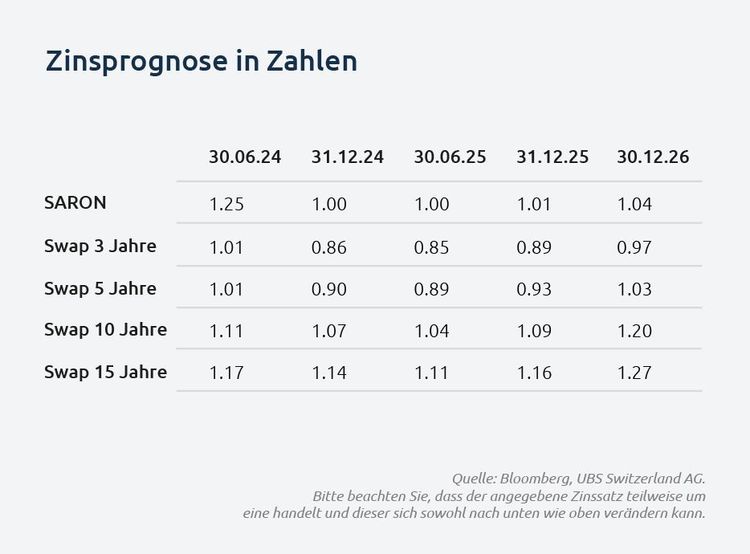

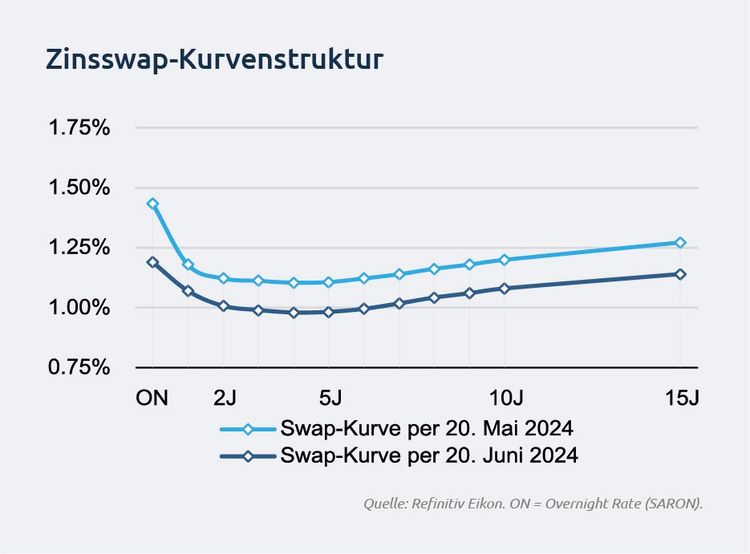

The SNB's decision to lower the key interest rate by another 0.25% has led to a downward shift in the yield curve.Swap rates with medium maturities of two to five years are now slightly below 1.00%, while long-term rates are slightly above 1.00%

With the latest cut, the inversion of the yield curve at the short end is also decreasing, and the interest rate difference between short-term and long-term rates is narrowing. Overall, a normalization of the yield curve is taking place, which should fully normalize with further rate cuts in the near future.

The majority of the already priced-in rate cuts have materialized. However, the current yield curve indicates that monetary policy is still slightly restrictive and can be eased with a third rate cut. A full rate cut is priced in by the March 2025 meeting at the latest, leaving the possibility for a third consecutive cut in September 2024.

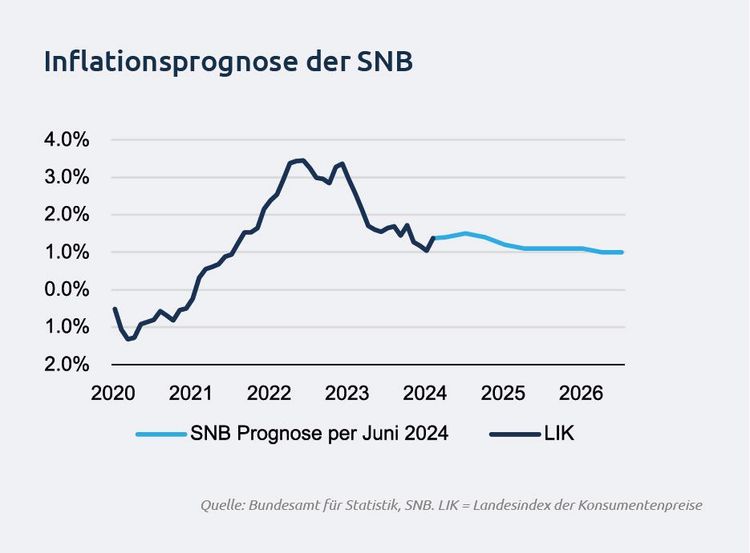

The SNB's decision and the new conditional inflation forecast clearly indicate that the current price level and the inflation path are satisfactory, and economic stimuli now take precedence.

From an economic perspective, the rate cut is welcome. Firstly, a higher interest rate differential compared to other currency pairs is intended to weaken the Swiss franc and support currency-intensive economic sectors. Secondly, the easing of monetary policy not only supports consumer demand but also sends positive signals for investment activities, which have been stagnant for a long time and delayed due to financing conditions and economic uncertainties.

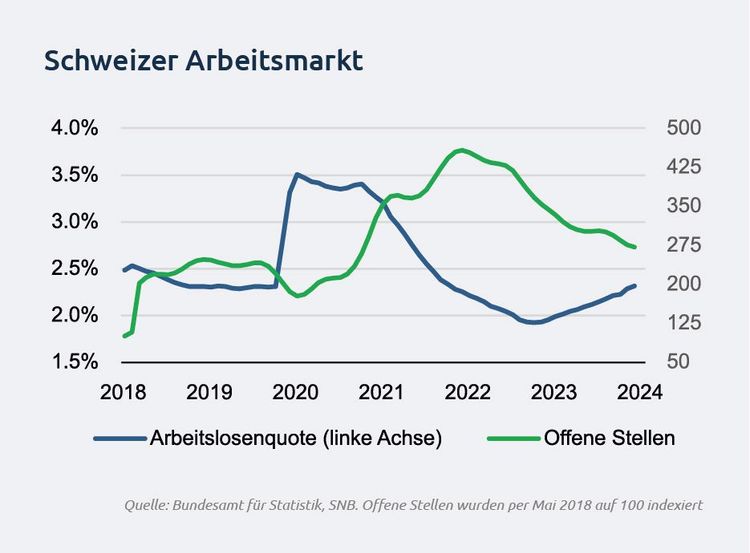

The effects of restrictive monetary policy are also noticeable in the labor market. An increase in the unemployment rate to pre-pandemic levels has been observed, and the number of job vacancies has significantly decreased. Overall, the labor market has cooled down and can currently be considered healthy. However, the economy should not be burdened by restrictive monetary policy measures longer than necessary. Therefore, it is appropriate to gradually mitigate or completely lift these effects.

The SNB's monetary policy path in the coming half-year will be determined by inflationary pressures. If the economic situation eases both domestically and internationally, the path would be clear for a third rate cut in September. However, if inflation risks materialize, for example, due to increased freight costs from ongoing geopolitical tensions or a rise in service prices due to increased consumer demand, the SNB would have to decide whether to prioritize economic support or maintaining price stability.

We consider a third rate cut to 1.00% in September as the baseline scenario from the current perspective but do not rule out a postponement to December.

The ECB has followed the SNB and begun easing its monetary policy in its most recent meeting. However, the path for further rate cuts is not as clear as it is for the SNB, as inflation remains persistent. Particularly concerning are the high wage growth rates, which significantly slow the hoped-for pace of monetary easing. Unless unexpected economic downturns occur, the ECB will need to gradually and data-dependently reduce monetary restrictions over the coming years to ensure medium- and long-term price stability.

In the USA, robust economic activity, persistent inflation, and concerns about further inflation spikes prevent the Fed from initiating easing measures. However, initial signs of a slowdown in economic momentum and consumer sentiment are noticeable, and the labor market has cooled to pre-pandemic levels. So far, these developments are within the desired range. As long as economic conditions remain stable, the Fed will delay a rate cut until the desired disinflation is achieved. However, if the situation worsens, the Fed will have to prioritize economic stimuli over price stability.

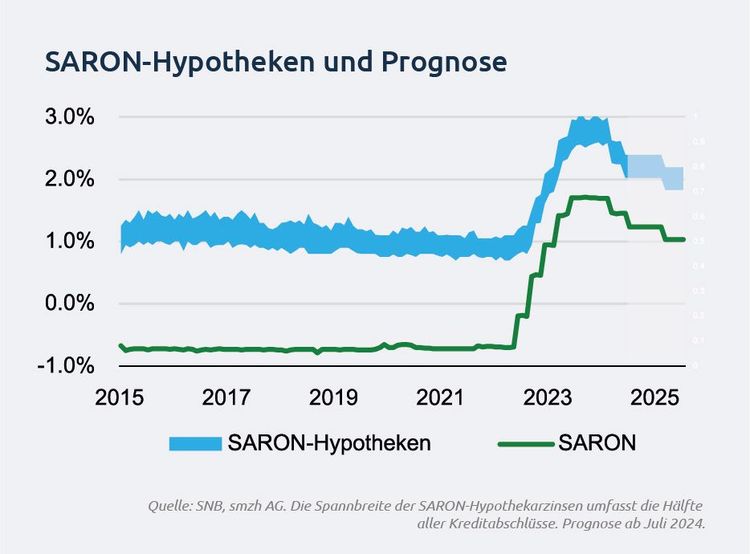

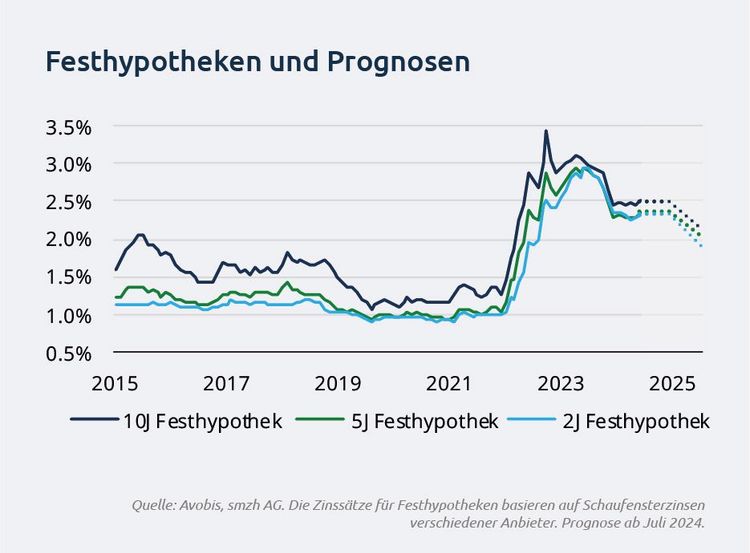

Mortgage interest rates have remained stable and unchanged compared to the previous month. Following the recent rate cut, the rates for both SARON and fixed-rate mortgages should now be lower and increasingly converge. The interest rate for SARON mortgages is likely to be between 1.90% and 2.20%, depending on the individual credit margin.

Fixed-rate mortgages are expected to experience a slight downward correction due to lower market interest rates. Since most of the anticipated rate cuts have already materialized, the advantage of a short-term fixed-rate mortgage compared to a SARON mortgage has now diminished. However, since the market is still pricing in at least one more rate cut, short-term fixed-rate mortgages can continue to be advantageous for risk-averse borrowers.