In a direct monthly comparison, market interest rates have hardly changed, although the inflation rate in Switzerland was surprisingly positive. The inflation situation now basically paves the way for the SNB to lower key interest rates.

However, monetary policy developments in the USA and Europe raise questions as to when the SNB will begin to cut interest rates. The most recent meetings of the Fed and the ECB resulted in a further pause in interest rates and indicate that the first interest rate cuts cannot be expected until the summer at the earliest.

These factors are contributing to uncertainty on the Swiss interest rate markets, as a result of which interest rates will remain high, as it remains unclear to what extent the SNB can make its decisions independently.

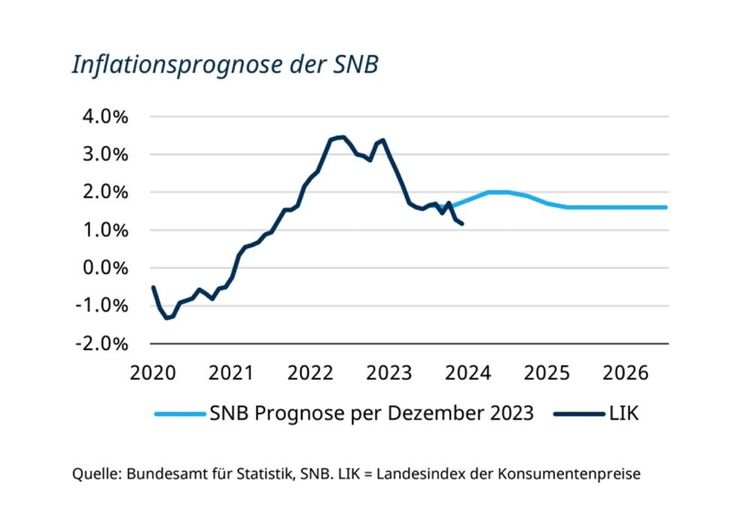

The latest data shows that inflation was 1.3% in February, which is well below the upper target of 2.0% set by the SNB. This figure is also lower than the values forecast in the last monetary policy assessment. It is encouraging to see that the inflation trend is moving in the desired direction and is slowly approaching the 1.0% mark. This could open the door for key interest rate cuts in the near future.

It is interesting to note that imported inflation is now helping to keep overall inflation rather low. This shows that the SNB's strategy of counteracting foreign inflation through the appreciation of the Swiss franc is successful.

Domestic inflation, which plays a central role in the general price trend, was driven in particular by rising rents. These increases are attributable to the adjustment of rents due to the two-time increase in the mortgage reference interest rate. In view of lower interest rates for fixed-rate mortgages and the expectation that the SNB will soon lower the key interest rate, it can be assumed that the mortgage reference interest rate will remain stable in the near future. This minimises the risk of further indirect effects on inflation.

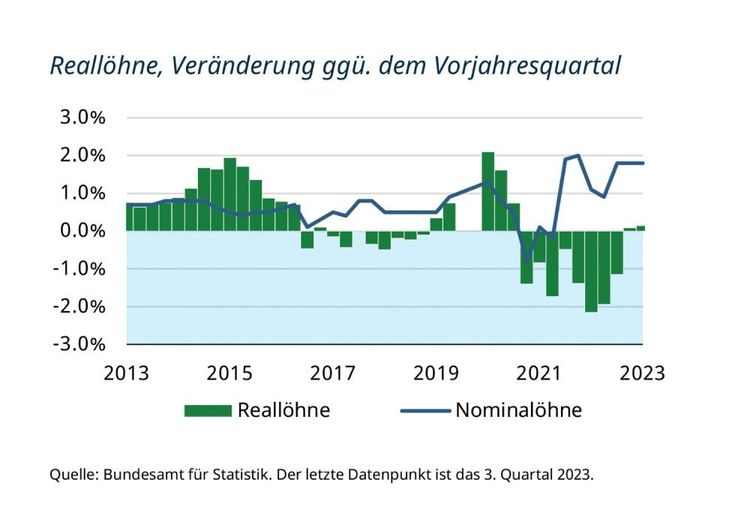

While there are concerns in Europe and the USA that a premature interest rate cut could reignite inflation, primarily due to rising real wages, this risk is considered moderate in Switzerland. Real wage growth has been negative in the last two years and future wage increases are likely to merely offset the losses of recent years.

In view of these developments, the SNB is likely to cut the key interest rate soon, with the first reduction of a quarter of a per cent expected in June 2024.

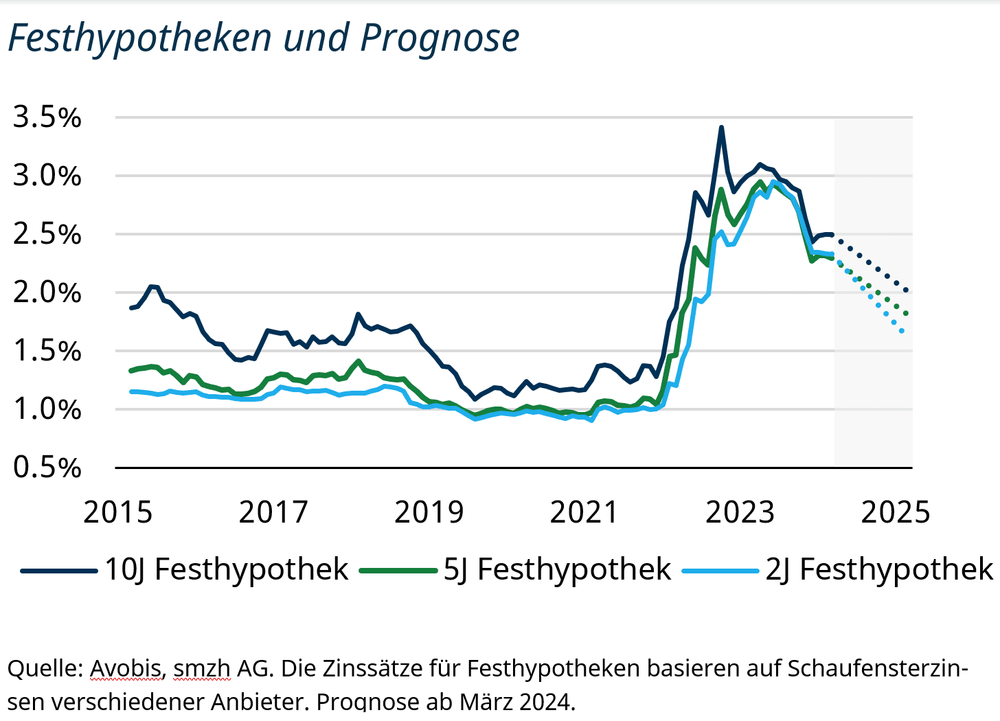

The advantages of fixed-rate mortgages currently outweigh those of SARON mortgages, mainly due to the inverted yield curve structure and the expectation of several imminent key interest rate cuts. SARON mortgages, which are currently between 2.5% and 2.9%, could become more attractive with the first key interest rate cut in June in parallel with the lower SARON rate.

The interest rate structure for fixed maturities has been flat for some time, with interest rates above 2.0% across all maturities. The upcoming key interest rate cut should reduce uncertainty and risk premiums, especially for medium to longer maturities. It is therefore to be expected that market interest rates with medium to long-term maturities will also correct downwards after the first interest rate cut.

As a result, we expect fixed-rate mortgages to become more favourable together with SARON mortgages from June at the latest - as soon as the first key interest rate cut has taken place.

Use our valuation calculator for a quick assessment

Have your property valued by our experts (CHF 390.- instead of CHF 1,250.-)

Compare your mortgage with us free of charge