Assessment of the interest rate and mortgage market

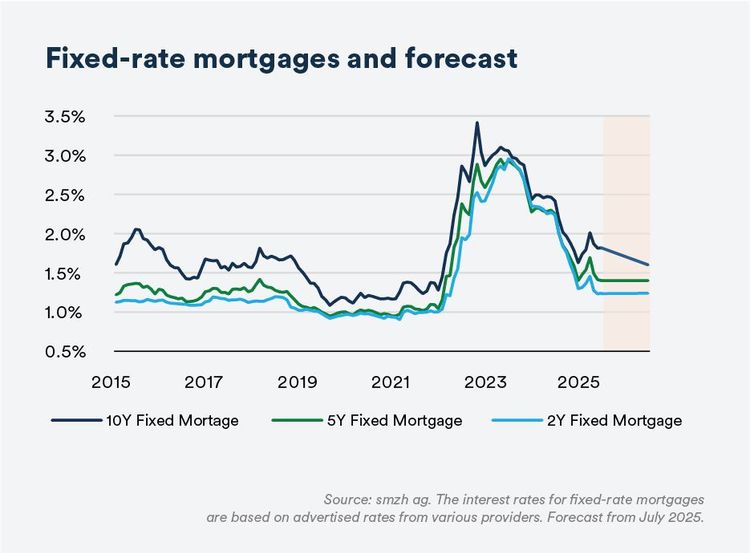

Interest Rate Market: With the recent policy rate cut, the yield curve has almost fully normalized. Amid geopolitical tensions in the Middle East, interest rates have risen slightly in recent weeks. However, the curve is expected to trend slightly downward again in the coming weeks.

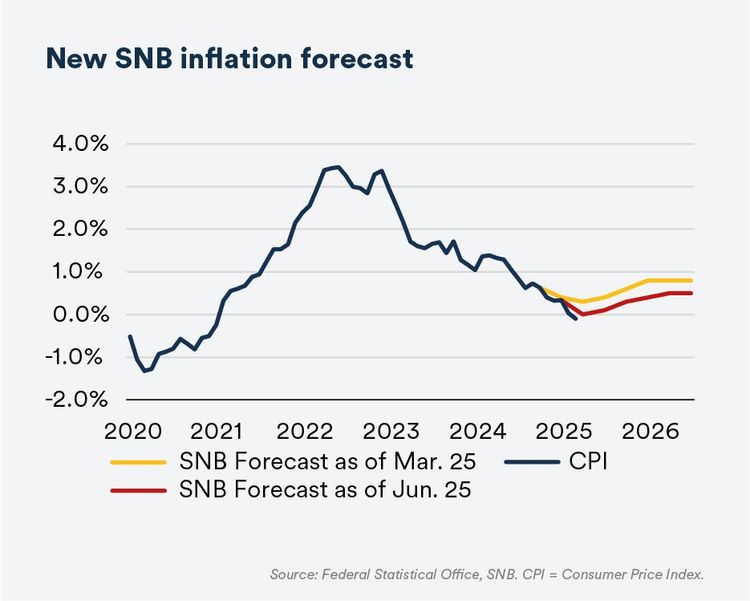

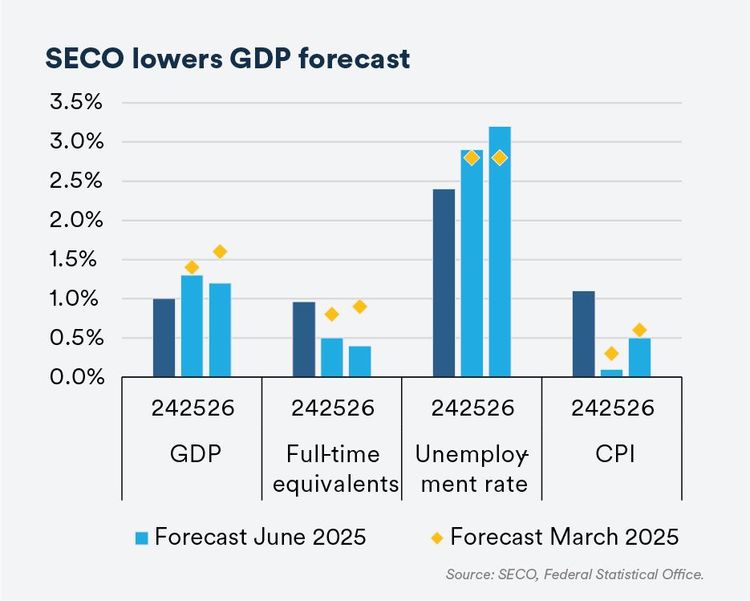

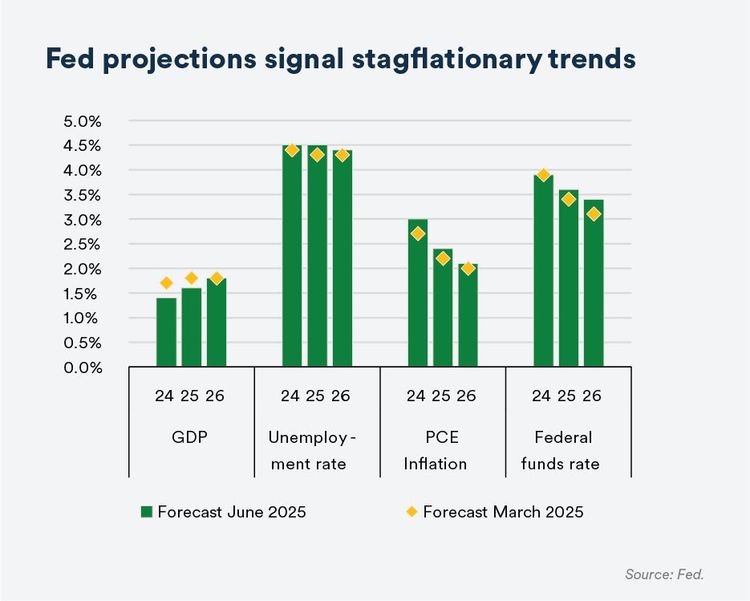

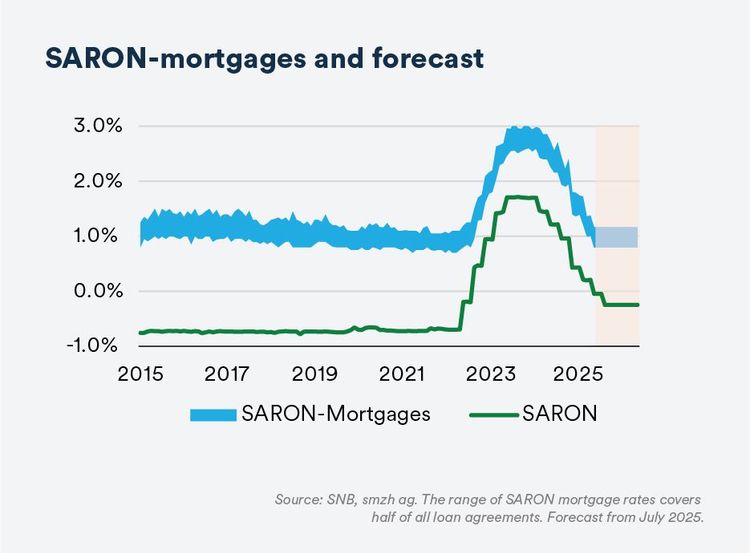

Monetary Policy: The economic outlook has continued to deteriorate slightly, both globally and in Switzerland. We expect weaker growth and a softening labor market. If risks were to intensify further and deflation to gain further traction, the SNB could take the next step in September: a return to negative interest rates.

Mortgage Rates: SARON mortgages have bottomed out. Any additional rate cuts would no longer ease the burden for borrowers, as a negative SARON is not passed on. Fixed-rate mortgages are currently attractive across all maturities, but there is little room for further decline. Only long-term rates are expected to ease slightly.

Interest Rate Market

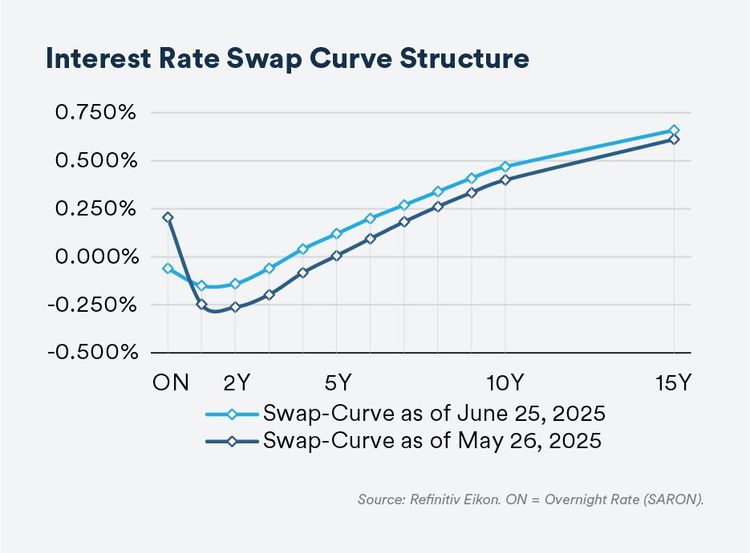

For now, the SNB is refraining from returning to negative interest rates, instead cutting the policy rate to 0.00%. As a result, the SARON now stands at –0.05%, falling below zero for the first time in nearly three years. The swap curve has almost fully normalized, once again sloping upwards with increasing maturity.

Compared to the previous month, the entire curve is slightly higher. This is likely due to geopolitical risk premia: the conflict between Iran and Israel temporarily raised concerns that rising oil prices could rekindle global inflation risks. Since this scenario has not materialized and tensions have eased recently, there is good reason to expect the curve to flatten again in the coming weeks, with slightly lower swap rates across all maturities.