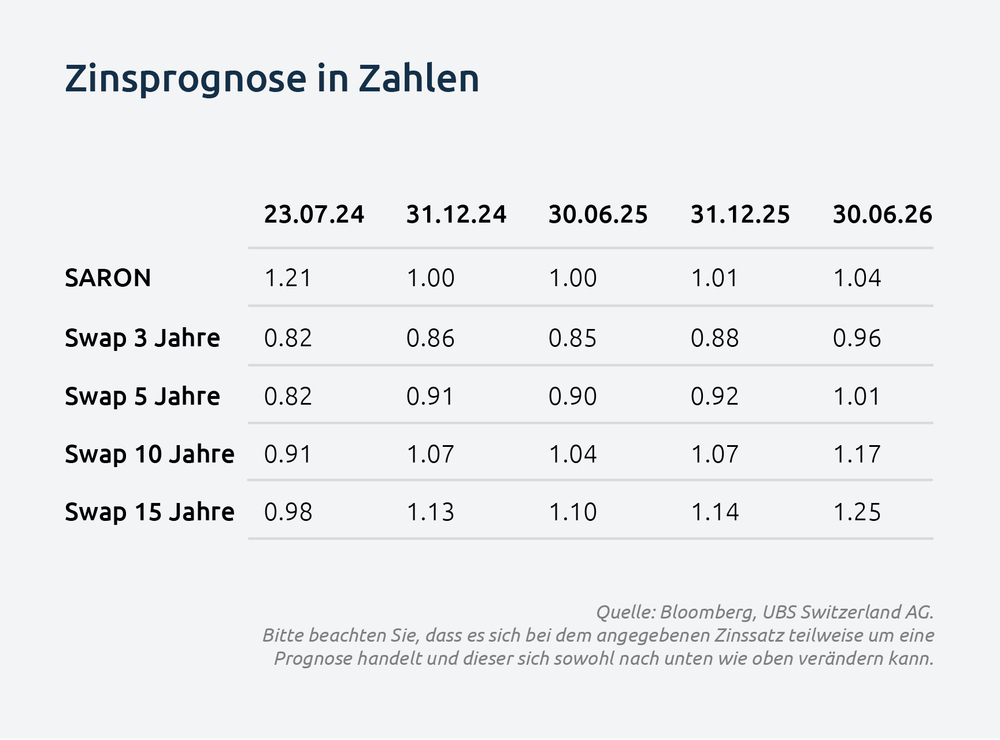

Since the SNB monetary policy decision, there has been a downward shift in the interest swap curve. Recent turbulence in global markets, triggered by concerning US economic data and the interest rate hike by the Bank of Japan, has led to a further decline in interest rates. Swap rates with medium maturities of two to five years are now slightly above 0.70%, while the 10-year swap rate is significantly below the 1.00% mark at 0.80%. The yield curve continues to maintain its inverse structure.

This shift can primarily be explained by the interest market's expectation of more aggressive rate cuts. The market currently expects the SNB to lower the key interest rate to 0.75% over the course of the next three monetary policy assessments. A 25 basis points cut in September is currently seen as certain, with the timing of the subsequent rate step in December being the most likely priced in.

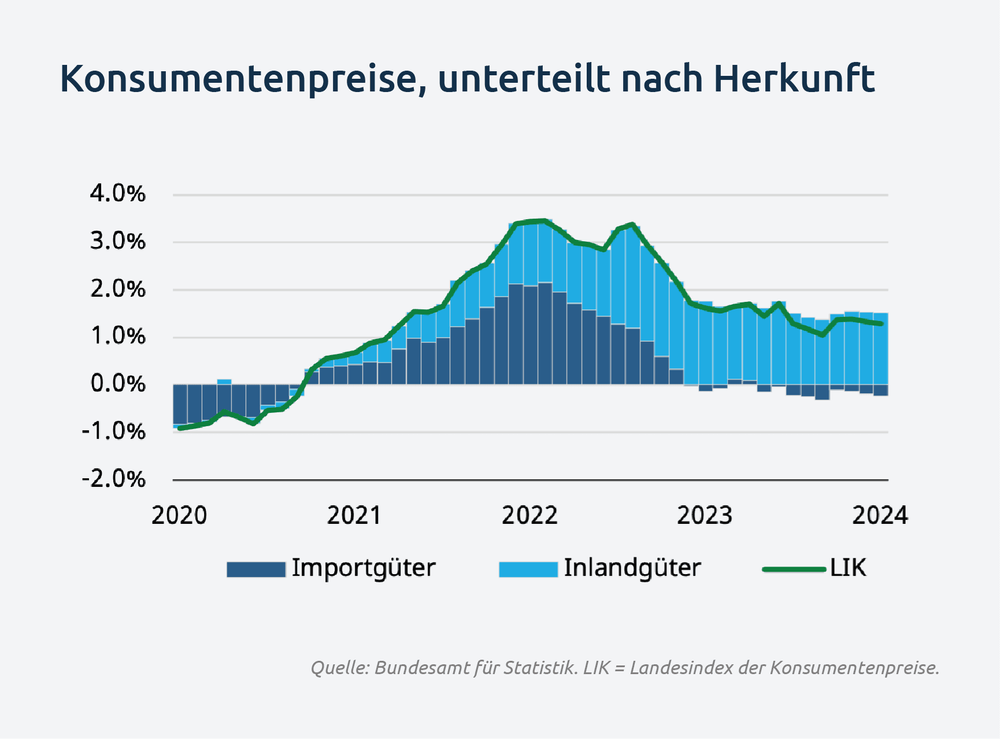

The inflation trends in July did not present any surprises, slightly decreasing to below 1.3% compared to the same month last year. In detail, domestic inflation continues to be the main driver, with rising service prices, while import prices—likely due to the appreciation of the Swiss Franc—recorded a decrease on a monthly basis. Overall, the inflation trend does not obstruct further interest rate cuts.

Regarding how low the Swiss National Bank (SNB) will reduce the key interest rate, opinions are divided. The interest market currently prices in two complete rate cuts by the March 2025 meeting. Most economists, however, refer to the concept of the neutral interest rate and consider a key interest rate of 1.0% as a short-term anchor.

The neutral interest rate, a crucial monetary policy indicator, reflects the economic fundamentals where the economy is neither stimulated nor restrained. Historically, it shows a declining tendency, and current estimates place it near 0%. With long-term inflation expectations at 1.0%, there is an expectation of a key interest rate of 1.0%.

Nevertheless, the neutral interest rate is only one of many indicators. The international interest rate environment, the strength of the Franc, and economic impulses should take priority in the short term. With expectations that the ECB and the Fed will lower interest rates in September, the Franc has already appreciated significantly. Although Switzerland remains competitive and exports are increasing, a stronger Franc poses a challenge that also needs to be addressed in the SNB's considerations.

A cautious approach in monetary policy could strain the economy and appreciate the Franc. A faster approach, however, would support economic recovery and reduce pressure on the Franc, which the SNB should also aim for. With rising domestic inflation and a weakening Franc, the SNB can still intervene with foreign exchange sales.

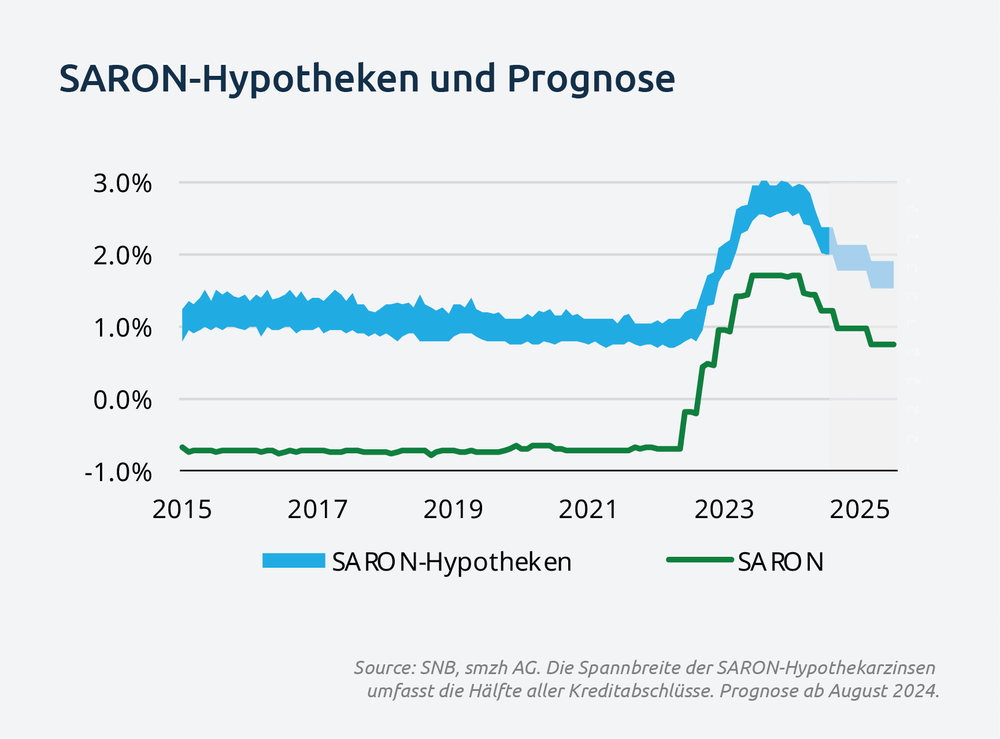

Therefore, we expect the SNB to make another cut by 25 basis points in September and at least one more reduction by March 2025. We do not rule out a fourth rate cut to 0.75% already in December.

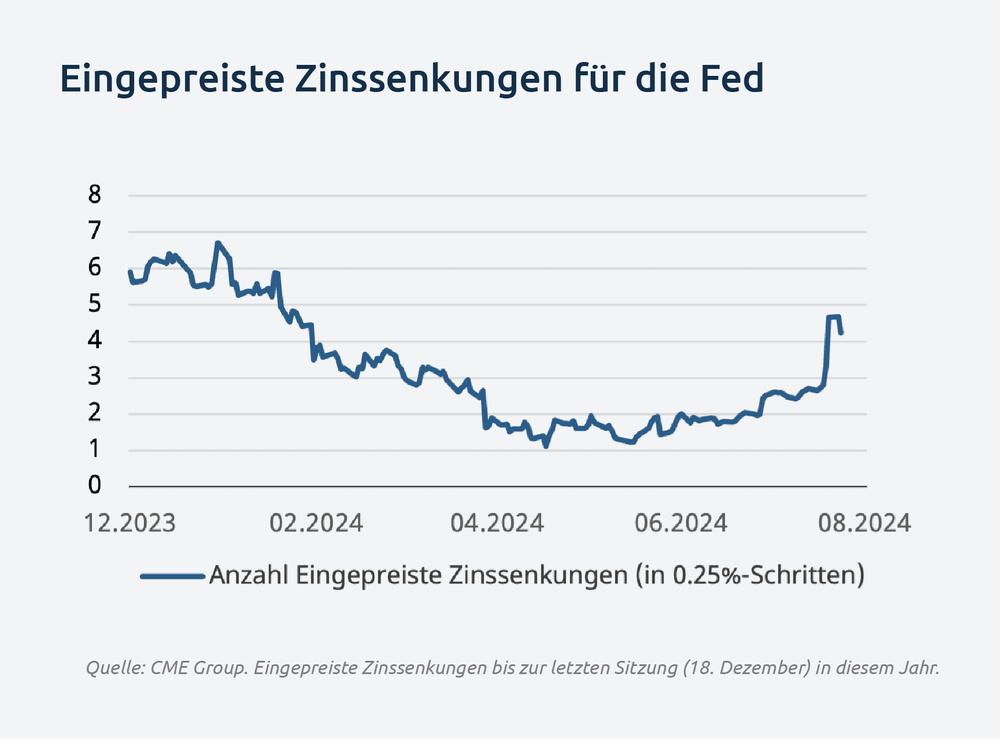

The recent global financial market turbulences are not only due to the unexpected rate hike by the Bank of Japan but also due to weak economic data from the USA. These data have rekindled expectations of Fed rate cuts after a long period. Although inflation in the USA is only slowly moving in the desired direction, signs of a weakening labor market and economy are increasing. This is evident in the rising unemployment rate and slowed employment growth. The monetary policy measures are now starting to take effect.

Should there be an unwanted significant weakening of the labor market, the Fed will need to respond with gradual rate cuts. In anticipation of this, the interest market has already reacted with declining rates across the entire yield curve, leading to speculation about rate cuts of 25 to 75 basis points at the meeting in September and even considerations of a possible emergency meeting before the regular session. While we view the current situation as somewhat of an overreaction, we see significant risk to the US labor market. Therefore, depending on the data released by then, we expect a rate cut of between 25 and 50 basis points in the regular September meeting.

The ECB is likely to follow the Fed and initiate its second rate cut in September despite unclear wage developments. Various indicators show continued high wage growth in Europe, while surveys from companies provide confidence that the situation should cool down in the coming years. Although the ECB emphasized its data dependency at its meeting and left the decision in September open, due to the weak economy, it is quite certain that they will need to cut rates in September.

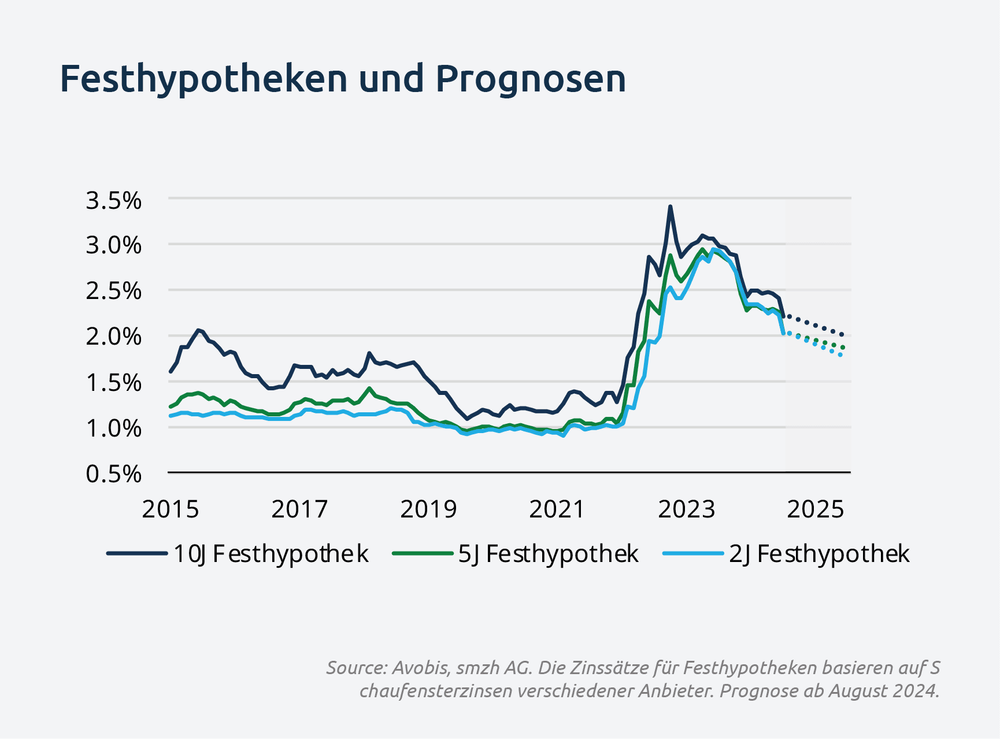

Interest rates for fixed-rate mortgages and SARON mortgages have both become more favorable. SARON mortgages range between 2.00% and 2.30%, depending on the individual credit margin, while the posted interest rates for fixed-rate mortgages range between 1.80% and 2.00%.

With the downward shift in the yield curve, the discrepancy between SARON and short- to medium-term mortgages persists. Since the latter now almost price in two rate cuts, maturities of two to five years continue to be an attractive option for risk-averse borrowers. If the expected rate cuts materialize and further reductions are priced into the interest rate market, lower fixed rates are certainly conceivable.