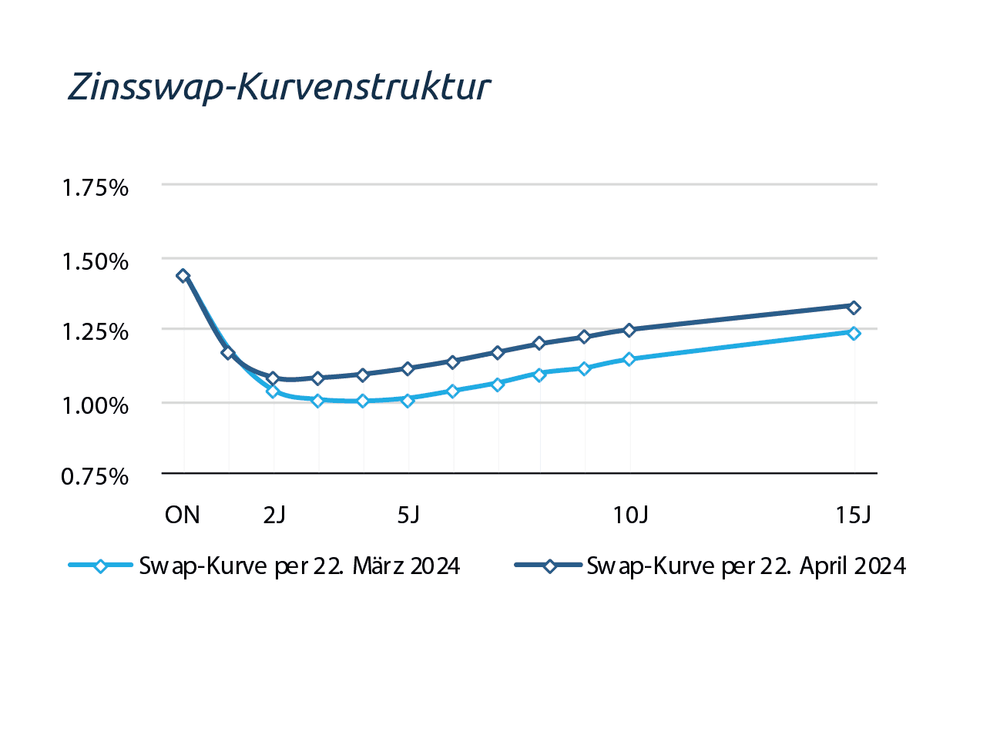

Market interest rates have hardly changed compared to the previous month or have even risen slightly. The interest rate for a two-year term is currently the most attractive.

The arguments for a further reduction in June are accumulating, which is also reflected in the interest rates at the short end of the yield curve. Nevertheless, interest rates for longer maturities remain at a relatively high level.

The persistently high interest rates in the medium to long maturity range are probably a consequence of geopolitical risks and the associated concerns about inflation risks. The geopolitical situation in the US is also likely to influence this trend, as a rate cut there is becoming increasingly unlikely and the «higher for longer» premise is once again gaining in importance. In view of this, it can be assumed that longer-term interest rates will remain at their current level for the time being.

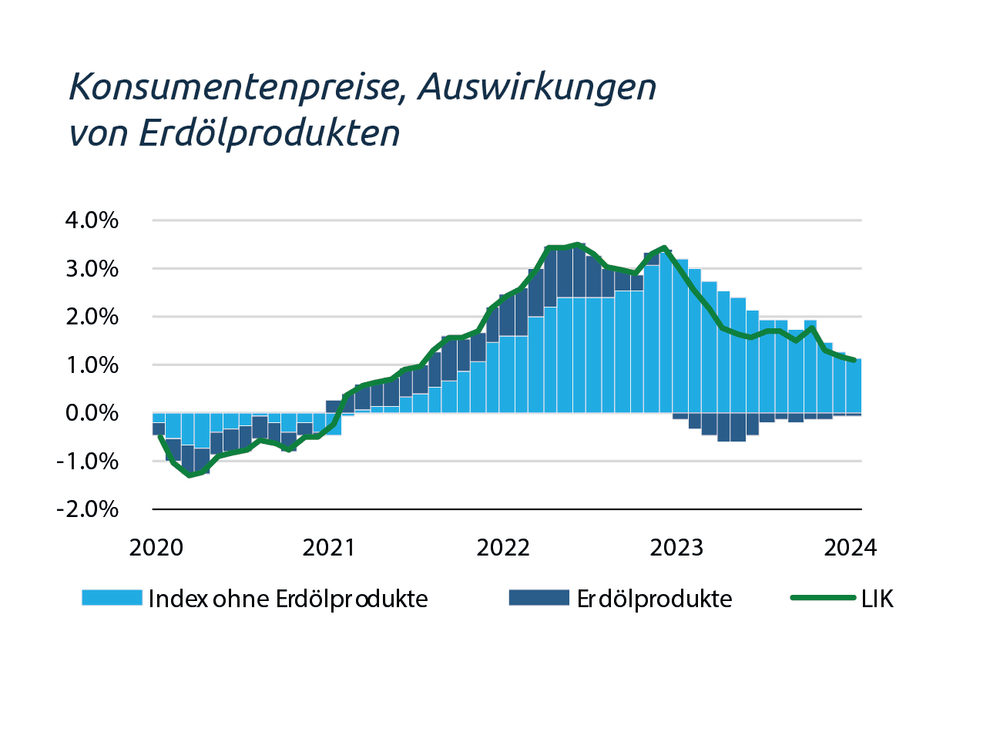

The latest consumer price data for March shows that the downward trend in inflation is continuing with a value of 1.04%. This development is once again more positive than the SNB's inflation forecast, which was recently revised significantly downwards at the March meeting.

Despite the current geopolitical events that are causing inflationary concerns, the moderate rise in risk premiums for commodities, particularly oil, is not expected to trigger an inflationary shock in Switzerland.

These developments support the arguments for a further interest rate cut in June. There is a consensus on the interest rate market and among most economists for a reduction in the key interest rate by 25 bps in June. We support this forecast and expect a key interest rate of 1.25% in June.

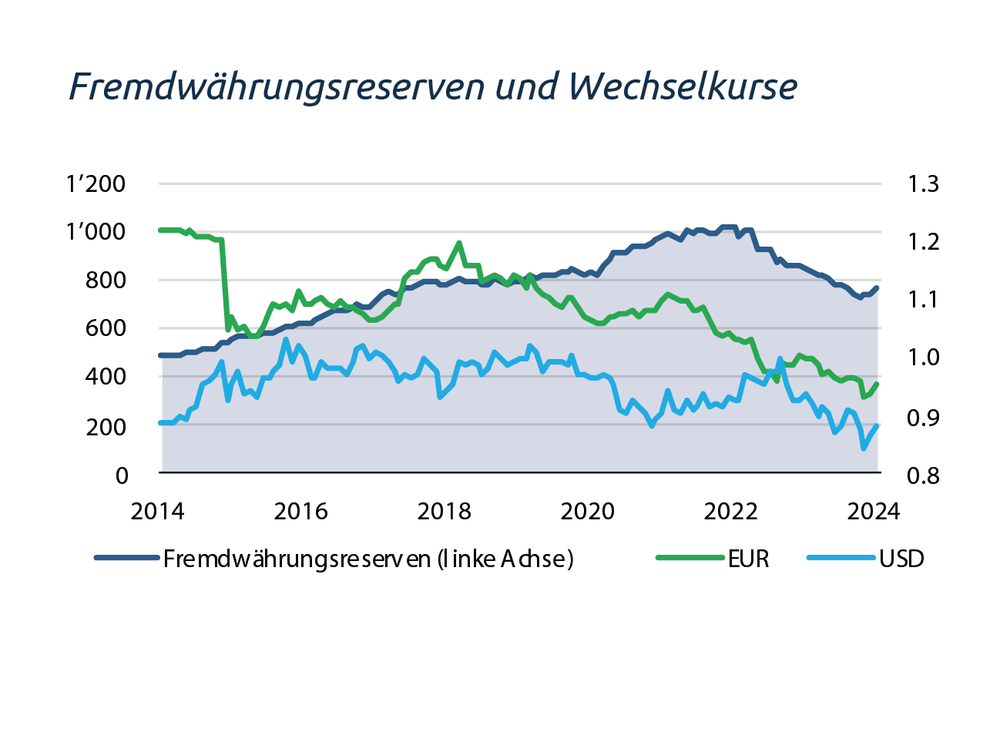

Now that inflation has been brought under control, the focus is likely to be more on the domestic currency. The SNB has revised its monetary policy foreign exchange strategy accordingly and is once again actively countering the appreciation of the franc through foreign currency purchases. Since the beginning of the year, the franc has depreciated significantly against the euro and the dollar. Should the franc appreciate again despite foreign currency purchases, the SNB could consider more aggressive cuts, depending on the ECB's and Fed's interest rate cuts, in order to reduce the attractiveness of the domestic currency.

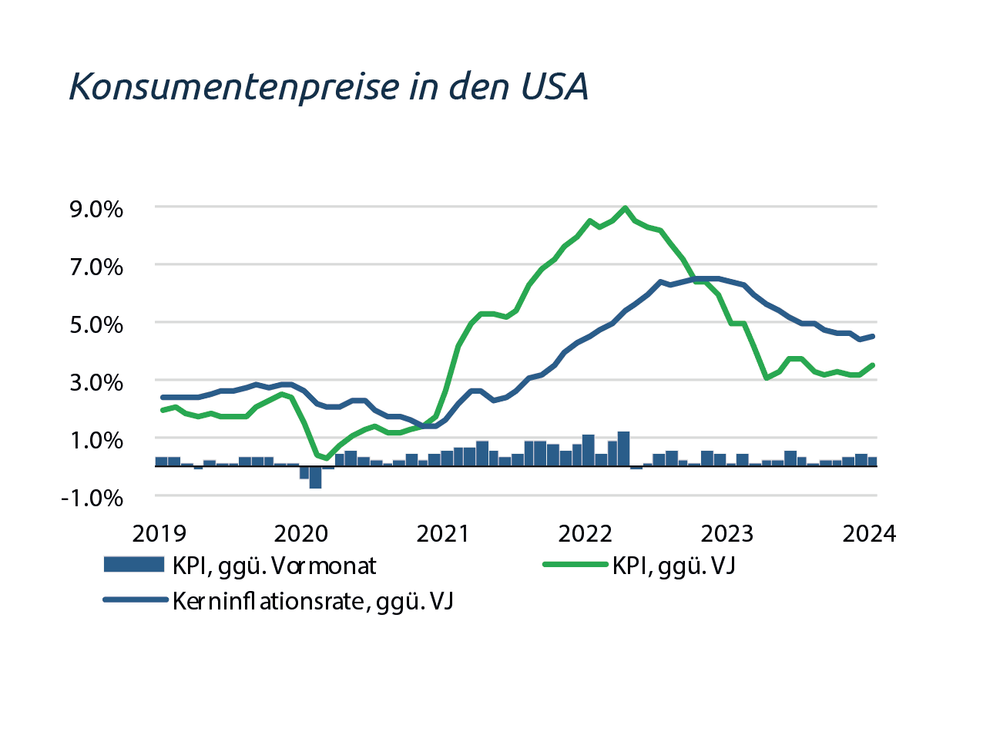

In the US, it is increasingly being questioned whether the Federal Reserve Bank (Fed) will be able to cut interest rates at all this year. This uncertainty is based on signs of a renewed rise in inflation, which has been indicated by higher than expected inflation data in recent months. A stable labor market and surprisingly positive economic momentum give the Fed no reason to rush to cut interest rates as quickly as possible.

This attitude is also reflected on the interest rate markets, where it is leading to rising bond yields. It is to be expected that the Fed will refrain from lowering interest rates until the summer break unless the data basis improves significantly.

The ECB is facing a different situation: weaker economic momentum and a slower inflation trend as a result. The data on wage growth rates, which will be published in May, will play a decisive role for the June meeting. The latest figures from Indeed, the online job board, show that the downward trend in wages is continuing. If the data published by the ECB mirrors Indeed's trends, this could pave the way for a rate cut in June.

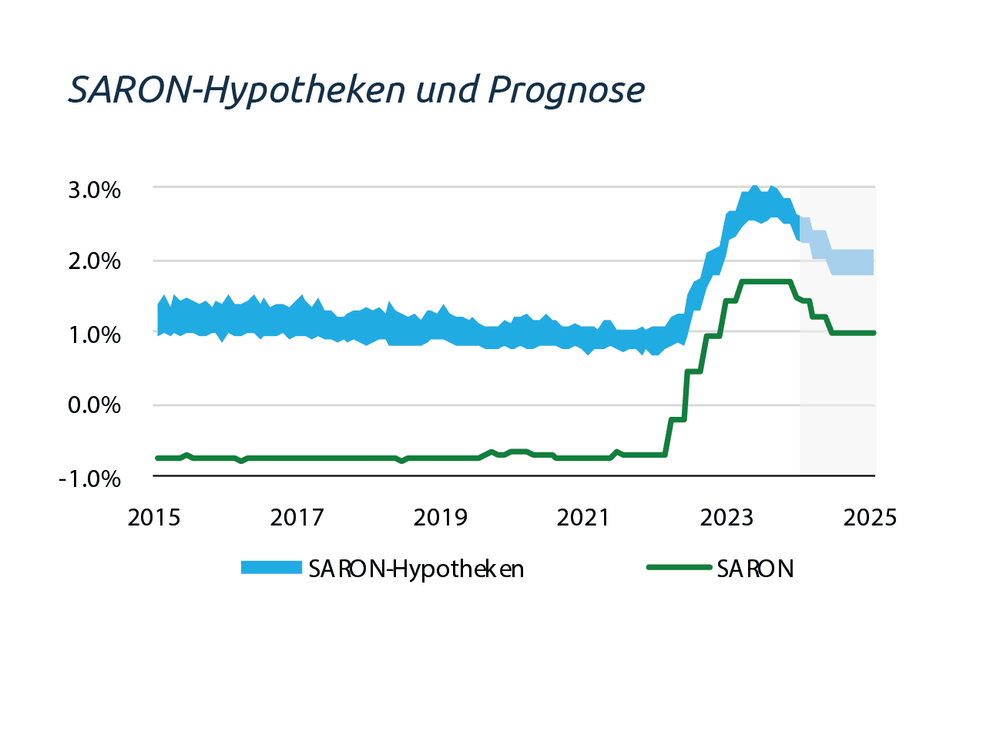

Market interest rates for medium and long maturities have risen slightly since the March meeting. As a result, SARON mortgages have become more attractive than fixed-rate mortgages. The interest rate for SARON mortgages is between 2.20% and 2.50%, depending on the individual credit margin.

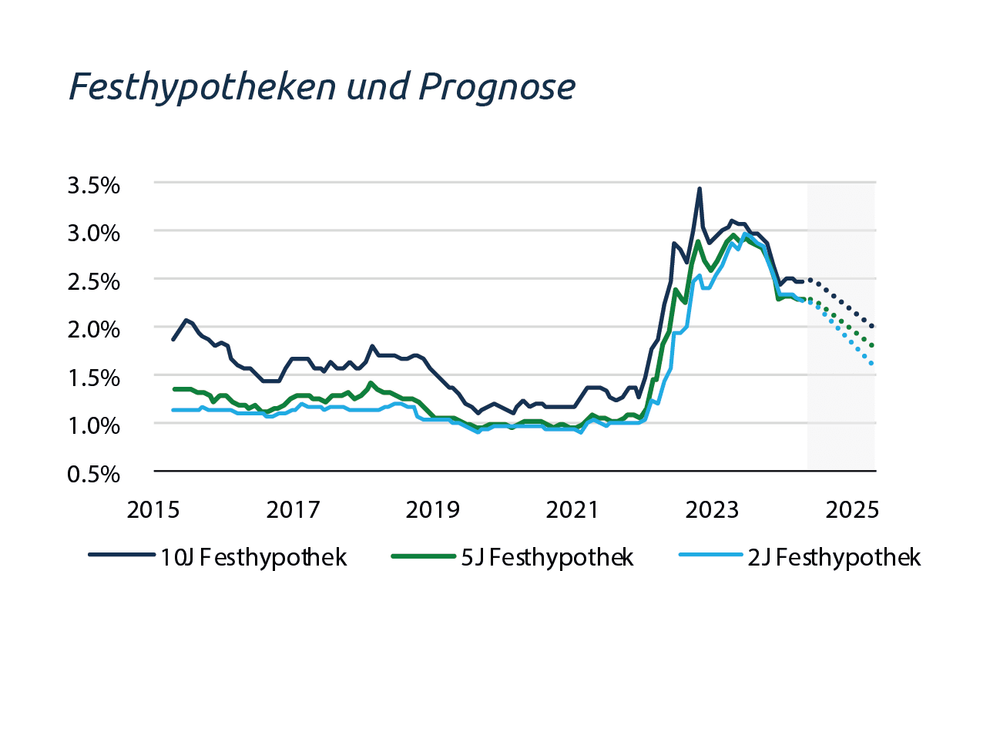

The interest rate structure for mortgages shows a slight increase from the middle segment onwards, with fixed interest rates above 2.00% for all maturities. In view of the uncertainties on the interest rate markets, we expect the curve structure to remain unchanged for the time being. In the long term, we continue to believe that fixed-rate mortgages will become more favorable.

Fixed-rate mortgages with a term of two years currently offer the most favorable conditions. They offer the opportunity to benefit from interest rate reductions that have already been priced in and at the same time eliminate the risk of interest rate changes during the term.