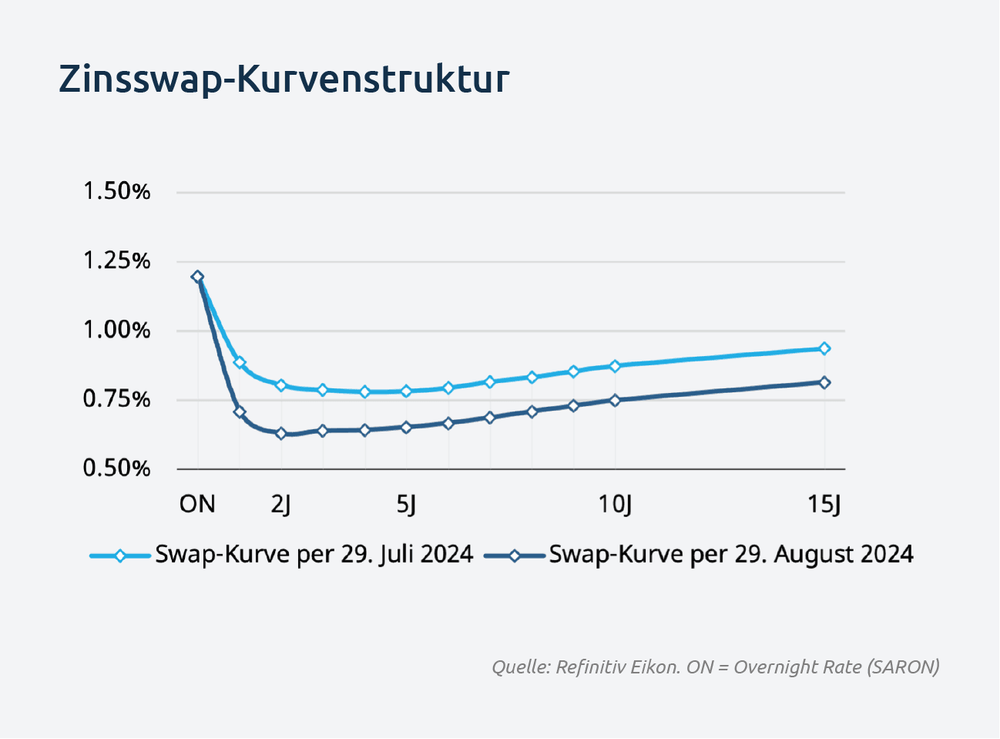

The yield curve has shifted slightly downwards again, with interest rate swap rates for terms of between two and ten years currently in the range of 0.65% to 0.75%.

At the short end of the curve, there are indications that almost three interest rate cuts have been priced in for the next four meetings. With the latest announcement by the US Federal Reserve that it is moving into the rate-cutting phase, market participants in Switzerland are increasingly focussing on the pace of interest rate cuts by the SNB. At the centre of the discussion is the question of whether the SNB will continue to act pre-emptively, prompting some market participants to hedge against a possible interest rate cut of half a percentage point in September.

Since the beginning of the year, the volatility of the yield curve has primarily been driven by expectations of potential interest rate moves. Should the SNB actually move to cut interest rates more aggressively, a further downward shift in the yield curve is quite likely.

The SNB's monetary policy assessment on 26 September is approaching and it is widely expected that the key interest rate will be cut for a third time in a row by at least 25 bps to 1.00%. The key question, however, is whether the SNB will preemptively cut by half a percentage point and whether this is the optimal decision under the current circumstances.

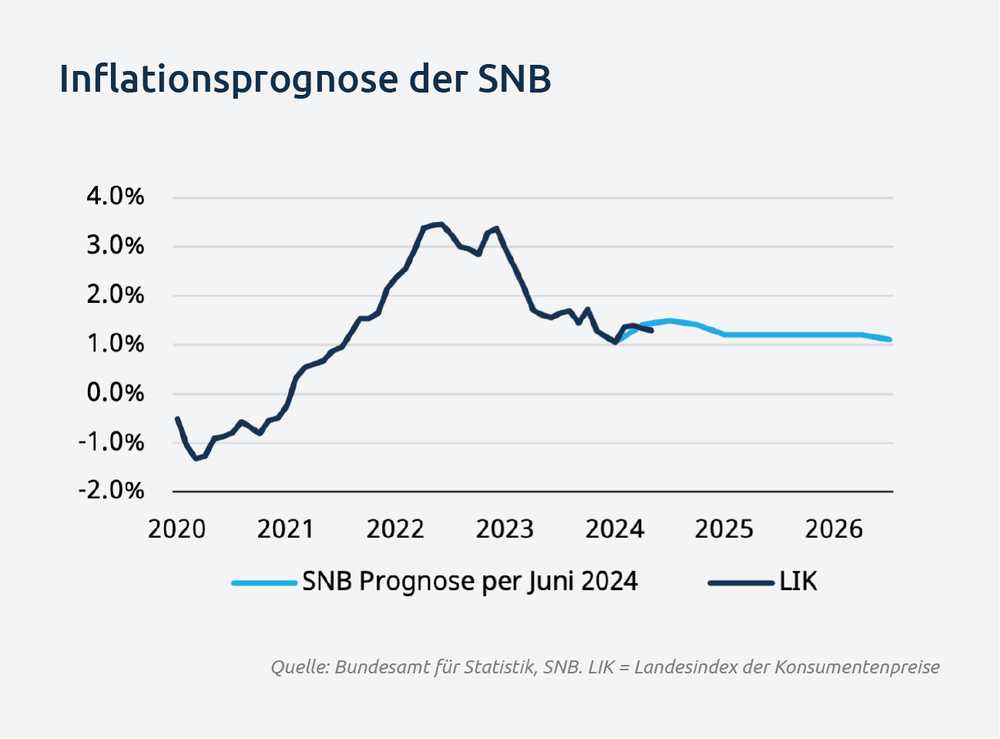

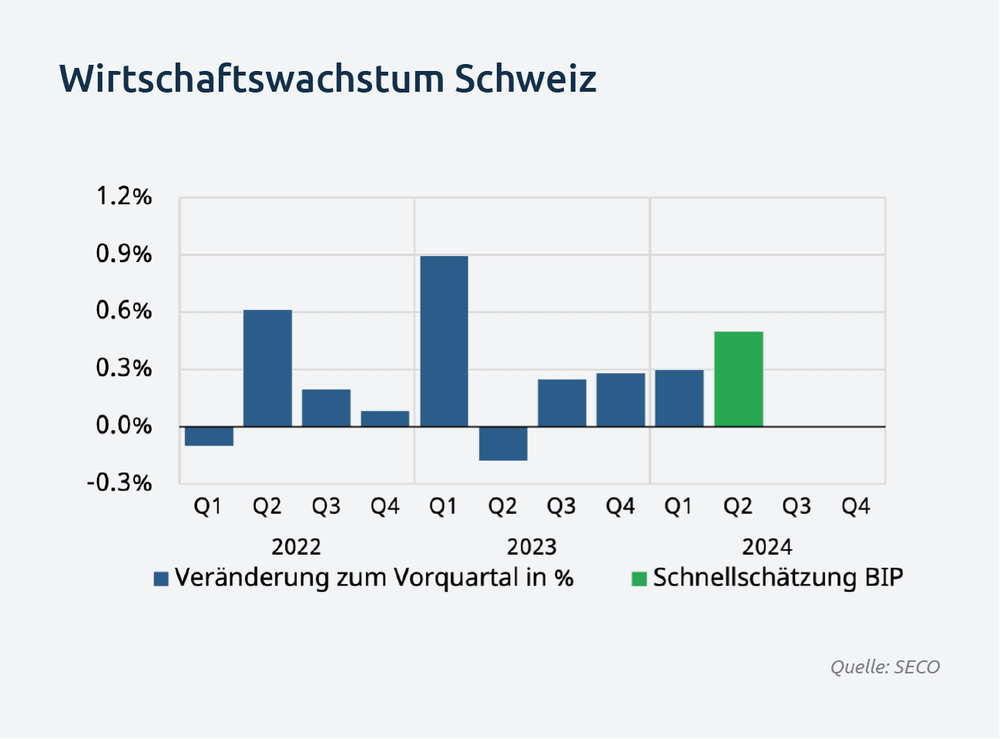

Disinflation is continuing, with no signs of wage inflation or multi-round effects, and there are currently no significant inflation risks from abroad either. It is therefore likely that inflation will once again be below the SNB's last conditional inflation forecast by the September meeting. At the same time, the Swiss economy has recovered well and is proving robust, which is confirmed by the flash estimates for economic growth in the second quarter. These point to slightly above-average growth, while the final figures will be published on 3 September.

In view of the current inflation trend, a further easing of monetary policy by at least 25 basis points is justified. A more aggressive approach is not absolutely necessary from an economic perspective, but could be received favourably.

The main argument in favour of an interest rate hike of half a percentage point is the strong Swiss franc, which has been under upward pressure for some time and is likely to gain further strength in the coming weeks and months. Large-scale currency interventions, such as those carried out by the SNB since the global financial crisis, are less effective in the current interest rate environment, as they are most effective in a low interest rate environment. The SNB therefore has little room for manoeuvre other than to maintain or widen the interest rate differential with the Fed and the ECB.

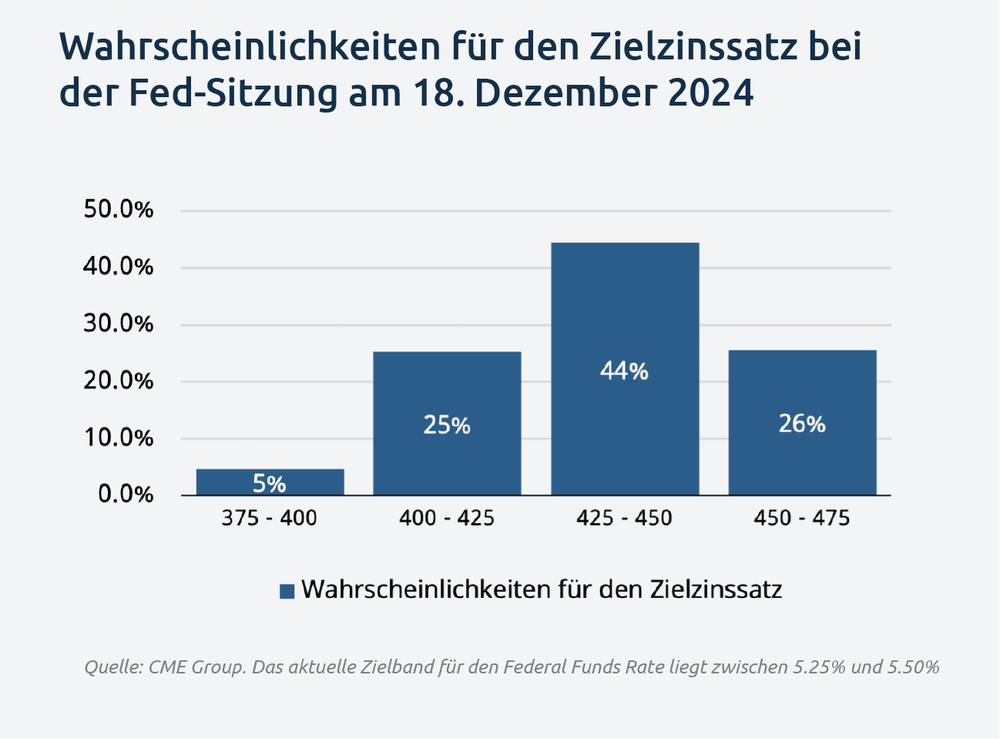

The pace of interest rate cuts by the ECB and especially the Fed will be particularly important. If economic conditions in the US deteriorate and aggressive interest rate cuts are expected, this could generate additional upward pressure on the Swiss franc. The SNB could pre-emptively counter this and cut rates by 50 bps as early as September.

We assume that the SNB will cut interest rates by at least 25 bps at each of the next two meetings. As the ECB and Fed meetings take place before the SNB, the SNB will have sufficient time to assess the decisions and their impact and react accordingly. If the Fed in particular cuts rates by 50 bps and the pressure on the Swiss franc increases sharply, it is very likely that the SNB will also cut rates by 50 bps.

Jerome Powell made it clear at the economic symposium in Jackson Hole that the time had come for interest rate cuts. The labour market had cooled sufficiently and the Fed would not tolerate a further slowdown. Inflation risks have calmed down, meaning that the Fed is no longer focussing on inflation.

The labour market is a clear limit for the Fed. Future data will therefore determine the pace of interest rate cuts. So far, the indicators point to a robust labour market. Despite downwardly revised figures (originally 242,000), over 170,000 jobs were still created per month last year, which corresponds to the average before the pandemic. However, signs of a slowdown are increasing and concerns about an abrupt deterioration are growing. The Fed now faces the challenge of achieving a soft landing by coordinating interest rate cuts to the right extent and at the right time.

The financial markets will react sensitively to new data, which is likely to lead to increased volatility. Interest rate expectations are also likely to fluctuate. Currently, around four interest rate hikes (100 bps) are priced in by the end of the year, with a cut of 25 bps considered most likely for the September meeting.

Indicators of wage development in the ECB area show a pleasing downward trend and support the probability of a second interest rate cut of 25 bps in September. After the September meeting, the Fed is likely to set the pace for the ECB and at least two further interest rate cuts of 25 bps each are expected by the end of the year.

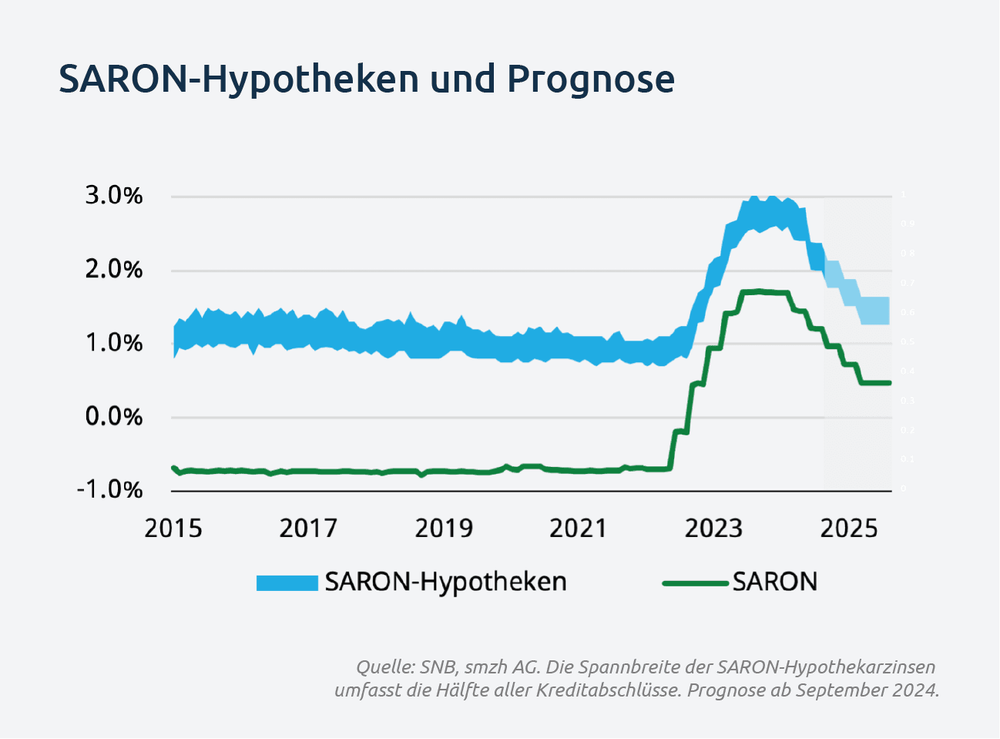

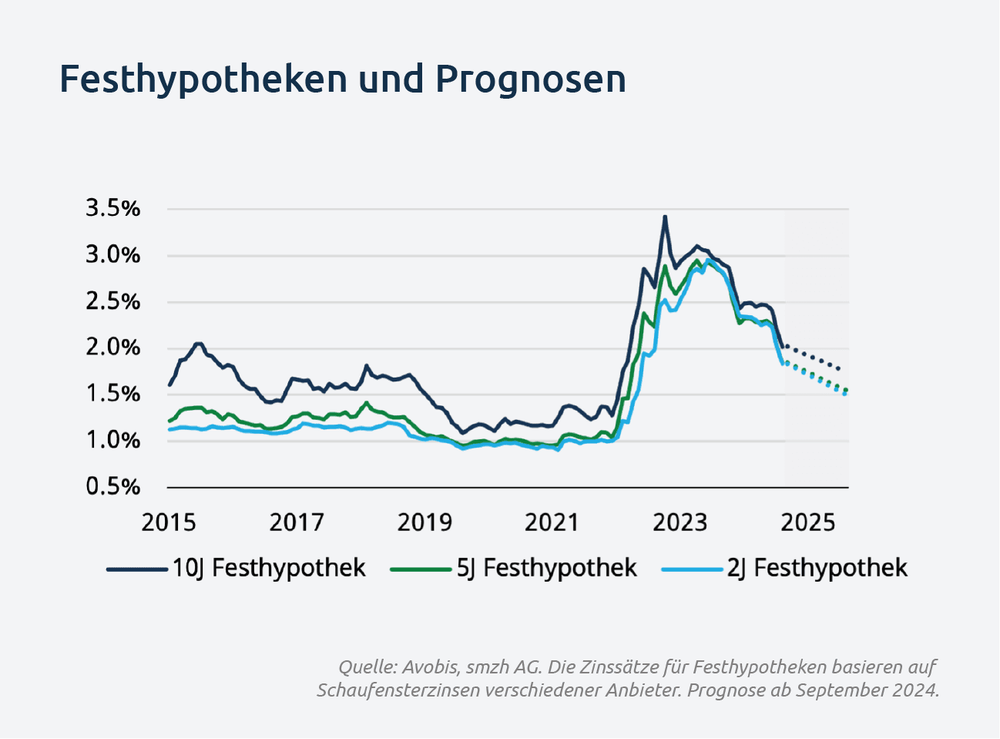

Interest rates for fixed-rate mortgages have fallen slightly and are currently between 1.70% and 1.90%. SARON mortgages remain in the range of 2.00% to 2.30%, depending on the individual credit margin. The difference between SARON mortgages and fixed terms therefore remains. If the expected three interest rate steps are actually implemented in the next four meetings, SARON mortgages would become 75 basis points more favourable and move closer to fixed interest rates.

Interest rates for fixed-rate mortgages, on the other hand, are more dependent on expectations of future interest rate cuts. If the expectation that the SNB will need to take more aggressive action prevails in the coming weeks, interest rates for fixed terms could fall further. However, if the view that three further rate cuts are sufficient becomes more firmly established, a floor should form for fixed interest rates. Developments up to the September meeting will be decisive in this respect.