Executive Summary

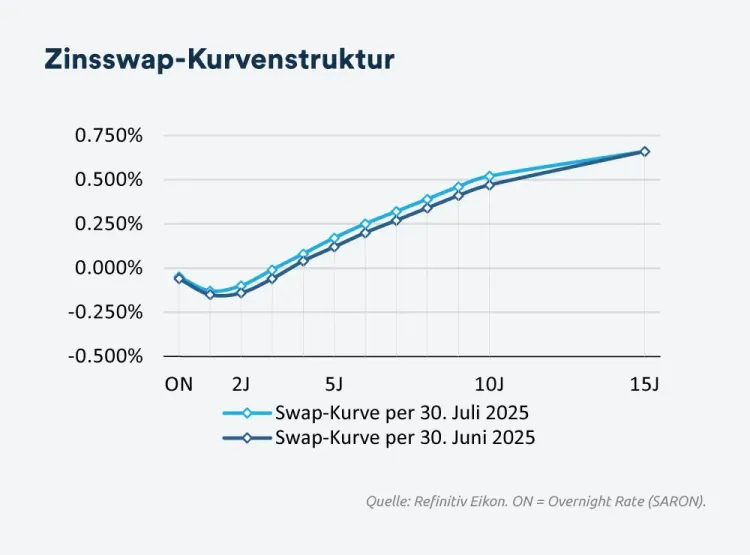

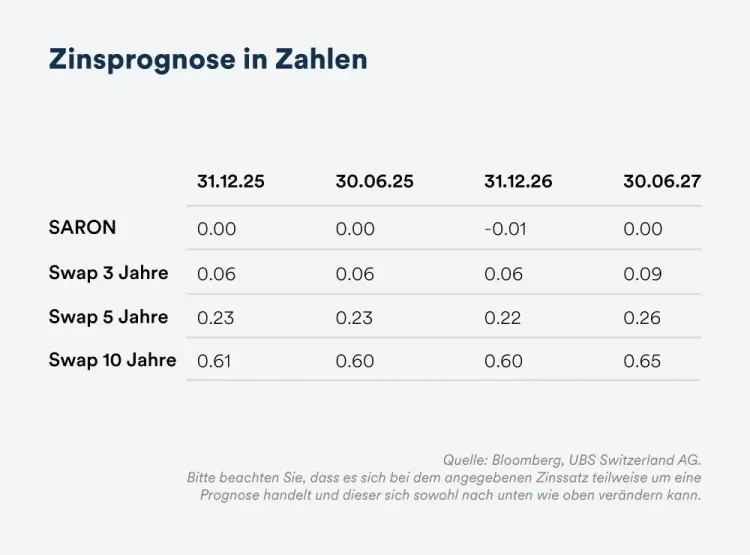

Interest Rate Market: The Swiss yield curve has changed little compared to the previous month, with no significant volatility observed. A return to negative key interest rates remains a possible scenario in principle, but the market is currently pricing in this risk with lower probability than in previous months.

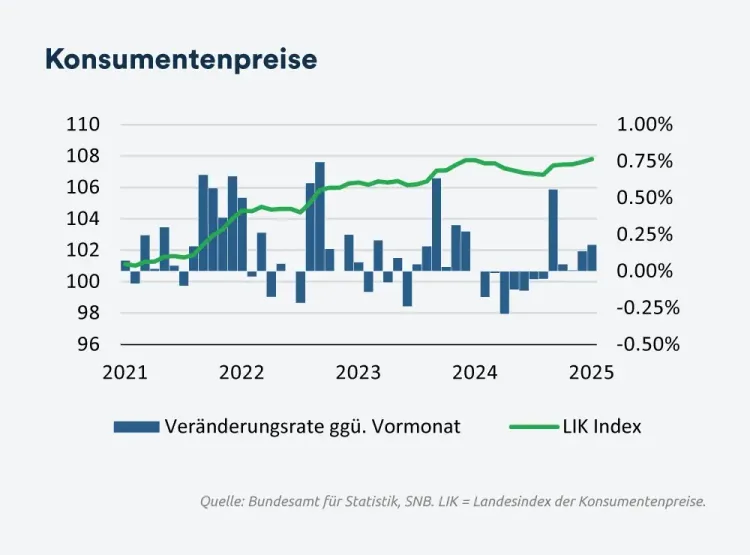

Monetary Policy: Inflation turned slightly positive again in June, raising the question of whether May’s decline was merely a temporary deviation or if there is a trend toward persistent negative inflation. A growth slowdown caused by the renewed US tariff shock could reinforce deflationary pressures and increase the likelihood that the SNB will cut its key rate into negative territory as early as September.

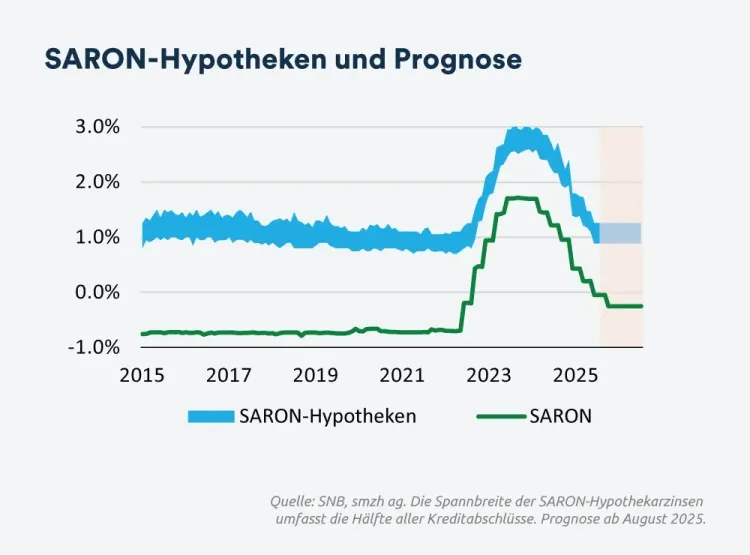

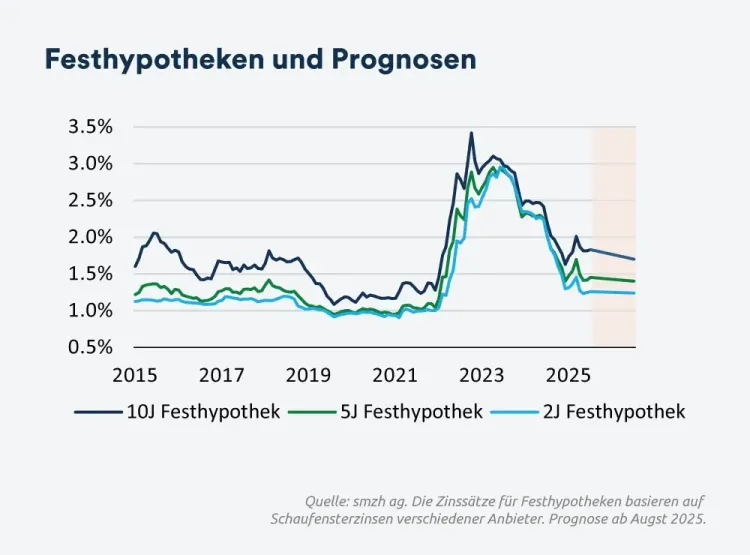

Mortgage Rates: At the end of July, mortgage rates were roughly at the same level as the previous month. Since the start of the year, credit spreads have increased overall, and the differences between providers have widened significantly. For SARON-based mortgages, the average margin has increased by 0.20 percentage points, almost equivalent to a full rate hike.

Interest Rate Market

The Swiss interest rate swap curve remained largely unchanged and showed remarkable stability in July. Maturities up to two years continue to trade below the SARON rate, and so remain in negative territory, while longer maturities show a positive slope and remain positive.

Short-term maturities now imply a lower probability of another key rate cut to –0.25% in September and no longer signal such a move, as was the case prior to the SNB’s monetary policy decision in June. Until the next monetary policy assessment, market expectations for a further SNB move are likely to remain volatile.