Swiss Monetary Policy

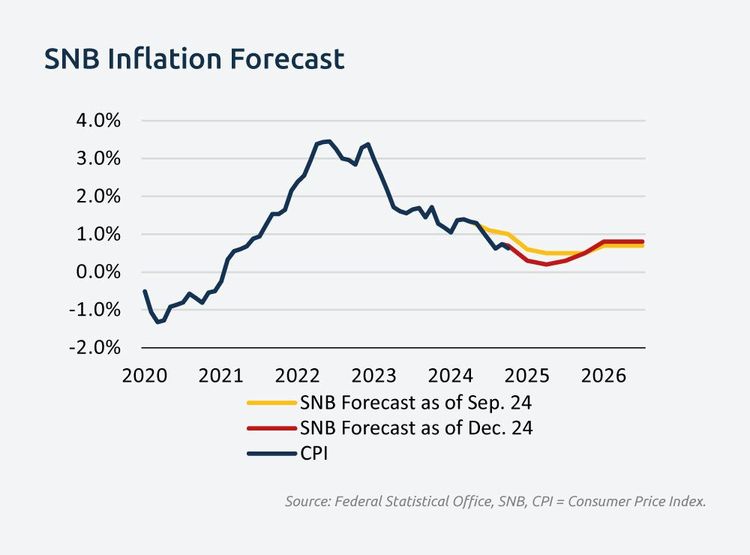

The average annual inflation rate for 2024 was 1.06% (2023: 2.14%). December inflation data showed a 0.06% price decline compared to the previous month and an overall inflation rate of 0.63% year-over-year. So far, this development aligns with the SNB’s December inflation forecast.

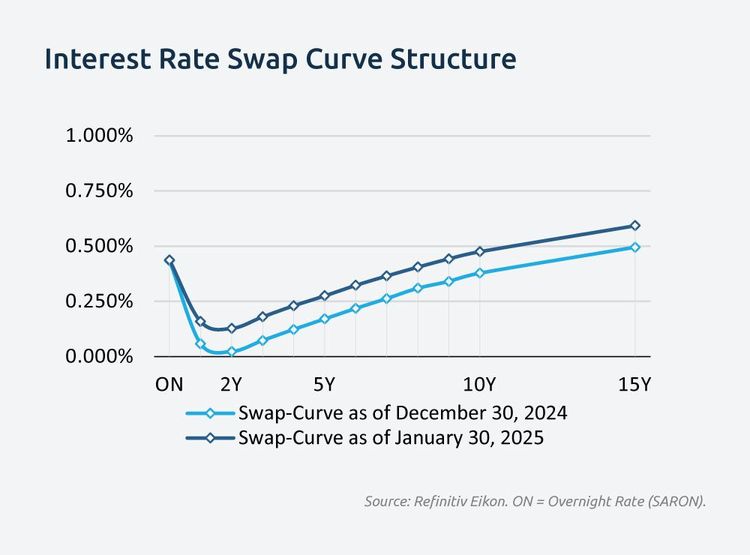

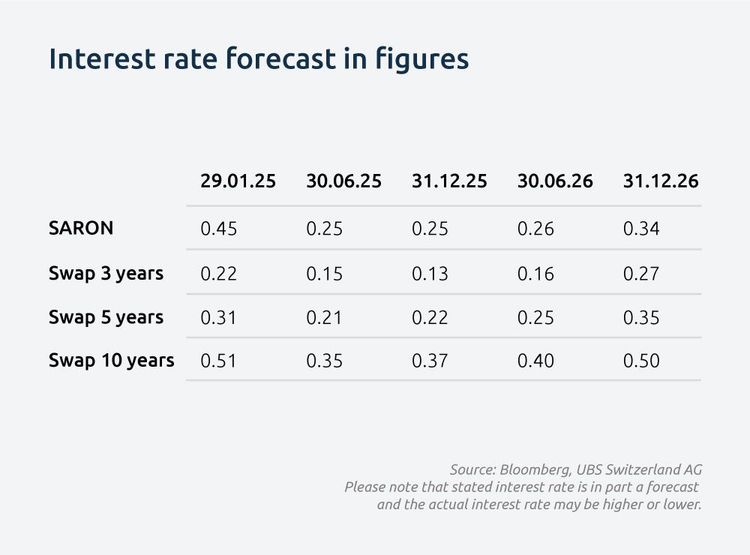

If inflation in January and February remains within the expected range, the SNB is likely to refrain from further rate cuts. The SNB currently assesses the price situation as stable, and any temporary drop in inflation to 0% or even negative territory would likely be short-lived. A 0.25% rate cut in March would require an unexpectedly lower inflation trend.

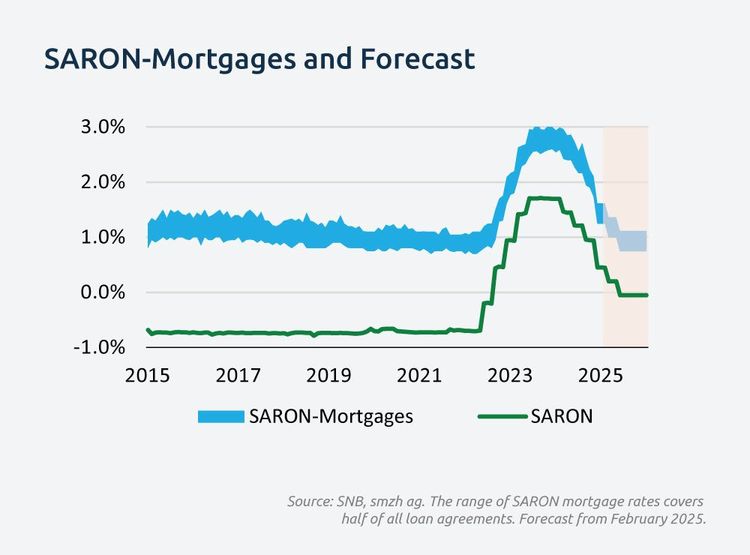

In the coming months, structurally driven price declines are expected to further reduce inflation. Lower electricity prices in January should have a noticeable dampening effect, and the anticipated reduction in the mortgage reference rate in March could further suppress inflation, potentially leading to lower-than-expected inflation figures.

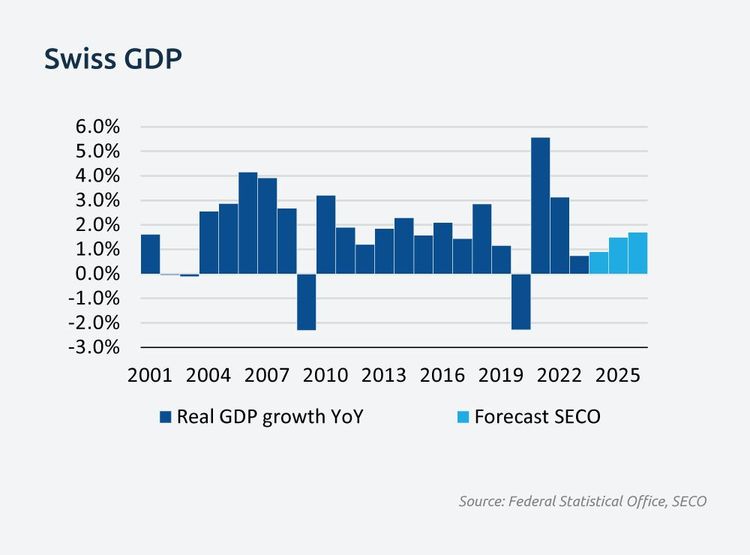

From a currency and economic policy perspective, there is no urgent need for a rate cut, even though easing could have positive effects. The Swiss franc remains strong, but there is no abrupt appreciation pressure necessitating SNB intervention. Moreover, SECO’s latest forecasts for 2025 and 2026 suggest moderate economic growth—expected to be higher than in recent years but still below the long-term average. How the SNB assesses the current situation and what decision it ultimately makes remains difficult to predict, meaning this meeting could once again surprise many market participants.