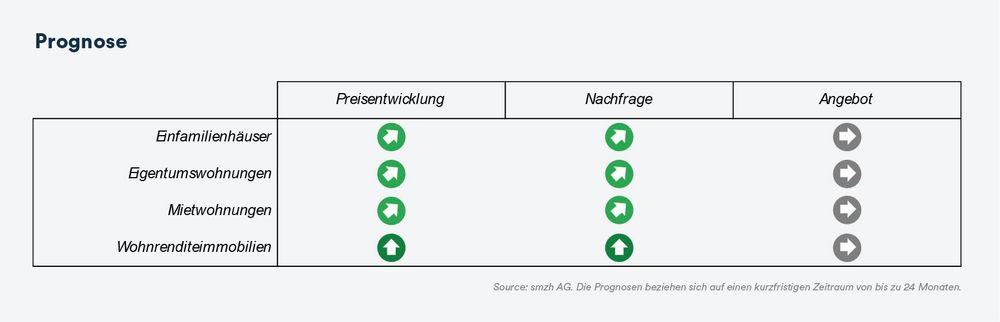

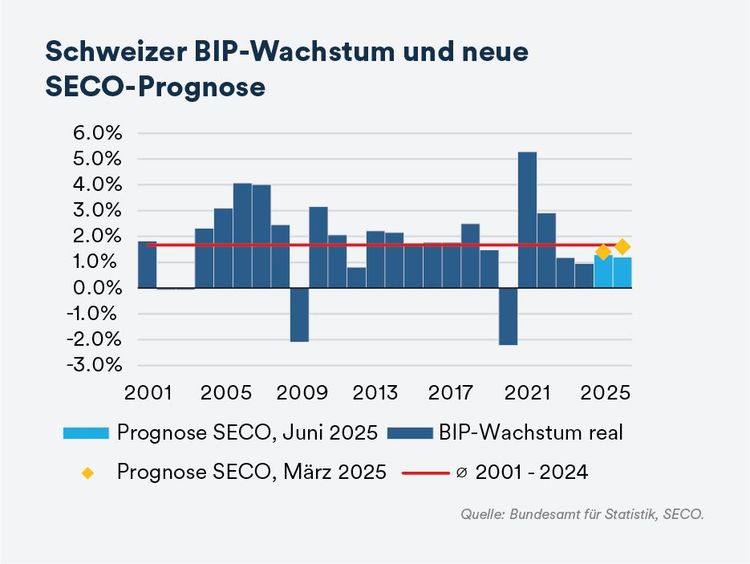

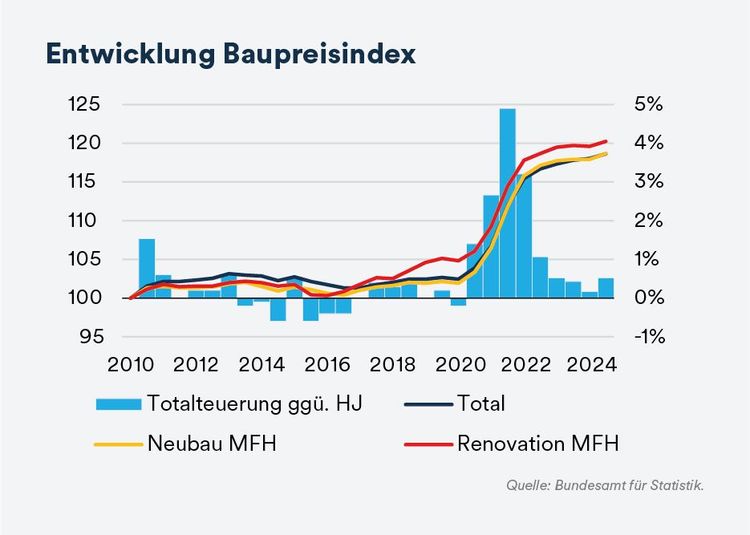

Marktumfeld: The construction sector is receiving positive momentum from the SNB’s key interest rate cut, even though the economic outlook has continued to worsen. The number of building applications and permits has increased over the past few quarters, indicating higher construction activity compared to last year. However, the effective net new supply is likely to be lower than the figures suggest, as a significant portion is attributable to replacement buildings.

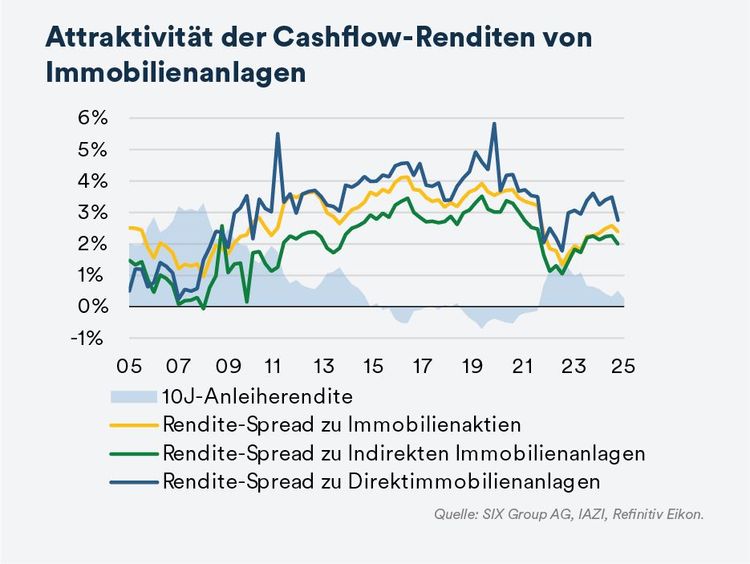

Investment property market: With the introduction of a key interest rate of 0.00%, the well-known TINA issue (“There Is No Alternative”) is once again in focus. Accordingly, capital market activity remains dynamic, with real estate investment vehicles continuing to absorb hundreds of millions in new equity. Early signs of yield compression are already evident, as purchasing yields are beginning to decline.

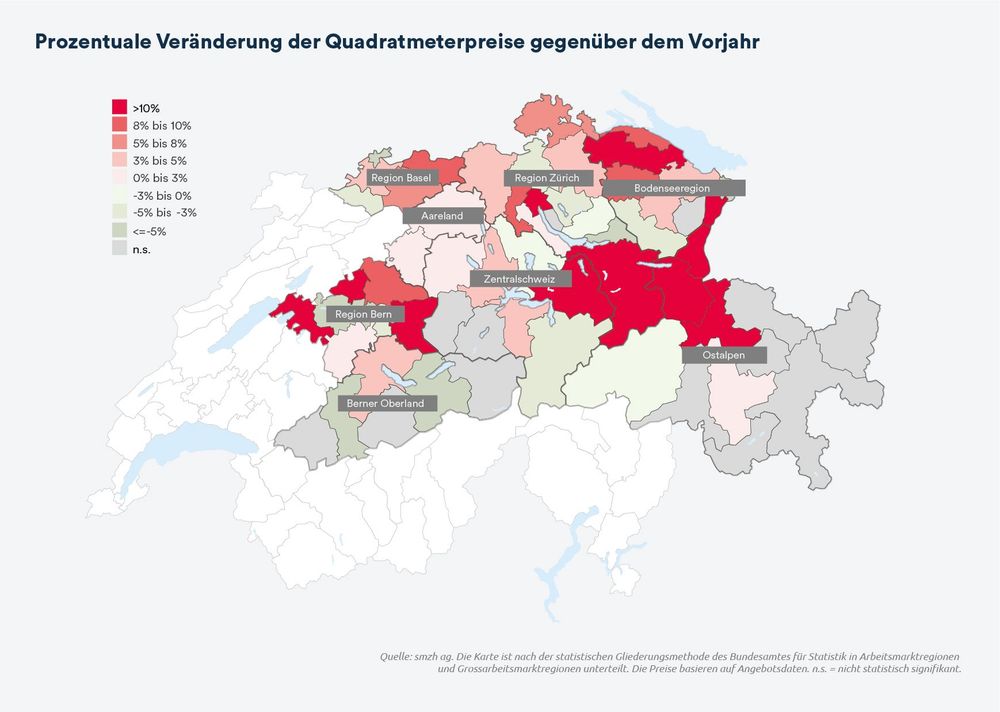

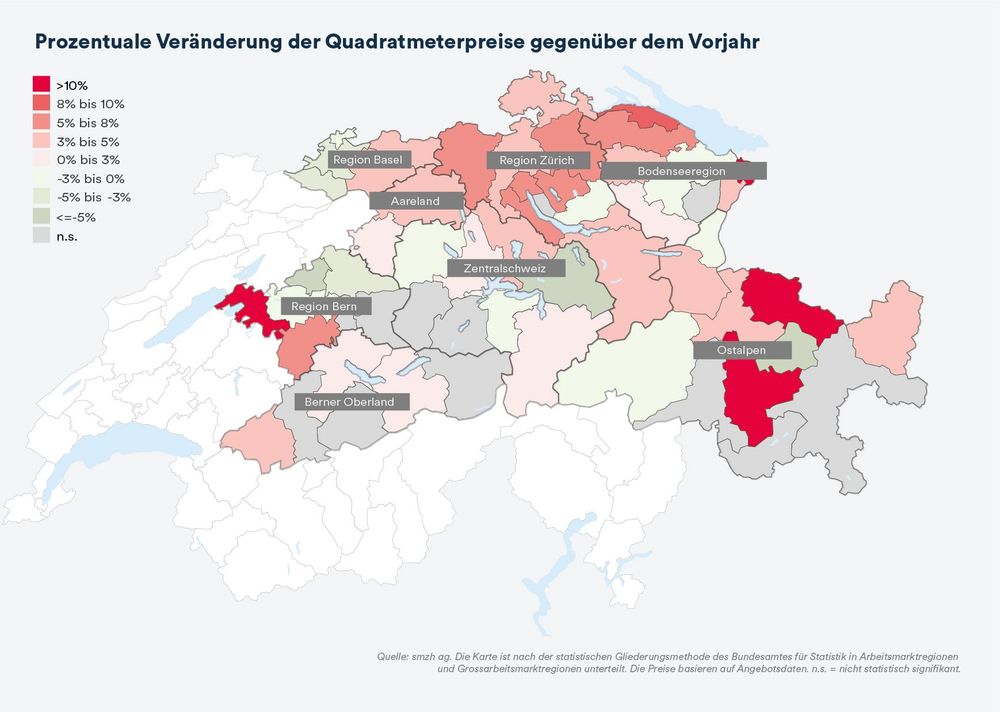

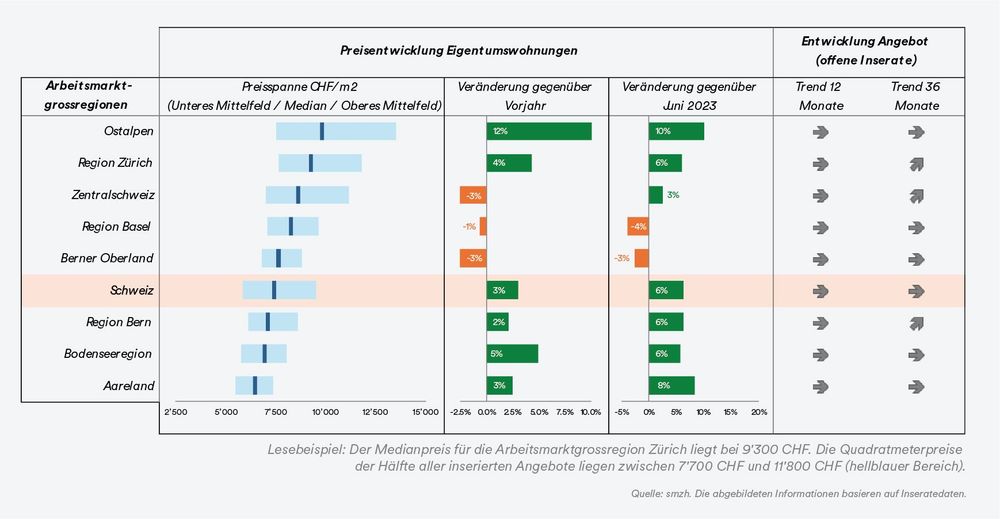

Owner-occupied housing market: A nationwide increase in property transfers, coupled with sustained or even accelerating positive price dynamics, speaks to robust market activity. The small discrepancy between rising listing price indices and transaction price indices suggests that the selling side is controlling price formation and that demand is fundamentally keeping pace.

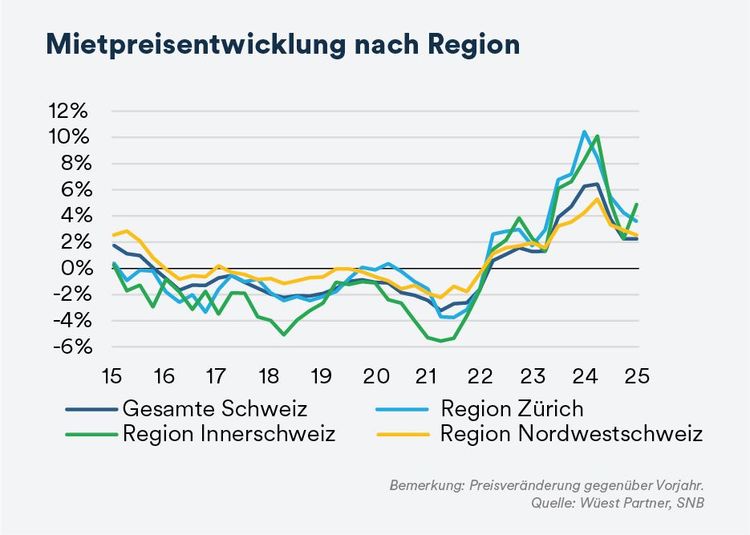

Rental market: Offered rents are expected to increase by 3% to 4% year-over-year in 2025, depending on the region – somewhat more moderately than in the extraordinary previous year, but still well above pre-pandemic levels. Given the structural excess demand, a noticeable short-term relaxation of the market situation is unlikely.