Executive Summary

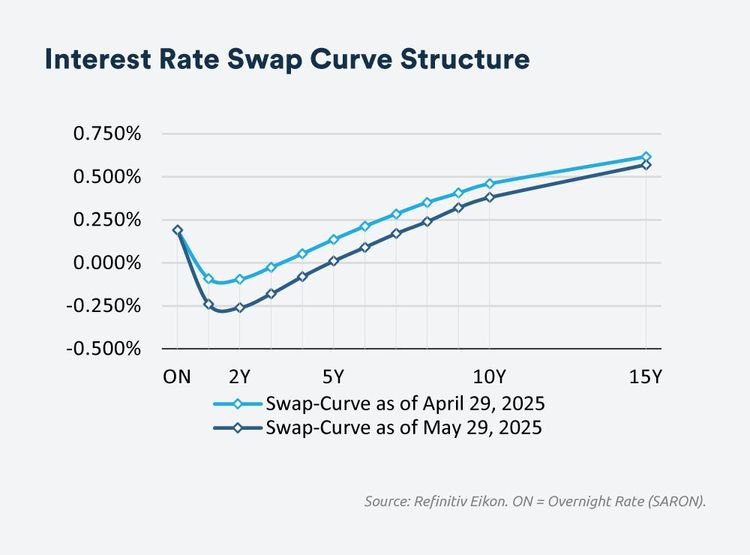

Interest Rate Market: The yield curve continues to decline further into negative territory, especially in the medium-term segment. A slight downward movement is also visible at the long end. The market increasingly expects a persistently loose monetary policy, with policy rates potentially remaining in negative territory for longer.

Monetary Policy: In an environment of a weak US dollar, foreign exchange interventions are costly and inefficient for the SNB. It therefore continues to rely on the policy rate as its central tool. A cut to 0% is considered the most likely step. A reduction by –0.50% would be excessive in the current environment.

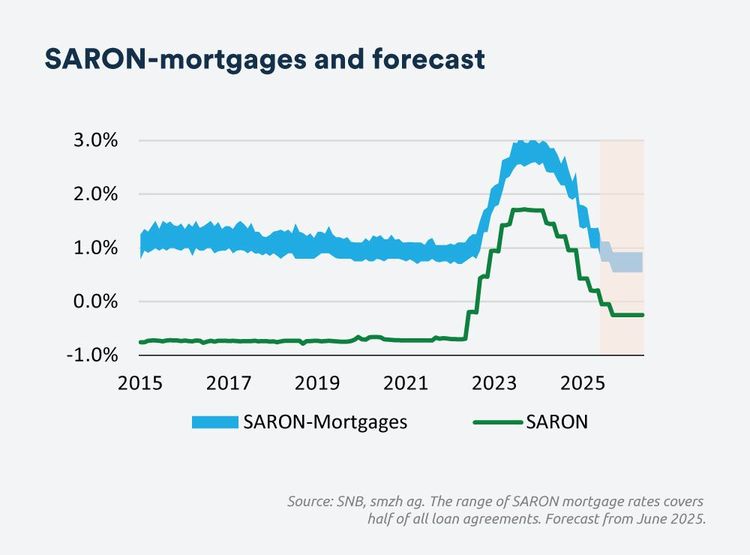

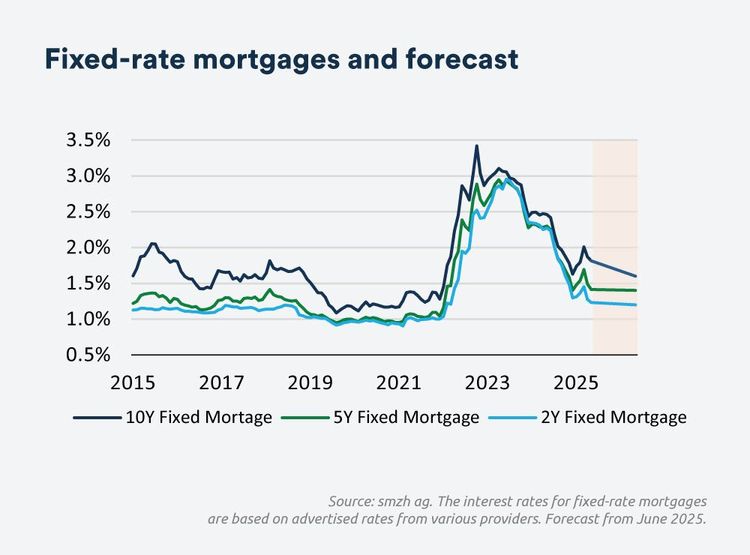

Mortgage Rates: Mortgage rates have slightly declined, while interest rates for ten-year fixed mortgages have remained largely unchanged. With the anticipated rate cut in June, SARON-based mortgages are expected to become cheaper one last time. For short and medium-term maturities, the downside potential is exhausted. However, at the long end, there is still some room for lower rates over the next twelve months.